Submarine Cable Systems Market Size, Share & Industry Growth Analysis Report by Application (Communication Cable and Power Cable), Component (Dry Plant Products and Wet Plant Products) Offering, Voltage, Type (Single Core and Multicore), Insulation, End User and Region - Global Forecast to 2029

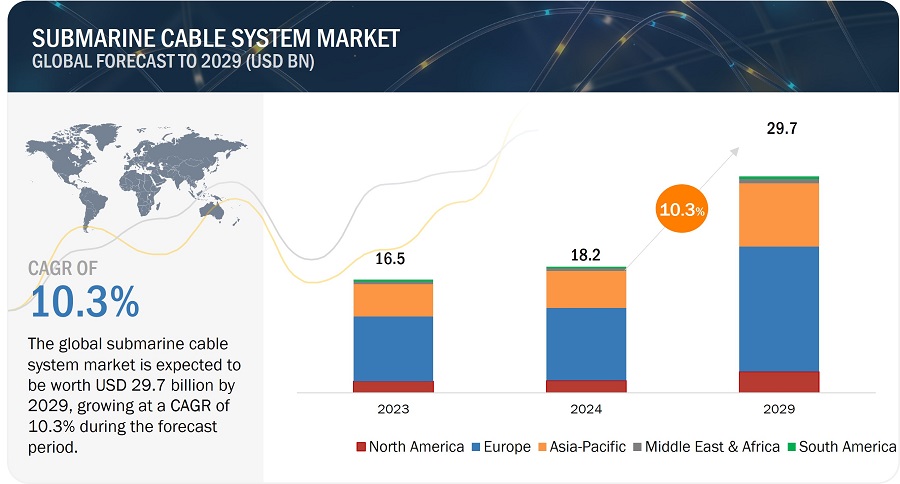

[313 Pages Report] The Submarine Cable System Market to grow from USD 18.2 billion in 2024 and is expected to reach USD 29.7 billion by 2029, growing at a CAGR of 10.3% from 2024 to 2029. Factors Expanding Offshore Wind Power Capacity, and Increasing network of submarine power cable systems drives the submarine cable system Industry.

Submarine Cable Systems Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Submarine cable system Market Dynamics

Driver: Expanding Offshore Wind Power Capacity

Globally, the need for subsea power cables is increasing due to the growth of offshore wind energy. Export cables, which connect an offshore substation to a land-based grid, and array cables, which connect surrounding wind turbines and transport electricity to the offshore substation, make up the market.

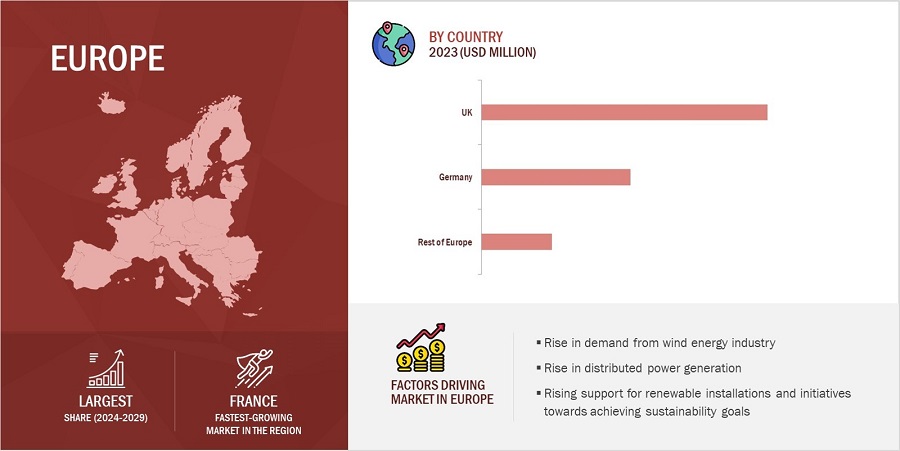

The Global Wind Report 2024 published by the Global Wind Energy Council (GWEC), the global offshore market is projected to experience significant growth, expanding from 10.8 GW in 2023 to 37.1 GW by 2028. This surge will elevate its share of new global installations from the current 9% to 20% by 2028. China and Europe are forecasted to maintain their dominance, collectively capturing over 85% of the global market share in 2024-2025. Over the period of 2024-2028, a total of 138 GW of offshore wind capacity is anticipated to be installed worldwide, with annual installations averaging around 27.6 GW. In Europe, over 42 GW of offshore wind capacity is anticipated to be developed between 2024 and 2028. The majority of this capacity, around 44%, is expected to be installed in the UK, primarily due to the anticipated commissioning of CfD Allocation Round 3, 4, and 6 projects. Germany is projected to account for 15% of the capacity, followed by Poland with 11%, the Netherlands with 8%, France with 6%, and Denmark with 5%.

Restraint: Involvement of multi-country government bodies leads to complexities and delays in approvals

Submarine cables are laid on seabed across countries, leading to the involvement of different governments and authorities. Permits are required for the installation of submarine cables on the seabed for operational time or lifetime, and some of these permits require environmental studies, easements, seabed leases, and specific governmental legislative permissions. It is difficult to install submarine communication cables between countries due to the difference in rules and regulations of countries. Legally, the status of undersea cables has little protection, particularly when they are outside the jurisdiction of a state and lie on the seabed of high seas.

Governments and authorities are involved in the cable laying process, as the cables cross through the maritime boundaries of multiple countries. Regulations and approval procedures to control the development of submarine cable projects help governments ensure that the project development pays due regard to the interests of stakeholders on issues including national security, exploitation of natural resources, and protection of the environment. Thus, network operators, system suppliers, and maintenance authorities are expected to work in accordance with the regulatory regime throughout the development process. In each case, developers face a set of hurdles that must be overcome to proceed with the investment, including working with relevant institutions, meeting policy and regulatory requirements, getting stakeholder buy-in, and appropriately allocating costs.

The fact that interconnector development involves multiple jurisdictions adds to the complexity of development and requires an additional layer of cross-border collaboration. These complex procedures often lead to project delays. Subsequently, in situations where the timescale for permit approval is not defined, developers experience difficulties in planning project implementation effectively. Permit delays can lead to the installed assets being placed on standby, inefficient installation, and delays to overall system availability, thereby acting as a restraint for market growth.

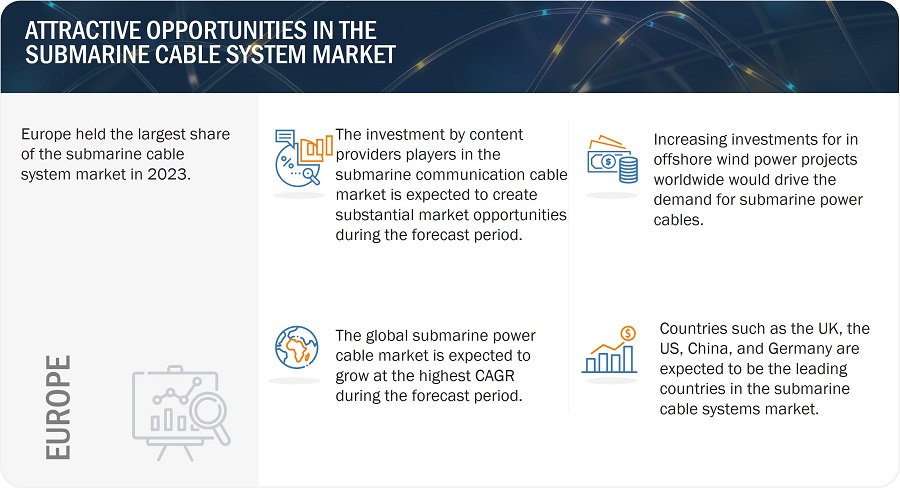

Opportunity: Increasing investments by content delivery and streaming partners to create opportunities

The telecommunications industry has undergone a major shift over the last five years, with over-the-top (OTT) providers accounting for a substantial share of investments in submarine cables. To meet the ever-increasing demand for additional capacity, OTT players such as Google, Facebook, Microsoft, and Amazon are investing in submarine cable projects. As of February 2024, Google and Meta, driven by their extensive bandwidth needs for search, video, and social media platforms, have respectively contributed to the investment in 29 and 15 submarine cable systems. To meet the large and complex infrastructure requirements, content providers are shifting focus from being capacity purchasers to cable owners. The entry of OTT players in the submarine cable systems market indicates significant growth opportunities.

Challenge: Emergence of alternative modes of internet service provisioning

The global telecom industry is making huge investments in building a sturdy networking infrastructure using fiber optics, microwave, and radio stations for terrestrial communications and subsea cabling to connect nations and continents. Currently, international internet communications depend mainly on submarine cables. Majority of international data flow is transmitted via submarines cables. However, even with the massive network of subsea cables, huge populations worldwide remain unconnected or are facing disrupted connectivity, which, in turn, is restricting the use of these cables as the primary means of data transfer on a global scale.

StarLink, provider of satellite internet services from space to Earth's orbit. By 2023, StarLink had already launched 12,000 satellites into space, with plans to deploy around 42,000 satellites by 2025. These satellites predominantly operate in Low Earth Orbit (LEO), situated approximately 550km above the Earth's surface, ensuring enhanced connectivity, high internet speeds, and reduced internet drops. Each StarLink satellite typically weighs between 100 and 500 kg and is strategically positioned in space using advanced technology to minimize collision risks and optimize internet connectivity. Other companies in the satellite internet technology sector, such as Telesat (Canada), and HughesNet (US) have also developed infrastructure to provide futuristic and sustainable internet services based on satellite communications. This technology is addressing the challenge of providing internet access to remote areas where traditional internet infrastructure is impractical to establish. Thus, the enhanced speeds and capacities facilitated by new internet providers could restrict the usage and deployment of urban, cable-based systems and, therefore, have an adverse impact on the global submarine cable market

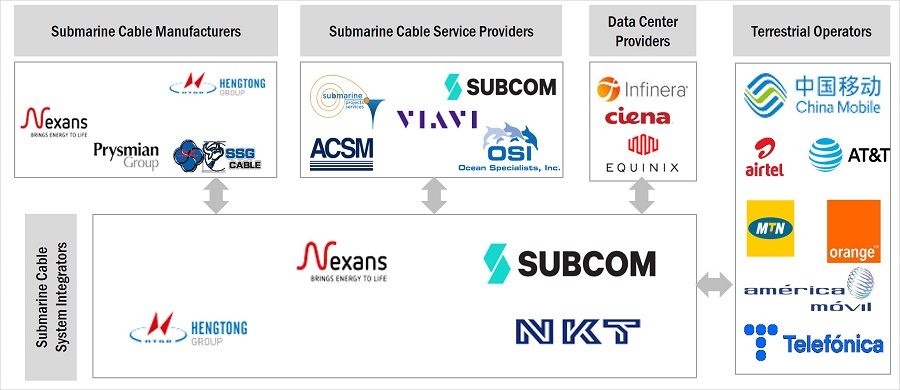

Submarine cable system Market Ecosystem

The submarine cable system market is competitive. It is marked by the presence of a prominent players, such as Alcatel Submarine Networks (France), SubCom, LLC (US), NEC Corporation (Japan), NEXANS (France), Prysmian Group (Italy),. These companies have created a competitive ecosystem by focusing on partnership, collaboration, and acquisition to achieve competitive advantage.

Upgrades segment to grow at the fastest CAGR during the forecast period.

Submarine communication cable upgrades are required to meet the capacity requirements within fixed budgets. A combination of careful planning, right equipment, and accurate field expertise is necessary to increase undersea network capacity. Innovations and upgrades in submarine communication cables enable developments in models, field trials, design methodologies, and power budget formulations to ensure successful upgrades in the coherent capacity installations of these cables

Multicore segment to achieve the fastest CAGR during the forecast period.

Multicore cables have lead sheaths to prevent water contact, conductor screens between different core conductors and insulations, and binder tapes and polypropylene string bedding around bundles of three conductors to keep them and fillers bound together. The outer side of the insulation layers has insulation screens, along with water-swellable tapes, metallic shields, and polyethylene jackets. These cables have an additional layer of galvanized steel armor with a polypropylene separator between armor layers and polypropylene, which leads to their large size and weight. A complete circuit can be laid in one trench using these cables, resulting in reduced installation and system costs

Oil-impregnated Paper to dominate market during forecast period.

OIP-insulated submarine power cables offer high voltage insulation and are usually employed for high-voltage DC transmission. These are also called mass-impregnated cables and are sustainable for the environment. This insulation type is the go-to for insulation for submarine power interconnectors, as it is suited for long-distance transmissions at extreme depths.

Europe to hold larger share of the market during the forecast period.

Europe hosts numerous offshore oil and gas projects, concentrated notably in countries such as the UK, Norway, the Netherlands, Italy, and Denmark. These projects, including Ekofisk, Montrose, Forties, Eldfisk, Dan, Brent, Frigg, Beryl, Sleipner, and Statford, are actively engaged in exploration and production activities, attracting fresh investments in the offshore oil and gas sector and subsequently fueling demand for submarine power cables in the region. Germany and the UK are poised for rapid growth during the forecast period.

Submarine Cable Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Submarine Cable System Key Market Players

The submarine cable system companies is dominated by globally established players such Alcatel Submarine Networks (France), SubCom, LLC (US), NEC Corporation (Japan), NEXANS (France), Prysmian Group (Italy), HENGTONG GROUP CO.,LTD. (China), ZTT (China), NKT A/S (Denmark), and LS Cable & System Ltd (South Korea). These players have adopted product launches/developments, partnerships, collaborations, and acquisitions for growth in the market.

Submarine Cable System Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 18.2 billion in 2024 |

|

Projected Market Size |

USD 29.7 billion by 2029 |

|

Growth Rate |

CAGR of 10.3% from 2024 |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) & Volume (Kilometers) |

|

Segments Covered |

By Application, By Component, By Offering, By Voltage, By Type, By Insulation, By End User, By Region. |

|

Region covered |

Submarine Power Cable Systems Market regions – North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

The key players in the submarine cable system market are Alcatel Submarine Networks (France), SubCom, LLC (US), NEC Corporation (Japan), NEXANS (France), Prysmian Group (Italy), HENGTONG GROUP CO.,LTD. (China), ZTT (China), NKT A/S (Denmark), Corning Incorporated (US), Hellenic Cables (Greece), Sumitomo Electric Industries, Ltd. (Japan), Apar Industries (India). AFL (US), TFKable (Poland), Hexatronic Group (Sweden), SSGCABLE (China), OCC Corporation (Japan), 1X Technologies LLC (US), Tratos (UK), Taihan Cable & Solution Co., Ltd. (South Korea), FURUKAWA ELECTRIC CO., LTD. (Japan), Ningbo Orient Wires &Cables Co.,Ltd. (China), Qingdao Han Cable Co., Ltd. (China), LS Cable & System Ltd (South Korea), and Ocean Specialists, Inc. (US). |

Submarine Cable Systems Market Highlights

In this report, the overall submarine cable systems market has been segmented based on application, type, offering, voltage, component, insulation, end-user, and region.

|

Segment |

Subsegment |

|

By Application: |

|

|

By Component: |

|

|

By Offering: |

|

|

By Region: |

|

|

By Type: |

|

|

By Voltage: |

|

|

By Insulation: |

|

|

By End-User: |

|

|

By Region: |

|

Submarine Cable System Recent Developments

- In September 2023 SubCom, LLC (US), expanded its manufacturing (more cables, faster production) and marine operations (new ships, deployment center) to meet the growing demand for undersea cables used in digital infrastructure. They've also increased their workforce by 20% to better serve customers.

- In April 2023, Sumitomo Electric Industries, Ltd. (Japan) announced plans to establish a new Power Cable factory (high voltage cable manufacturing plant) in the Scottish Highlands to support the UK Government’s goal to achieve Net zero in 2050.

- In April 2023, Nexans (France) successfully finalized the acquisition of Reka kaapeli oy, a leading Finnish manufacturer of high, medium, and low voltage cables, to become a key player in electrification and contribute to carbon neutrality by 2030.

Frequently Asked Questions (FAQs):

Which are the major companies in the submarine cable system market? What are their major strategies to strengthen their market presence?

Alcatel Submarine Networks (France), SubCom, LLC (US), NEC Corporation (Japan), NEXANS (France), Prysmian Group (Italy),, are some of the major companies operating in the submarine cable system market. Contracts, and acquisitions were the key strategies these companies adopted to strengthen their submarine cable system market presence.

What are the drivers for the submarine cable system market?

Drivers for the submarine cable system market are:

- Expanding Offshore Wind Power Capacity

- Increasing penetration of Internet and collaborations among tier 1 vendors

- Growing demand for bandwidth due to emergence of 5G

- Growing demand in Asia Pacific region owing to increased traffic

- Increasing network of submarine power cable systems

What are the challenges in the submarine cable system market?

Scarcity of commissioning and repair vessels, and emergence of alternative modes of internet service provisioning are among the challenges faced by the submarine cable system market.

What are the Opportunities in the submarine cable systems?

Upcoming projects to boost market growth, and increasing investments by content delivery and streaming partners to create opportunities in Pacific are a few of the key opportunities of submarine cable system market.

What is the total CAGR expected to be recorded for the submarine cable system market from 2024 to 2029?

The CAGR is expected to record a CAGR of 10.3% from 2024-2029.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

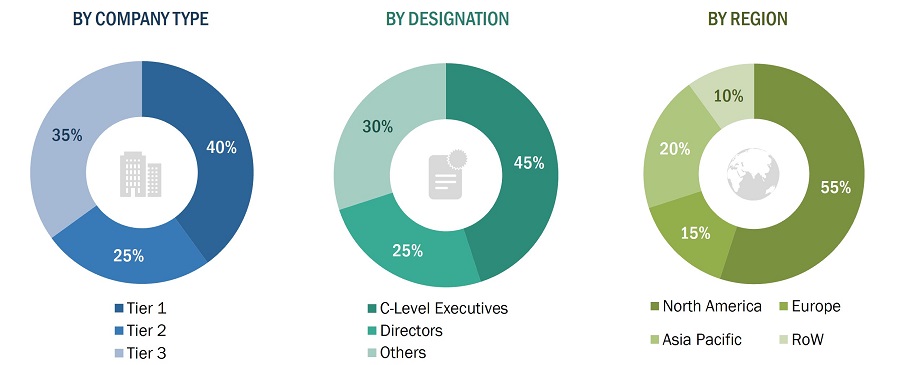

The study involved four major activities in estimating the size of the submarine cable system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the submarine cable system industry, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the submarine cable system market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

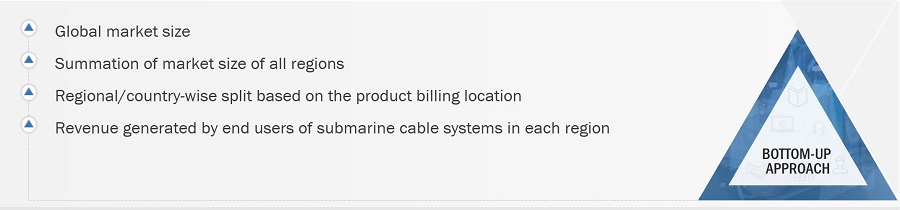

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the submarine cable system market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various end users that are using or are expected to deploy submarine cable systems

- Analyzing each application, along with major related companies, and identifying the hardware and integrators for the implementation of a functional submarine cable systems ecosystem for power and communication applications

- Estimating the submarine cable systems market size, by end user

- Understanding the demand generated by companies operating across different applications

- Tracking the ongoing as well as upcoming projects of submarine cable systems and forecasting the market on the basis of these developments and other parameters such as macro-and-micro economic factors

- Carrying out multiple discussions with key opinion leaders to understand the submarine cable systems and services to analyze the breakdown of the scope of work carried out by each major company in the market

- Arriving at the market estimates by analyzing the revenue of market players in each country and totaling the revenue of all market players to arrive at regional market estimates

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, including CXOs, directors, and operation managers; and, finally, with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the overall market was split into several segments and subsegments. Market breakdown and data triangulation procedures were employed, wherever applicable, for the overall market engineering process, as well as to arrive at the exact statistics for all segments and subsegments. Data was triangulated by studying various factors and trends from demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

Submarine cable systems are widely used for communication and power transmission. Submarine communication cables are laid on the seabed to carry telecommunication signals from one land-based station to another across oceans. Submarine power cables are laid on ocean beds, straits, or rivers to transmit electricity at high voltages over long distances and are primarily used to connect the mainland with large islands and mainland power grids with oil & gas platforms as well as to transmit electricity across countries or islands.

Stakeholders

- Telecommunication service providers

- Electricity providers

- Submarine cable system manufacturers

- Technology investors

- Research institutes and organizations

- Small and large technology centers

- Renewable energy solution providers

- Market research and consulting firms

Research Objectives

- To describe and forecast the submarine cable system market, by application, in terms of value & volume.

- To describe and forecast the submarine communication cable market, in terms of value, by component, offering, and region

- To describe and forecast the submarine power cable market, in terms of value, by end user, insulation, voltage, and type

- To describe and forecast the submarine communication cable market, in terms of value, for various segments in 6 main regions: Transatlantic, Transpacific, Intra-Asia, the Americas, Europe-Asia, and EMEA

- To describe and forecast the submarine power cable market, in terms of value, for various segments in 5 main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the submarine cable system market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for various stakeholders by identifying the high-growth segments of the submarine cable system market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2

- To provide a detailed competitive landscape of the market

- To analyze competitive developments such as contracts, agreements, acquisitions, product launches, and partnerships in the submarine cable system market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Submarine Cable Systems Market

Want to identify component that are covered within this report.