Polyethyleneimine Market by Type (Branched, Linear), Application (Detergents, Adhesives and Sealants, Water Treatment Chemicals, Cosmetics, Paper, Coatings, Inks, and Dyes), and Region - Global Forecast to 2029

Updated on : May 23, 2024

Polyethyleneimine Market

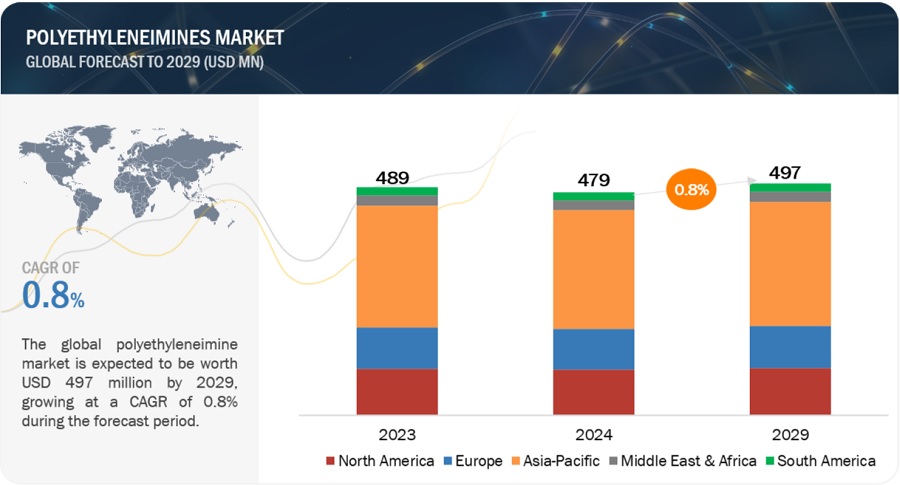

The Polyethyleneimine Market is valued at USD 479 million in 2024 and is projected to reach USD 497 million by 2029, growing at 0.8% cagr from 2024 to 2029. Adhesives & Sealants and Detergent, by application segment in the Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for polyethyleneimine. As a highly effective polymer, polyethyleneimine finds extensive use in sectors such as adhesives, sealants, coatings, biomedical, and detergent formulations. Its ability to form strong bonds, enhance product performance, and provide solutions to diverse industrial challenges fuels its demand globally. Additionally, increasing research and development activities focused on exploring new applications and improving product characteristics further propel the growth of the polyethyleneimine market.

Attractive Opportunities in the Polyethyleneimine Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Polyethyleneimine Market Dynamics

Drivers: Application growth in adhesives and sealants

Polyethyleneimine plays a crucial role in enhancing adherence and serving as a coating or lamination material, particularly in water-based primers for metals, fabrics, and packaging films. This versatility aligns with the evolving needs of industries such as construction, automotive, and packaging, where demand for high-performance adhesives and sealants is steadily increasing. In adhesive formulations, Polyethyleneimine's cationic properties facilitate strong bonding between surfaces, ensuring improved adhesion and durability. This is particularly crucial in sectors like construction and automotive, where robust bonding is essential for structural integrity and performance. In the construction sector, Polyethyleneimine's ability to improve bonding strength and durability makes it indispensable for applications such as bonding building materials and sealing joints. Similarly, in the automotive industry, Polyethyleneimine is utilized in adhesive formulations for assembling vehicle components, contributing to enhanced vehicle performance and safety. Furthermore, in the packaging industry, Polyethyleneimine's use in extrusion coatings ensures the integrity and protection of packaged goods. The rising demand for Polyethyleneimine across these industries underscores its pivotal role in driving market growth, as industries continue to prioritize efficiency, durability, and performance in their adhesive and sealant applications.

Restraints: Raw material price instability

Instability in the availability and pricing of raw materials used in Polyethyleneimine production can disrupt the supply chain and significantly impact production costs for manufacturers. Fluctuations in raw material prices, driven by factors such as geopolitical tensions, or changes in supply and demand dynamics, directly affect the profitability of Polyethyleneimine manufacturers. Moreover, supply chain disruptions, whether due to logistical challenges or unexpected events, can lead to delays in production and distribution, further exacerbating market challenges. As a result, Polyethyleneimine manufacturers may face difficulty in maintaining competitive pricing and meeting customer demand, ultimately hindering market growth.

The unpredictability in raw material availability and pricing creates a challenging environment for Polyethyleneimine manufacturers, making it difficult to forecast production costs accurately and maintain competitive pricing strategies. Sudden spikes in raw material prices can squeeze profit margins, impacting the overall financial health of companies operating in the Polyethyleneimine market. Additionally, supply chain disruptions, such as transportation delays or inventory shortages, can hinder the timely delivery of Polyethyleneimine products to customers, leading to potential dissatisfaction and loss of market share.

Opportunities: Expanding polyethyleneimine application in shale inhibition

The utilization of graphene grafted with polyethyleneimine in water-based drilling fluids offers a myriad of benefits including enhanced shale inhibition properties, improved stability against water, advanced rheological features, and reduced fluid loss during drilling operations. By synergizing the unique attributes of graphene with the efficacy of polyethyleneimine, this technology effectively addresses key challenges encountered in unconventional gas drilling such as shale hydration, swelling, and borehole instability. Moreover, the adoption of polyethyleneimine-grafted graphene contributes to environmental sustainability by diminishing the reliance on oil-based drilling fluids. With the escalating demand for high-performance water-based drilling fluids, driven by the industry's shift towards eco-friendly practices, the integration of graphene-polyethyleneimine composites presents a promising growth opportunity for the polyethyleneimine market. This advanced solution not only enhances drilling efficiency but also resonates with the industry's increasing emphasis on pioneering innovative and environmentally conscious technologies for unconventional gas exploration and production.

Challenges: Stringent regulatory policies

Environmental regulations pertaining to polymer usage and disposal have a significant impact on the polyethyleneimine market, as compliance with these regulations is essential for market players to ensure sustainable operations and maintain a positive reputation in the industry. These regulations often impose strict limits on the release of pollutants into the environment, including emissions during polyethyleneimine production processes and disposal of polyethyleneimine-containing products at the end of their lifecycle.

One of the key challenges faced by polyethyleneimine manufacturers is the need to invest in advanced pollution control technologies and waste management systems to meet regulatory requirements. This often entails significant upfront costs and ongoing operational expenses, which can impact profit margins and competitiveness in the market. Additionally, regulatory compliance may require changes to manufacturing processes or formulations to reduce environmental impact, which can further add complexity and cost to operations.

Moreover, the complexity and variability of environmental regulations across different regions and jurisdictions present a challenge for global polyethyleneimine manufacturers operating in multiple markets. Ensuring compliance with diverse regulatory frameworks requires comprehensive understanding and monitoring of local regulations, as well as proactive engagement with regulatory authorities to address any compliance issues.

Furthermore, the growing public awareness and scrutiny of environmental issues place additional pressure on polyethyleneimine manufacturers to demonstrate their commitment to sustainability and environmental stewardship. Failure to meet regulatory requirements or address environmental concerns effectively can result in reputational damage and loss of market share.

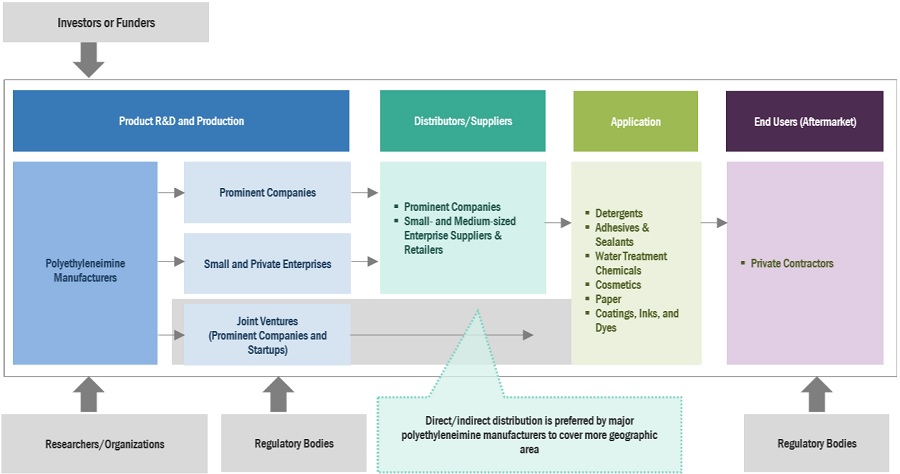

Polyethyleneimine Market Ecosystem

Prominent companies in this market include well established, financially stable manufacturers of polyethyleneimine. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in the market include Nippon Shokubai Co. Ltd (Japan), BASF SE (Germany), FUJIFILM Wako Pure Chemical Corporation (Japan), and Shanghai Holdenchem Co. (China).

“Branched type account the largest share of polyethyleneimine market in terms of value.”

Branched polyethyleneimine molecules have a higher number of amine groups, leading to increased reactivity compared to linear polyethyleneimine. This increased reactivity makes branched polyethyleneimine particularly effective as a crosslinking agent, adhesive, and flocculant in industries such as paper manufacturing, water treatment, and coatings. Additionally, branched polyethyleneimine exhibits better solubility in aqueous solutions, making it easier to handle and formulate in various industrial processes. Its wide-ranging applications and superior performance characteristics contribute to its dominance in the polyethyleneimine market.

“Paper is projected to be the second fastest growing application segment of polyethyleneimine market .”

Polyethyleneimine's cationic nature enables it to act as an effective retention aid and drainage aid in papermaking processes, improving paper quality and production efficiency. Additionally, its high molecular weight and charge density contribute to enhanced paper strength, retention of fines, and reduction of filler usage, resulting in cost savings for paper manufacturers. Furthermore, the increasing demand for eco-friendly and sustainable paper products drives the adoption of polyethyleneimine-based solutions as they offer alternatives to traditional chemicals with lower environmental impact. As paper industries continue to prioritize efficiency, quality, and sustainability, the demand for polyethyleneimine in paper applications is expected to grow significantly, further fueling its rapid expansion in this segment.

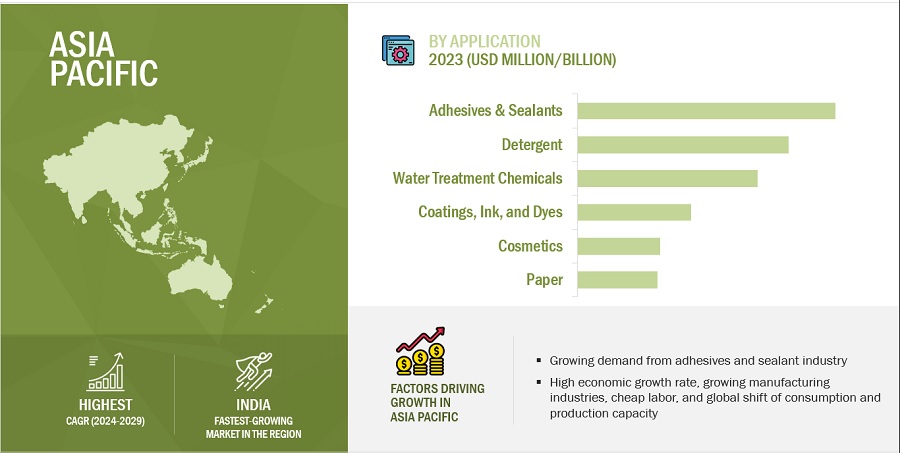

In Asia Pacific, India is the fastest-growing polyethyleneimine market.

To know about the assumptions considered for the study, download the pdf brochure

The country's expanding industrial sector, particularly in segments such as textiles, paper manufacturing, and water treatment, necessitates the use of polyethyleneimine for various applications. With rapid urbanization and infrastructure development projects underway, there is a growing demand for polyethyleneimine-based construction materials, coatings, and adhesives to meet the needs of modern urban living. Additionally, India's increasing emphasis on environmental sustainability and water conservation has led to a surge in the adoption of polyethyleneimine for water treatment applications, addressing the challenges of pollution and water scarcity.

Furthermore, the rising disposable incomes and changing consumer preferences in India are fueling demand for products that incorporate polyethyleneimine, such as personal care items, household products, and specialty chemicals. Moreover, government initiatives promoting manufacturing growth, foreign investment, and technological innovation are creating a conducive environment for the expansion of the polyethyleneimine market in India. With these combined factors, India is poised to witness robust growth in the consumption of polyethyleneimine, positioning itself as a key player in the global market.

Read More: Polyethyleneimine Companies

Polyethyleneimine Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2022-2029 |

|

Base year considered |

2023 |

|

Forecast Period |

2024-2029 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

By Type, By Application, By Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa and South America |

|

Companies covered |

Nippon Shokubai Co. Ltd (Japan), BASF SE (Germany), FUJIFILM Wako Pure Chemical Corporation (Japan), and Shanghai Holdenchem Co. (China) |

Based on type, the polyethyleneimine market has been segmented as follows:

- Linear

- Branched

Based on application, the polyethyleneimine market has been segmented as follows:

- Detergents

- Adhesives & Sealants

- Water Treatment Chemicals

- Cosmetics

- Paper

- Coatings, Inks, and Dyes

- Other Applications

Based on the region, the polyethyleneimine market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Polyethyleneimine Market Players

Nippon Shokubai Co. Ltd (Japan), BASF SE (Germany), FUJIFILM Wako Pure Chemical Corporation (Japan), and Shanghai Holdenchem Co. (China) are the key players in the global polyethyleneimine market.

Nippon Shokubai Co Ltd (Nippon Shokubai) is a chemical company specializing in the production and distribution of a diverse range of basic and functional chemicals, as well as catalysts. Their product line encompasses acrylic acid, ethylene oxide, ethanolamine, maleic anhydride, and De-NOx catalysts. Additionally, they offer super water-absorbing resins, unsaturated polyester resins, automotive catalysts, process catalysts, decomposition catalysts, coating material resins, organic and inorganic particles, among others. Operating on a global scale, Nippon Shokubai distributes its products across Japan, Europe, Asia, North America, and other regions. The company operates manufacturing facilities located in Japan, the United States, Belgium, Singapore, Indonesia, China, and Taiwan. Nippon Shokubai's headquarters are situated in Osaka, Japan.

Recent Developments

- In January 2018, Nippon Shokubai Co., Ltd. expanded its production capacity for functional monomer “VEEA”, and functional polymers “EPOCROS” and “EPOMIN” to meet the strong growth in global demand. “EPOMIN” is a water-soluble polymer (Polyethyleneimine) with the highest cationic charge density among existing materials. “EPOMIN” has excellent reactivity and adhesiveness, and its demand is increasing for water treatment and pigment dispersion.

Frequently Asked Questions (FAQ):

What are the growth driving factors of polyethyleneimine market?

Application growth in adhesive and sealants.

What are the major type for polyethyleneimine?

The major type of polyethyleneimine are Linear and Branched.

What are the major applications of polyethyleneimine?

The major applications of polyethyleneimines are Detergents, Adhesives & Sealants, Water Treatment Chemicals, Cosmetics, Paper, and Coatings, Inks, and Dyes.

Who are the major manufacturers?

Nippon Shokubai Co. Ltd (Japan), BASF SE (Germany), FUJIFILM Wako Pure Chemical Corporation (Japan), and Shanghai Holdenchem Co. (China) are some of the leading players operating in the global polyethyleneimine market.

Which is the largest region in the polyethyleneimine market?

Asia Pacific is the largest region in polyethyleneimine market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

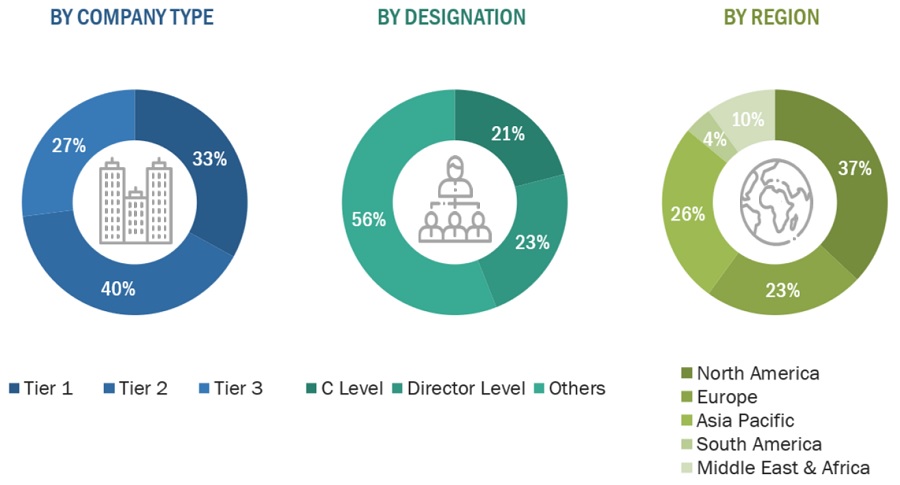

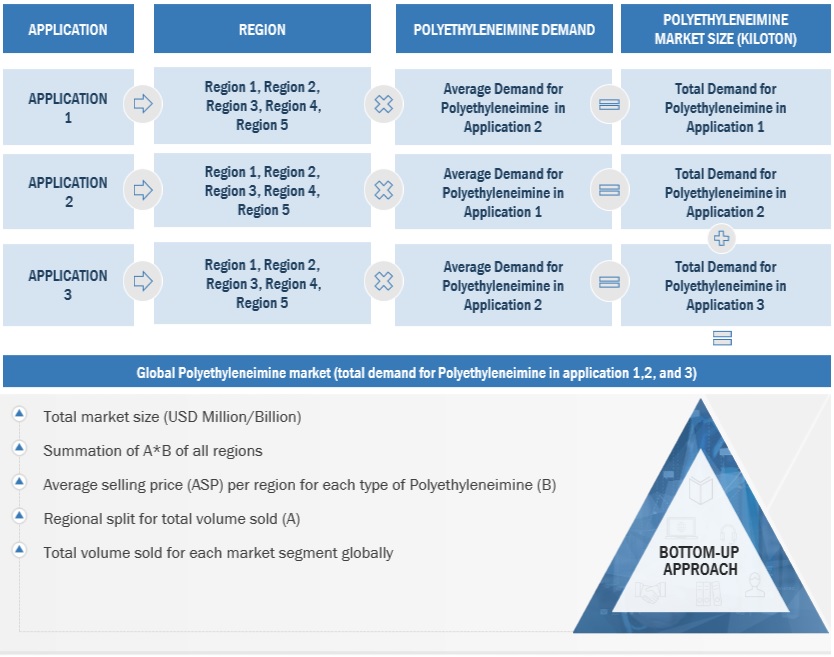

The study involved four major activities in order to estimate the current size of the polyethyleneimine market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, Chemical & Petrochemicals Manufacturers Association, European Ethylene Producers Committee, American Chemical Society, and International Council of Chemical Associations.

Primary Research

Extensive primary research was carried out after gathering information about polyethyleneimine market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the polyethyleneimine market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, application, and region.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Shanghai Holdenchem Co. |

Sales Manager |

|

Basf SE |

Project Manager |

|

WUHAN BRIGHT CHEMICAL Co. Ltd |

Individual Industry Expert |

|

Dow |

Manager |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the polyethyleneimine market. The market sizing of the polyethyleneimine market was undertaken from the demand side. The market size was estimated based on market size for polyethyleneimine in various technology.

Global Polyethyleneimine Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Polyethyleneimine Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Polyethyleneimine (PEI), a versatile polymer known for its cationic properties and diverse applications, finds extensive use in sectors such as water treatment, detergents, cosmetics, Paper, and coatings. In water treatment, PEI-based polymers function as flocculants or coagulants, facilitating the removal of contaminants such as heavy metals, organic pollutants, and dyes from water sources. PEI provides adhesion to various substrates (e.g., metals, plastics) due to its strong bonding capabilities and PEI coatings provide protection against corrosion, abrasion, and chemical damage. In cosmetics it primarily acts as a binding agent, helping to stabilize formulations and improve the consistency and texture of cosmetic products such as creams, lotions, and gels.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, and forecast the size of the polyethyleneimine market in terms of value and volume

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market size by type and application

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as expansions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the polyethyleneimine market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the polyethyleneimine Market

Growth opportunities and latent adjacency in Polyethyleneimine Market