E-Commerce Packaging Market by Material (Corrugated Boards, Paper & Paperboards, Plastics), Product Type (Boxes, Mailers, Tapes, Protective Packaging, Labels), Application (Electronics, F&B, Fashion, Cosmetics) & Region - Global Forecast to 2029

E-commerce Packaging Market

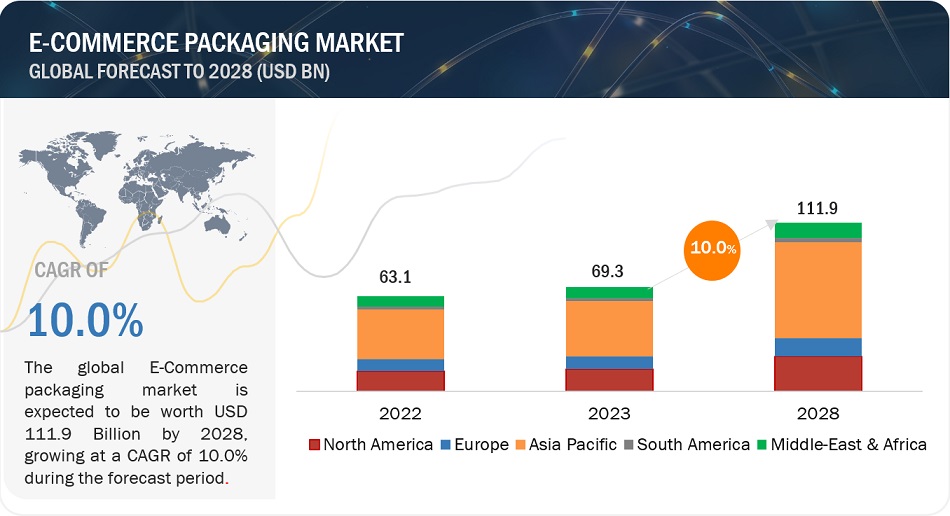

The global E-commerce Packaging market is valued at USD 77.4 billion in 2024 and is projected to reach USD 124.9 billion by 2029, growing at 10.0% cagr from 2024 to 2029.

The E-commerce packaging market refers to the businesses that provide packaging solutions to companies experiencing exponential growth because of the rising popularity of online e-commerce. The e-commerce packaging solutions can be used to cater the demands from several application areas such as electronics products, food items, apparel, etc. The growth of the market is driven by several factors, such as increasing e-commerce sales, rising demand for packaging solutions in the food & beverage industry, and growing technological advancements in packaging solutions. Apart from this, growing demand for sustainable packaging solutions also helps to drive the market. However, leading brands which are involving in providing the customizable packaging solutions helps to improve the consumer's unboxing experience and also impact the market in a positive way. Increasing adoption of smartphones and rise in internet activities have contributed to the growth of online shopping which consequently supports the growth of e-commerce packaging market. Increased international reach of e-commerce platforms such as amazon, etc. has also risen the demand for safe and secure packaging. As products which are sold online, travel long distances to reach the consumer base safely.

Attractive Opportunities in the E-Commerce Packaging Market

To know about the assumptions considered for the study, Request for Free Sample Report

E-Commerce Packaging Market Dynamics

Driver: Increasing use of the internet and smartphones

Due to an increase in smartphone usage and easy availability of the internet, it is going to help the e-commerce as this may lead to a increased online shopping activity. This change is taking place not only in the urban but also the rural areas, due to improved internet infrastructure. Customers are also using online platforms to order daily essential things such as groceries, electronic products, etc., due to the convenience factor. With the widespread adoption of the internet and smartphones, consumers nowadays ease an access to several online platforms, which allows them to search for a wide variety of products. This convenience helped to raise the demand for e-commerce packaging.

Restraint: Lack of appropriate recycling infrastructure

E-Commerce packaging is mostly made from paper and plastic materials, majorly plastics which is harmful for the environment. And this waste generated requires to be recycled. However, there is a lack of infrastructure for recycling packaging materials, which is going to add to the negative impact on the environment. With the absence of inadequate recycling infrastructure across the regions, it is impossible to divert the materials away from landfills. In addition to this, it is difficult for the manufacturers to implement uniform sustainable practices across the region. Moreover, mandates and regulations, from regulating bodies for sustainable packaging are becoming more and more forceful, and with the absence of proper recycling infrastructure, companies may face difficulty to comply with such regulations.

Opportunities: Brand identity creation using e-commerce packaging

To increase the sales, companies are using e-commerce packaging as a means to drive their profits. It involves graphics, use of decorative papers and plastics, vibrant colors which may attract the customers. This level of customization is a step towards increasing customer footprint. With the investment in creating innovative and attractive packaging solutions, manufacturers can create a long-lasting impression on consumers. In addition to this, creating innovative packaging solutions can be a crucial element in the customer’s unboxing experiences, which becoming a great marketing tool on social media platforms.

Challenges: Harmful effects of plastic on the environment

As stated earlier, e-commerce packaging majorly uses plastics, which is having harmful effects on the environment. It contributes to waste creation and some types of plastics used for packaging are not even recyclable. With the increasing e-commerce sales, the amount of packaging waste going into landfills and oceans also increases. However, with the increasing awareness towards environmental pollution, consumers and regulatory bodies puts a pressure on the manufacturers to provide sustainable packaging solutions. As a result of this, companies seek alternatives to plastic packaging in the form of biodegradable, compostable, or recyclable materials.

E-commerce Packaging Market ECOSYSTEM

By Material, Paper and Paperboards account for the second highest CAGR in the E-Commerce packaging market during the forecast period.

Paper and Paperboards have demonstrated the second-highest compounded annual growth rate (CAGR) in the E-Commerce packaging market. They are extensively employed for void filling and interior packaging to safeguard the items inside the box. Additionally, Paper and Paperboards are used in crafting paper bags and mailers, both of which are crucial for e-commerce packaging. Furthermore, they are known for being the most sustainable form of packaging due to their recyclability, which helps to minimize environmental impacts.

By Product Type, Mailers account for the second highest CAGR in the E-Commerce packaging market during the forecast period.

Mailers have the second-highest compounded annual growth rate (CAGR) thanks to their lightweight nature and cost-effectiveness. They are particularly useful for shipping small, delicate items. Mailers come in a variety of forms, such as bubble envelopes, padded envelopes, and poly mailers, which are chosen based on the specific type of item being shipped.

By Application, Food & Beverage segment has the second-largest CAGR in the E-Commerce packaging market.

In the e-commerce packaging market, the food and beverage segment accounts for the second-highest CAGR in the forecast period. Pacakging is considered very important for this industry because it protects the item in transit. The increase in online food orders through different platforms is driving the packaging segment. In addition to this, rise in online grocery shopping also helps to drive the market during the forecast period.

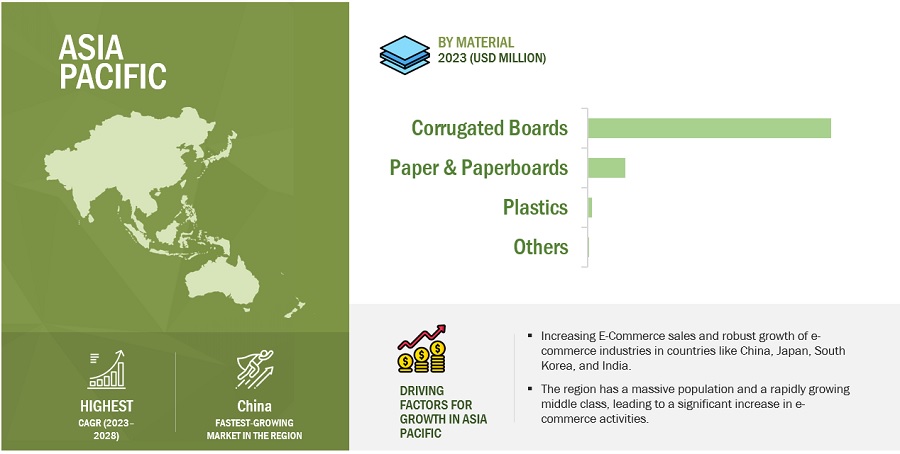

Asia Pacific is projected to account for the highest market share in the E-Commerce packaging market during the forecast period.

Asia Pacific is the largest market for e-commerce packaging market, due to increased use of packaging in countries like China, Japan, South Korea and India. Various factors like large population, increase in disposable incomes, are leading to this growth. And thus, Asia Pacific stands as the largest consumption market for e-commerce packaging. Apart from this, the region also witnessed the exponential growth in online sales, which supports the largest market share of the region in the market. Moreover, rapid urbanization, and expansion in the logistics infrastructure further boost the demand for packaging solutions, which drives the market of e-commerce packaging during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

E-commerce Packaging Market Players

The E-Commerce packaging market comprises key manufacturers such as International Paper (US), Amcor (Australia), Mondi Group (UK), DS Smith (UK), Smurfit Kappa (Ireland), and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the E-Commerce packaging market. A major focus was given to the expansions and deals.

E-commerce Packaging Market Scope:

|

Report Metric |

Details |

|

Years Considered |

2021–2029 |

|

Base year |

2023 |

|

Forecast period |

2024–2029 |

|

Unit considered |

Value (USD Million/Billion) |

|

Segments |

Product Type, Material, Application, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies |

The major players are International Paper (US), Amcor. (Switzerland), Mondi Group (UK), Smurfit Kappa (Ireland), Rengo Co., Ltd (Japan), Berry Global Inc (US), Sonoco Products Company (US), CCL Industries (Canada), H.B. Fuller (US), Sealed Air Corporation (US), Georgia-Pacific LLC (US), Stora Enso Oyj (Finland), and others are covered in the E-commerce Packaging market. |

This research report categorizes the global E-commerce Packaging market on the basis of Product Type, Material, Application, and Region.

E-commerce Packaging Market, By Product Type

- Boxes

- Mailers

- Tapes

- Labels

- Protective Packaging

- Other Product Types

E-commerce Packaging Market, By Application

- Electronics

- Food & Beverages

- Fashion

- Cosmetics

- Furniture

- Other Applications

E-commerce Packaging Market, By Material

- Corrugated Boards

- Paper & Paperboards

- Plastics

- Other Materials

E-commerce Packaging Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In May 2024, Amcor launched its European Innovation Center in Belgium to develop sustainable packaging solutions and new designs.

- In April 2024, International Paper announced the acquisition of DS Smith plc, a British packaging company, to enhance its presence in the European market and grow the North American business.

- In February 2024, The Mondi Group completed the acquisition of Hinton Pulp Mill in Alberta, Canada, from West Fraser Timber Co. Ltd (Canada). This will help the company to produce kraft papers, which will be converted into paper bags. This acquisition will help the company serve consumers across the Americas region.

- In October 2023, International Paper invested USD 100 million to enhance the facility located in Rome, which has helped to boost the production capacity.

- In August 2023, Phoenix Flexibles Pvt Ltd., a manufacturer of flexible packaging for food, home care, and personal care applications, was acquired by Amcor. This deal has given Amcor access to advanced technology in flexible film packaging and increased its production capacities in sustainable packaging.

- In May 2023, Smurfit Kappa invested in expanding its plant in Polland by installing state-of-the-art technology. The investment in Poland includes the installation of a new high-tech corrugator and a range of ultra-modern converting machinery, which help to cater to the demand from several end-use industries such as food & beverages.

- In September 2022, Smurfit Kappa acquired PaperBox, a packaging plant in Rio de Janeiro. This has expanded the company’s footprint in Brazil to meet the growing demand for innovative and sustainable packaging.

- In May 2022, Smurfit Kappa launched a new water-resistant paper, AquaStop, which is water-resistant due to a unique coating that is applied to the AquaStop paper during manufacture. This coating, unlike many others, does not affect the product’s recycling ability. It can be recycled in the same manner as conventional paper-based packaging.

- In August 2021, Amcor partnered with the School of Packaging of MSU and unveiled a new alliance that reflects their shared dedication to developing future talent, fostering innovation, and responsible packaging solutions.

- In June 2021, In partnership with the Italian machinery manufacturer ACMI, Mondi Group developed a new pallet wrapping technique that employs paper rather than plastic.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the E-Commerce packaging market?

The E-commerce packaging market is projected to experience notable expansion in the coming years. This growth is attributed to the increasing E-commerce sales globally, widespread availability of smartphones and internet access, technological advancements, and the adoption of sustainable packaging solutions within the E-commerce industry.

What is the major challenge in the E-Commerce packaging market?

The primary concern in the E-Commerce packaging industry is the adverse environmental impact resulting from the prevalent use of plastics in various packaging solutions. Even certain types of corrugated boxes are challenging to recycle, which adds to the waste generated through packaging.

What are the restraining factors in the E-Commerce packaging market?

The E-Commerce packaging market faces a major challenge due to the lack of proper recycling infrastructure for plastics, potentially leading to increased waste and adverse environmental impact.

What is the key opportunity in the E-Commerce packaging market?

The E-Commerce packaging market presents a significant opportunity for businesses to leverage by enhancing and personalizing their packaging solutions, thanks to the growing impact of social media. Businesses are prioritizing packaging as a tool to promote their brand and establish a distinct identity, which may lead to increased demand for different types of e-commerce packaging.

What are the applications where E-Commerce packaging materials are used?

E-commerce packaging materials are majorly used by several application areas such as electronics, food and beverage, cosmetics, fashion, furniture, and others. Each industry has unique packaging requirements that support the continuous growth and success of e-commerce packaging practices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

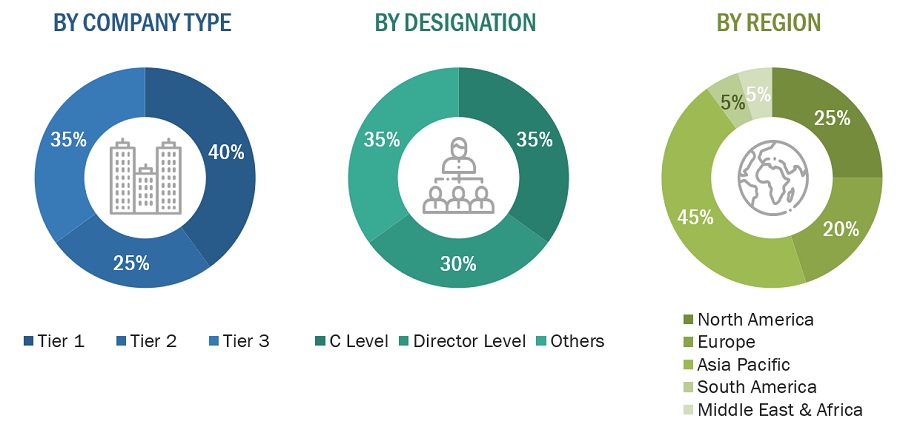

This research involved using extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the E-commerce Packaging market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The E-commerce Packaging market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product users. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, managers, directors, and CEOs of companies in the E-commerce Packaging market. Primary sources from the supply side include associations and institutions involved in the E-commerce Packaging industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global E-commerce Packaging market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

E-commerce packaging is used by businesses to protect their goods while they transit from the warehouse to the client. It is a form of protective packaging that must be practical for travel to shield the item from harm. The e-commerce packaging market is a specialized sector that serves the packaging needs of online retailers and e-commerce businesses. It encompasses the design, manufacturing, and distribution of packaging materials and solutions tailored specifically for the challenges of shipping products sold through online platforms. The e-commerce market consists of several product types, such as boxes, mailers, labels, tapes, protective packaging, and other types. In addition to this, the market also includes several materials such as corrugated boards, paper & paperboards, plastics, and other materials. In terms of application, the market study includes several applications such as electronics, food & beverages, fashion, cosmetics, furniture, and other applications.

Key Stakeholders

- Raw Material Suppliers

- Regulatory Bodies

- Government, and consulting firms

- End User

- Research and Development Organizations

- E-commerce Packaging manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global E-commerce Packaging market in terms of value, and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on product type, material, application, and region

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, partnerships, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC E-commerce Packaging market

- Further breakdown of the Rest of Europe’s E-commerce Packaging market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in E-Commerce Packaging Market