Tumor Ablation Market Size, Share & Trends by Technology (Radiofrequency, Microwave, Laser, IRE, HIFU, Cryoablation), Product (Generators, Probes), Mode (Surgical, Laparoscopic, Percutaneous), Cancer (Liver, Lung, Bone), End User (Hospitals, Clinic) & Region - Global Forecast to 2029

Tumor Ablation Market Size, Share & Trends

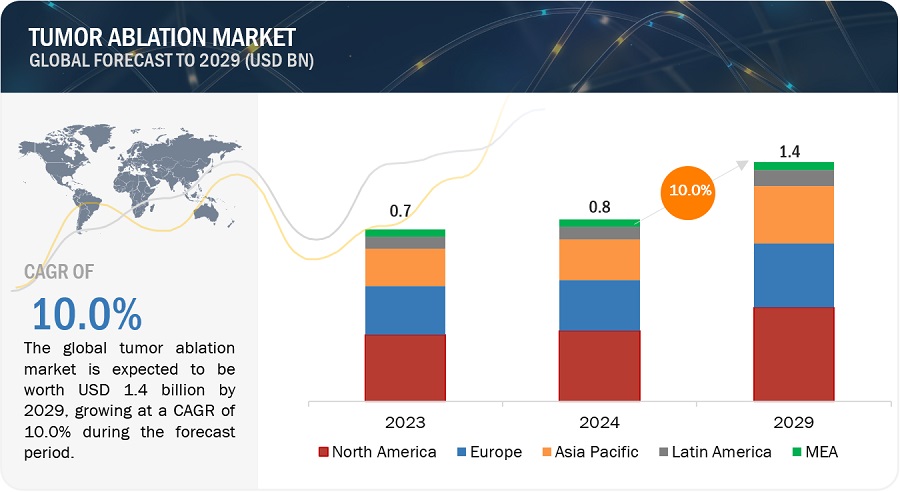

The size of global tumor ablation market in terms of revenue was estimated to be worth $0.8 billion in 2024 and is poised to reach $1.4 billion by 2029, growing at a CAGR of 10.0% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Major driver is the rising incidence of cancer, particularly among the aging population. Additionally, advancements in probe/electrode technology have led to the increasing demand for ablation systems, which offer precise ablation and minimal damage to healthy tissue. Moreover, rising awareness about early detection and rising disposable incomes, coupled with expanding access to healthcare services in emerging markets, further fuel the demand for tumor ablation.

Tumor Ablation Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Tumor Ablation Market Dynamics

Driver: Increasing cancer incidence and rising geriatric population

Tumor ablation market is primarily driven by the rising incidence of cancer globally. Tumor ablation is widely used for the treatment of lung cancer, liver cancer, prostate cancer, bone cancer, and kidney cancer among others. According to WHO, cancer was the major cause of death globally in 2020 -accounted for around 10 mn deaths. Emerging economies in Asia, Africa, and Oceania reported 55% of the 18.1 million cancer cases diagnosed. With the continuous rise in the global cancer patient population, there is expected to be a significant increase in demand for tumor ablation procedures during the forecast period.

Restraint: Increasing cancer incidence and rising geriatric population

High cost of tumor ablation systems is one of the restrains in tumor ablation market. Premium product pricing hinders the adoption in emerging countries. Small healthcare facilities rely on third-party payers to reimburse the costs incurred in diagnostic, screening, and therapeutic procedures. The high cost of the equipment makes it difficult for most hospitals in emerging economies to afford this technology. Hence, smaller end users are hesitant to invest in this equipment.

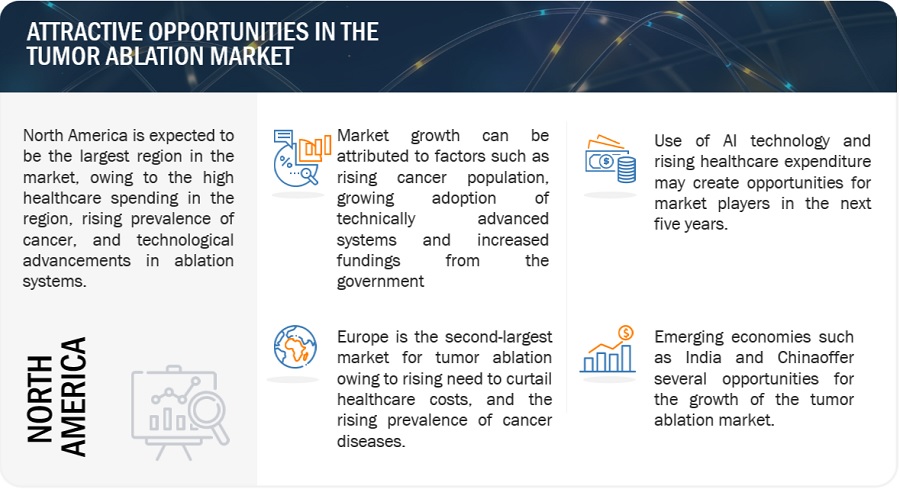

Opportunity: Rising healthcare expenditure across emerging economies

Growing healthcare expenditure in emerging nations such as China, India, Brazil, and Mexico are expected to offer lucrative opportunities for tumor ablation market. For instance, according to GLOBOCAN 2020 data, over 50% of the global cancer population resides in emerging economies. Increasing government initiatives towards providing advanced healthcare services and improving reimbursement coverage support the adoption of tumor ablation devices. rapid increase in the per-capita healthcare expenditure and the rising public demand for affordable healthcare in emerging economies to further expected to drive the demand for ablation systems in developing countries.

Challenge: Rising adoption of refurbished tumor ablation systems

Small scale end users specifically in developing countries often opt for refurbished alternatives as a cost-effective solution. Refurbished systems are sold at a fraction of the cost of new equipment Refurbished systems are sold at a fraction of the cost of new equipment. Due to similar functioning and affordable cost the adoption of refurbished systems is experiencing a surge in the adoption. This poses a challenge for smaller manufacturers who are struggling to keep up and is expected to impact the market growth.

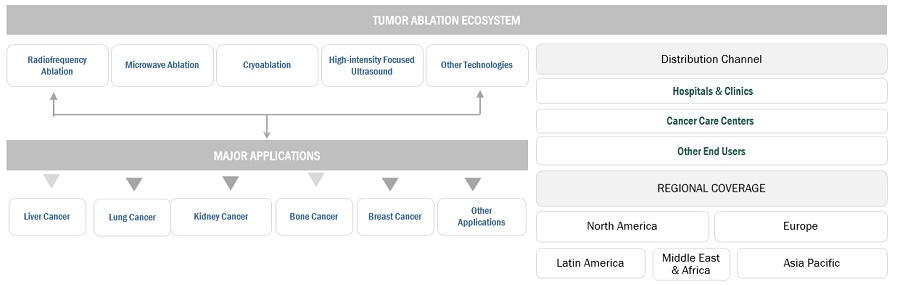

Tumor Ablation Industry Ecosystem.

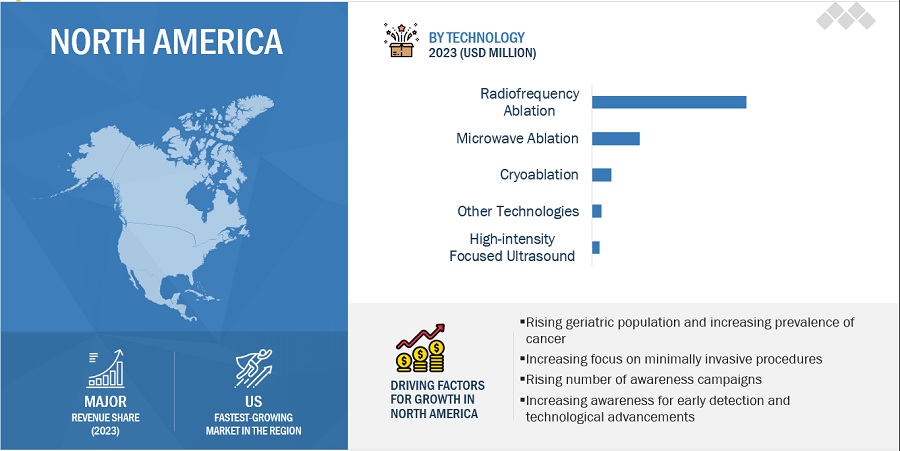

By Technology, the radiofrequency ablation segment accounted for the largest share of the tumor ablation industry in 2022.

Based on technology, the tumor ablation market is segmented into radiofrequency ablation, microwave ablation, high intensity focused ultrasound (HIFU), cryoablation, and other technologies. In 2023, the radiofrequency ablation segment accounted for the largest market share. Rising awareness of proactive health and expansion of market players fuel the growth of tumor ablation market.

By Product Type, the generators segment of the tumor ablation industry to register significant growth in the near future.

Based on product type, the tumor ablation market is segmented into generators probes and electrodes. The generators segment accounted for the largest market share in 2023. The demand for minimally invasive procedures is increasing due to the emphasis on improving quality of life. Additionally, favorable regulatory scenarios and a surge in oncological surgeries contribute to the rising adoption of tumor ablation systems.

The laparoscopic ablation segment for mode of treatment segment is expected to register a higher CAGR of the tumor ablation industry forecast period.

Based on mode of treatment, the tumor ablation market is segmented into laparoscopic ablation, surgical ablation, and percutaneous ablation. Increasing collaboration between industry players and healthcare providers and integration of ablation systems with other treatment modalities contribute to the growth of this segment. Laparoscopic ablation has improved benefits as compared to other modes of treamtnets. Factors such as reduced pain, greater visibility due to laparoscopic cameras, quick recovery, and shorter stays at the hospitals contribute to the exponential growth of this segment.

The liver cancer segment for application segment held the largest share of the tumor ablation industry in 2023.

Based on application, the tumor ablation market is segmented into liver cancer, kidney cancer, lung cancer, bone cancer, and other applications. Liver cancer segment held largest share of the market in 2023 and is also expected to register a significant growth rate from 2024 to 2029. Increasing adoption of image-guided therapies and increasing funding opportunities for cancer research are driving the adoption.

By end user, the hospitals and clinic centers segment of the tumor ablation industry held the largest share.

The tumor ablation market is segmented by end users into hospitals and clinics, cancer care centers, and other end users. However, the cancer care centers segment is expected to grow at the highest CAGR during the forecast period. The rise in number of chronic diseases, including cancer, increasing cancer diagnostic procedures in the hospitals globally, and the potential of benefits of ablation observed in patients with early stage cancer have contributed to the growth of this segment.

By region, North America is expected to be the largest market of the tumor ablation industry by 2029.

The US and Canada accounted for a significant market share in 2023. North America's faster growth in the tumor ablation market can be attributed to its technological leadership, robust healthcare infrastructure, favorable insurance coverage, growing funding and grants for developing advanced medical equipment, favorable regulatory scenario, strategic research collaboration, and a supportive market environment fostering innovation.

To know about the assumptions considered for the study, download the pdf brochure

As of 2023, prominent players in the market are Johnson & Johnson MedTech (US), Medtronic Plc (Ireland), Stryker Corporation (US), Varian Medical Systems, Inc. (US), Olympus (Japan), AngioDynamics, Inc. (US), Boston Scientific Corporation (US), IceCure Medical Ltd. (Israel), Bioventus Inc. (US).

Scope of the Tumor Ablation Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$0.8 billion |

|

Projected Revenue by 2029 |

$1.4 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.0% |

|

Market Driver |

Increasing cancer incidence and rising geriatric population |

|

Market Opportunity |

Rising healthcare expenditure across emerging economies |

This report has segmented the global tumor ablation market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- Radiofrequency Ablation

- Microwave Ablation

- Cryoablation

- High-intensity Focused Ultrasound

- Other Technologies

By Product Type

- Generators

- Probes/electrodes

By Mode Of Treatment

- Surgical Ablation

- Percutaneous Ablation

- Laparoscopic Ablation

By Application

- Liver Cancer

- Lung Cancer

- Kidney Cancer

- Bone Cancer

- Other Applications

By End User

- Hospitals & clinics

- Cancer care centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments of the Tumor Ablation Industry:

- In May 2023, Varian launched the Isolis cryoprobe for CryoCare systems. These are disposable probes with improved efficiency and precision for cryoablation. It helps with tumor ablation. They also support accuracy and help to reduce procedure time.

- In April 2023, AngioDynamics extended its partnership with Cardiva. The collaboration aims to introduce AngioDynamics’ oncology products across Europe.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global tumor ablation market?

The global tumor ablation market boasts a total revenue value of $1.4 billion by 2029.

What is the estimated growth rate (CAGR) of the global tumor ablation market?

The global tumor ablation market has an estimated compound annual growth rate (CAGR) of 10.0% and a revenue size in the region of $0.8 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the tumor ablation market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial tumor ablation market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

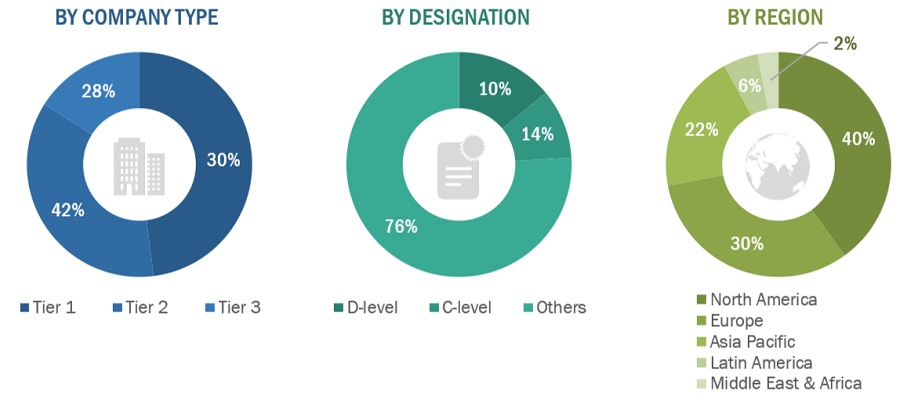

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the tumor ablation market. The primary sources from the demand side include hospitals, clinics, retailers, and other end users. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2023: Tier 1 => USD 1 billion, Tier 2 = USD 200-500 million to USD 1 billion, and Tier 3 =< USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

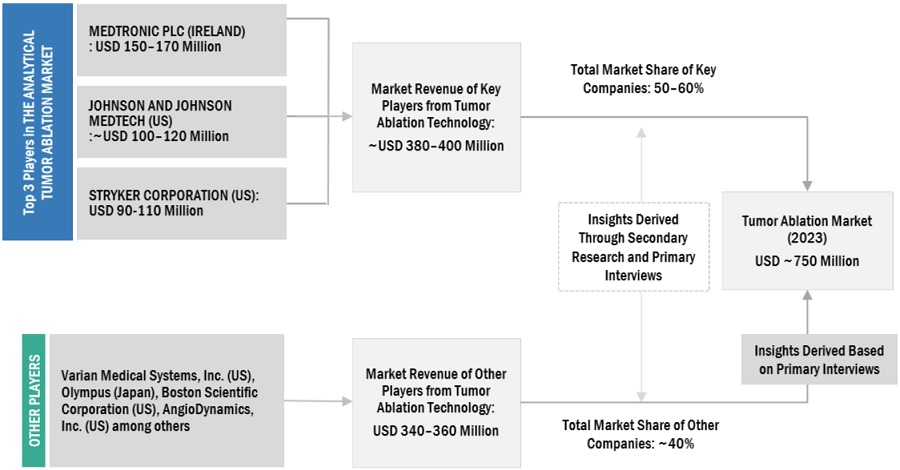

In this report, the tumor ablation market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the tumor ablation market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2022

- Extrapolating the global value of the tumor ablation market industry

Bottom-up approach

In this report, the size of the global tumor ablation market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the tumor ablation business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/product providers. This process involved the following steps:

- Generating a list of major global players operating in the tumor ablation market

- Mapping the annual revenues generated by major global players from the tumor ablation segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 50-55% of the global market share as of 2023

- Extrapolating the global value of the tumor ablation industry

Market Size Estimation For Tumor Ablation: Approach 1 (Company Revenue Estimation)I

To know about the assumptions considered for the study, Request for Free Sample Report

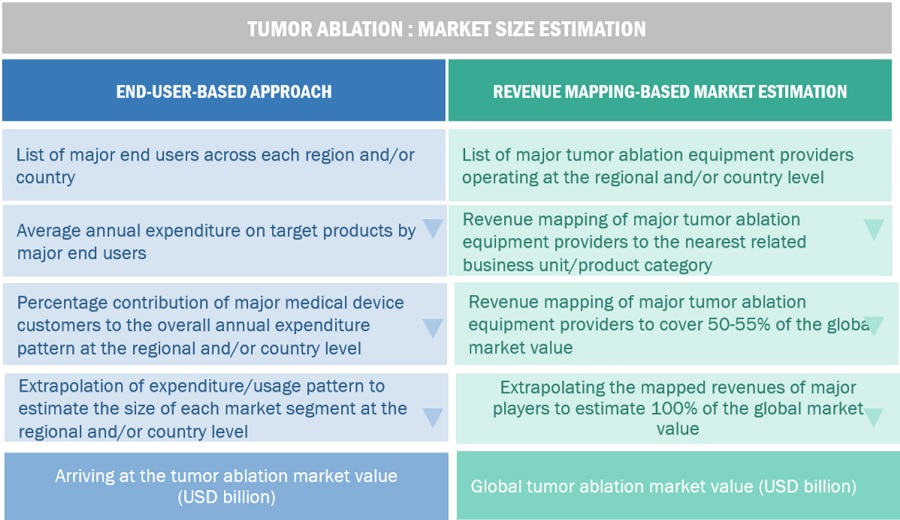

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of tumor ablation was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of tumor ablation product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall tumor ablation expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall tumor ablation market at the regional/country level

Tumor Ablation Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global tumor ablation market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the tumor ablation market was validated using top-down and bottom-up approaches.

Market Definition

Tumor ablation is a minimally invasive surgical procedure used to remove or destroy cancerous tissue from the affected area as part of cancer management and treatment. The targeted tissue is subjected to ablating energy through surgical, laparoscopic, or percutaneous methods. This technique is commonly used for treating liver, bone, lung, kidney, prostate, and other types of cancer.

Key Stakeholders

- Tumor ablation product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Interventional radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the tumor ablation market based on technology, product type, mode of treatment, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global tumor ablation market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe tumor ablation market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific tumor ablation market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tumor Ablation Market