Plant-based Protein Market by Source (Soy, Wheat, Pea, Canola Oats, Rice & Potato, Beans & Seeds, Fermented Protein), Type (Concentrates, Isolates, Textured), Form (Dry, Liquid), Nature (Conventional, organic), Application - Global Forecast to 2029

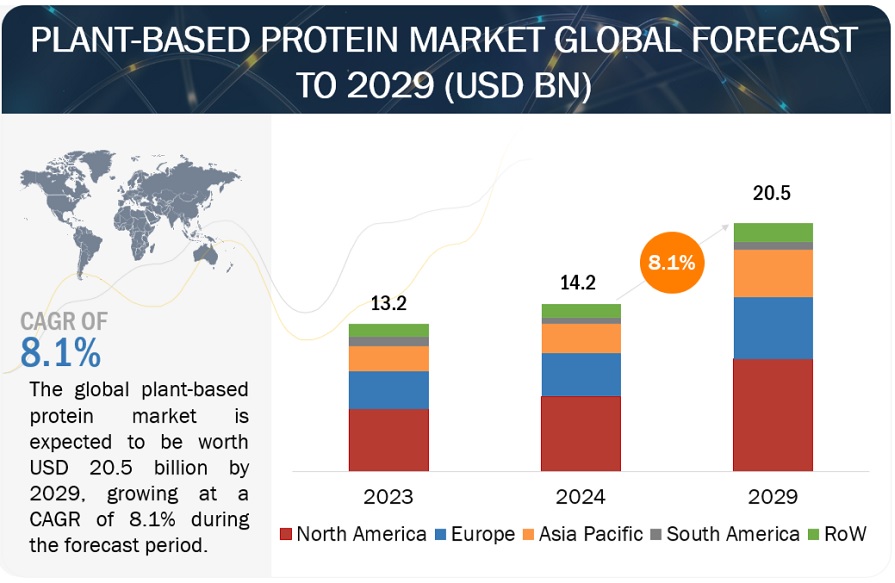

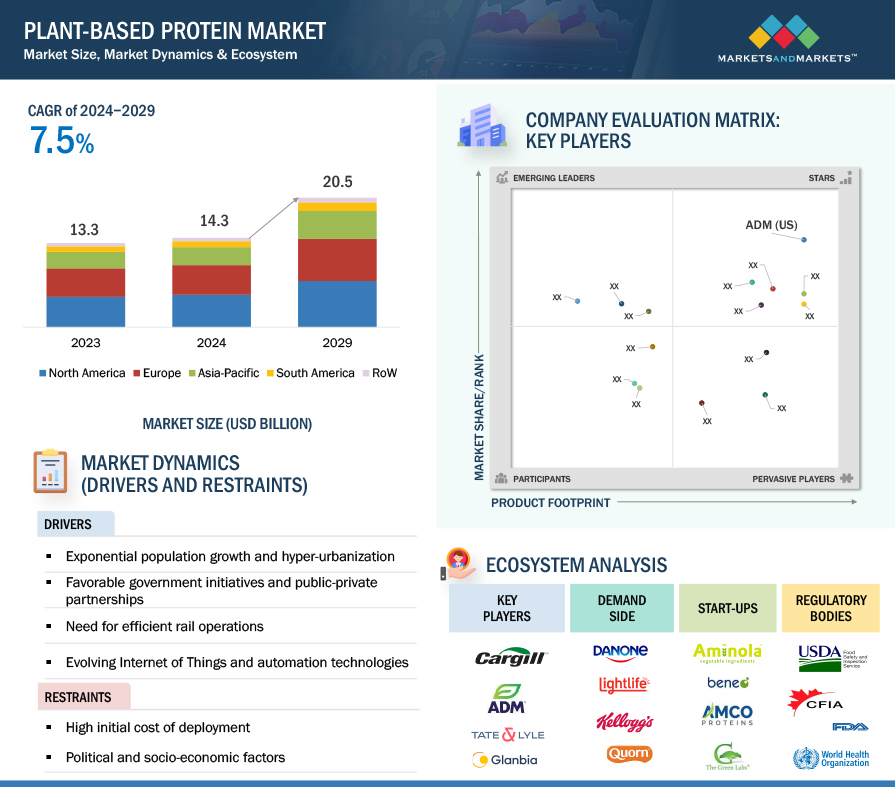

[350 Pages Report] The market for plant-based protein is estimated at USD 14.2 billion in 2024; it is projected to grow at a CAGR of 8.1% to reach USD 20.5 billion by 2029. The plant-based protein market has experienced a significant increase in popularity as consumers seek alternatives to traditional animal-derived protein sources. This trend is driven by a multitude of factors, including concerns about health, ethics, environmental awareness, and personal dietary preferences. Many individuals are opting for plant-based protein products due to reasons such as allergies, dietary restrictions, or a preference for a healthier lifestyle. Furthermore, there is a growing demand for plain formulations in this sector, particularly those that are low in calories and free from added sugars.

Plant-based protein represents a burgeoning opportunity in today's market for alternative protein sources. While meat has historically been the dominant source of protein in developed economies, there is an increasing interest in alternative options in emerging markets. Shifting consumer preferences towards plant-based protein sources, motivated by factors such as nutritional value, trends towards clean eating, health considerations such as lactose intolerance, environmental consciousness, and concerns for animal welfare, have propelled the expansion of this market. Plant-based protein has transcended its traditional applications in meat and dairy substitutes to encompass segments such as performance nutrition and infant nourishment. The acknowledgment of the functional benefits of plant-based protein has contributed to its growing acceptance among consumers. Additionally, the incorporation of plant-based protein into supplements has been associated with various health advantages, including improvements in brain function, eye health, heart health, muscle endurance, strengthened immunity, and weight management.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Plant-based Protein Market Dynamics

Driver: Growing interest in health-centric food and beverages

The growth of the plant-based protein market is being propelled by evolving consumer preferences, notably among a significant portion of Western millennials, who are gravitating towards healthier dietary options. There is a noticeable surge in the demand for organic and plant-based food products, driven by their perceived health advantages, particularly in terms of digestive health and the prevention of obesity and chronic illnesses.

The expanding vegan and flexitarian demographic is expected to be a key driver of the plant-based protein market in the foreseeable future. With increasing health consciousness among consumers, various food items, such as meat patties and sausages, are being substituted with plant-based or plant-infused alternatives, which is anticipated to positively influence the demand for plant-based protein. According to data from The Food Science and Health Database Organization, approximately 22 million UK citizens have embraced a flexitarian lifestyle, indicating a significant shift towards healthier eating habits, particularly among influential millennials.

Retail sales of plant-based alternative food and beverages in the United States, designed to replace traditional meat, dairy, eggs, and seafood products, reached USD 7.4 billion in 2021, reflecting a 6% increase from the previous year, as reported by the Plant-based Foods Association (PBFA). Notably, during the COVID-19 pandemic, sales of plant-based food and beverages in the US surged by 90% in March 2020 compared to the previous year, underscoring a heightened consumer interest in these products. The Good Food Institute (GFI) highlights a remarkable surge in demand for plant-based products in the US, driven by consumers' growing inclination towards sustainable and health-conscious choices, thereby fostering a burgeoning market for plant-based foods and beverages.

Restraint: Possibility of nutritional deficiencies among vegans

While vegan diets can offer health benefits, eliminating animal-derived foods entirely may raise concerns about obtaining essential nutrients. Although there are numerous plant-based protein sources like lentils, beans, chickpeas, nuts, seeds, soy products, and whole grains, some vital nutrients found primarily in animal products may be lacking in a vegan diet. Many individuals assume that meeting protein needs on a plant-based diet is straightforward, but the absence of animal products can lead to deficiencies in vitamin B12, omega-3 fatty acids, iron, and creatinine.

Vitamin B12, crucial for red blood cell formation and neurological health, is exclusively present in animal-derived foods such as fish, meat, dairy, and eggs, with minimal amounts found in certain seaweeds. Without supplements or fortified foods, vegans face a heightened risk of vitamin B12 deficiency. Creatinine, a compound abundant in animal products, plays roles in muscle development and brain function. While primarily stored in muscles, it also contributes to brain health, serving as a readily available energy source for muscle cells, enhancing their endurance and strength.

Opportunity: Changes in consumer lifestyles

The global population's expansion is placing heightened strain on limited resources, with escalating energy prices and raw material expenses impacting food costs, particularly affecting lower-income demographics. Additionally, the strain on food resources is being intensified by water scarcity, notably prevalent across Africa and Northern Asia. Within the Asia Pacific region, there exists a cost advantage in terms of both production and processing, fostering high demand and offering favorable conditions for dairy alternative suppliers and manufacturers to target this market.

As lifestyles evolve rapidly, there's a noticeable shift towards more nutritious and health-conscious food options. The distinction between fast food and junk food is anticipated to grow, with consumers increasingly seeking quick yet wholesome alternatives. Recognizing naturally rich nutritional products presents a significant opportunity for suppliers and manufacturers to meet evolving consumer preferences.

Furthermore, the rise in disposable incomes is driving demand for convenient, healthy, and highly nutritious products across Asia Pacific nations. Emerging economies within the region present substantial opportunities for growth within the plant-based protein market.

Challenge: Concerns over quality of food and beverages due to adulteration of GM ingredients

Soy, wheat, and peas are key sources utilized for extracting plant-based protein and are extensively cultivated in Brazil, the US, Argentina, China, and India. As consumer demand for plant-based food and beverages grows, so does the demand for these crops. However, there's a rising concern about adulteration with Genetically Modified (GM) ingredients to meet the increasing demand. While non-GMO soybeans are primarily used for human consumption, GM soybeans are predominantly used in livestock feed. Producing non-GMO soybeans requires extra attention and effort from producers, leading to higher production costs and lower profits.

A significant portion of GM soy is processed with hexane, which poses health risks if consumed in large quantities. Consequently, the consumption of plant-based products made from GM soybeans has become a global concern among consumers.

Government regulators in regions like the Asia Pacific and Europe have mandated the declaration of GM/non-GM status on food packaging. GM ingredients are linked to allergic reactions and may contain herbicidal residues, posing challenges for their production and use in plant-based foods. For example, the launch of GMO-based soybean burger patties by Impossible Burgers (US) has faced skepticism from consumers due to the inclusion of inorganic ingredients and herbicides.

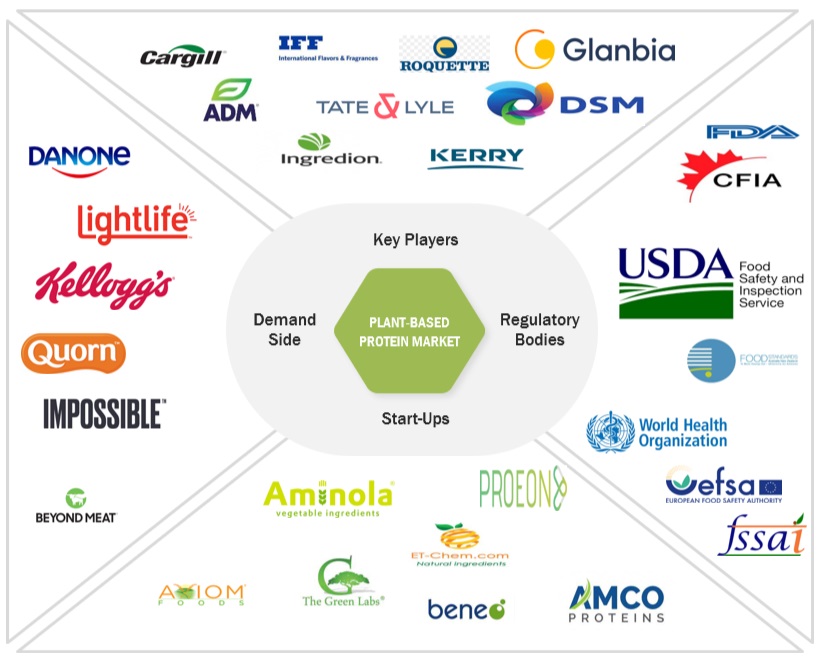

Plant-Based Protein Market Ecosystem

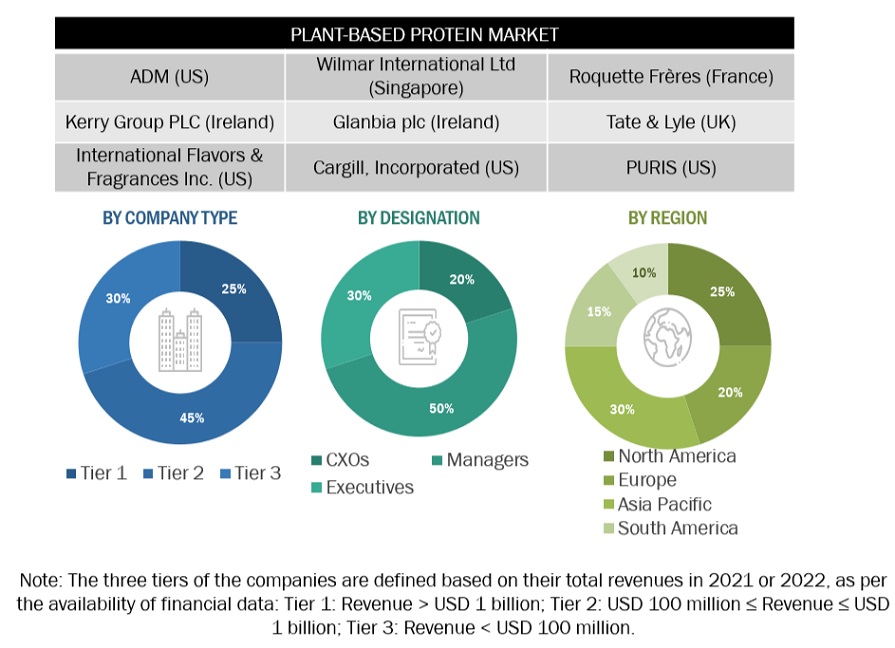

Prominent companies in this market include well-established, financially stable manufacturers of plant-based protein. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Roquette Frères (France), Ingredion (US), Wilmar International Ltd. (Singapore).

Based on type, the isolates sub segment is estimated to grow at the fastest CAGR during the studied period.

Protein isolates represent a refined form of protein powder distinguished by its remarkable purity and exceptionally high protein content, typically averaging around 90%. Despite their higher cost compared to other plant-based protein options, plant protein isolates are preferred for their outstanding digestibility and adaptability across various food products. Typically derived from legume sources such as soy and pea de-oiled cake, they are widely regarded as one of the safest protein sources, suitable even for infant

nutrition. The plant-based protein market anticipates significant growth prospects for isolates owing to their concentrated protein content, rendering them highly suitable for incorporation into nutritional and functional foods like snacks, cereals, beverages, and plant-based meat substitutes. Pea protein isolates, in particular, have emerged as a valuable protein source, responding to the nutritional industry's increasing demand for high-protein offerings.

The market demand for plant protein isolates, notably those sourced from peas, is on the rise due to expanding business prospects and consumer preferences. Plant-based protein manufacturers are introducing novel isolates to cater to this demand and leverage the associated business opportunities. For Instance, in July 2023, Burcon NutraScience Corporation, a Canadian firm, unveiled a hempseed protein isolate aimed at enriching the nutritional composition of snacks, as well as protein-rich food and beverage items. This strategic move by the company was prompted by the escalating consumer interest in plant protein isolates.

The feed application in the plant-based protein market is forecasted to register the most significant CAGR over the projected period.

The demand for plant-based proteins in animal feed is steadily increasing, reflecting the rise in consumption of various products in developed countries. North America and Asia Pacific play significant roles in both meat production and feed consumption. Although plant-based sources have been used in the food industry for some time, they have typically been processed and utilized in a relatively basic protein form. However, there is a noticeable trend towards the development of higher-quality protein-based feeds, such as isolates, indicating an enhancement in feed quality. Pea protein isolates, particularly favored in aquafeed, and potato proteins, widely used in compound premixes to improve overall yields, are gaining popularity. This shift towards plant-based proteins in feed applications is driven by growing concerns about sustainable agricultural practices, aiming to mitigate the environmental impact of future food production.

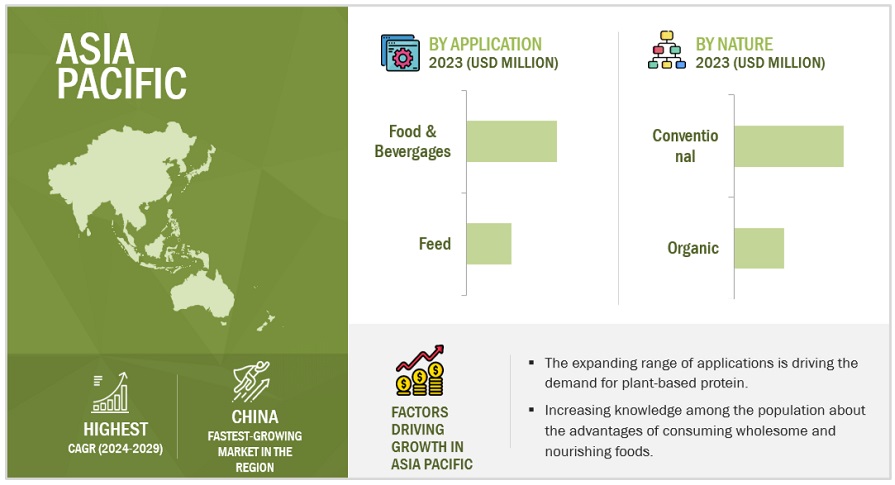

The Asia Pacific region is anticipated to experience the most rapid growth between 2024 and 2029.

The Asia Pacific region is experiencing rapid growth within the plant-based protein market, primarily due to increasing awareness of health, immunity, and environmental sustainability among consumers. This shift towards plant-based protein sources reflects a growing understanding of the health benefits associated with a plant-focused diet, including reduced risks of chronic diseases and improved immune function. Moreover, mounting concerns about environmental sustainability, such as carbon emissions and land use linked to animal agriculture, are driving consumers towards plant-based alternatives. This trend is further supported by innovative food technologies offering a wide variety of plant-based protein products that cater to the region's diverse culinary preferences. As a result, the Asia-Pacific region is becoming a significant influencer in shaping the global plant-based protein market, poised for continuous growth and innovation in the foreseeable future.

Key Market Players

Key Market Players in this include Tate & Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland, ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), Kerry Group PLC (Ireland), DSM-Firmenich (Switzerland), AGT Food and Ingredients (Canada), Burcon NutraScience Corporation (Canada), Emsland Group (Germany), PURIS (US), COSUCRA (Belgium), Tate & Lyle (UK).

Other players include BENEO GmbH (Germany), SOTEXPRO (France), Shandong Jianyuan group (China), AMCO Proteins (US), Axiom Foods, Inc (US), Aminola (Netherlands), The Green Labs LLC. (US), Australian Plant Proteins Pty Ltd (Australia), ETChem (China), PROEON (India), Nutraferma, Inc. (US), MycoTechnology (US), European Protein A/S (Denmark), naVitalo (Germany), Bioway Organic Group Limited (China).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Source, By Type, By Form, By Nature, By Application, and by Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

Key Players:

Other Players:

|

This research report categorizes the plant-based protein market based on source, type, form, nature and application and region.

Plant-based protein market:

By Source

- Soy

- Wheat

-

Pea

- Yellow Split Peas

- Chickpeas

- Lentils

- Canola, Oats, Rice, & Potato

- Beans & Seeds

-

Fermented Protein

- Soy

- Pea

- Rice

- Others

- Other Sources

By Type

- Concentrates

- Isolates

- Textured

By Form

- Dry

- Liquid

By Nature

- Conventional

- Organic

By Application

-

Food & beverages

- Meat Alternatives

- Dairy Alternatives

- Bakery Products

- Performance Nutrition

- Convenience Foods

- Other Food & Beverages Applications

- Feed

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Frequently Asked Questions (FAQ):

What is the current size of the plant-based protein market?

The plant-based protein market is estimated at USD 14.2 billion in 2024 and is projected to reach USD 20.5 billion by 2029, at a CAGR of 8.1% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in this market include ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), Kerry Group PLC (Ireland).

The market for plant-based proteins is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the plant-based protein market?

The North American market is expected to dominate during the forecast period. North America currently stands as a formidable force in the plant-based protein market, boasting dominance fueled by a convergence of factors, including robust research and development initiatives, advanced manufacturing capabilities, and a deeply rooted culinary tradition that heavily relies on plant-based protein products. North American countries have become pivotal players in supplying plant-based products globally. The key market players in the North American plant-based protein market include Cargill incorporated (US), ADM (US), and Ingredion (US) contribute significantly to this dominance through their innovation, expertise, and extensive distribution networks.

What kind of information is provided in the company profile section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential..

What are the factors driving the plant-based protein market?

The surging interest in health and wellness is driving remarkable expansion in the plant-based protein market. As consumers increasingly seek out functional foods and supplements to bolster their immune systems and overall well-being, the demand for high-quality, protein-rich products has soared. The plant-based protein market is thriving due to rising awareness of the environmental impact of animal agriculture, prompting consumers to seek sustainable alternatives. Simultaneously, health and wellness concerns are driving the adoption of plant-based diets, perceived as healthier options. Moreover, advancements in food technology have enabled the creation of innovative plant-based protein products, closely resembling traditional animal-based proteins, further boosting market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

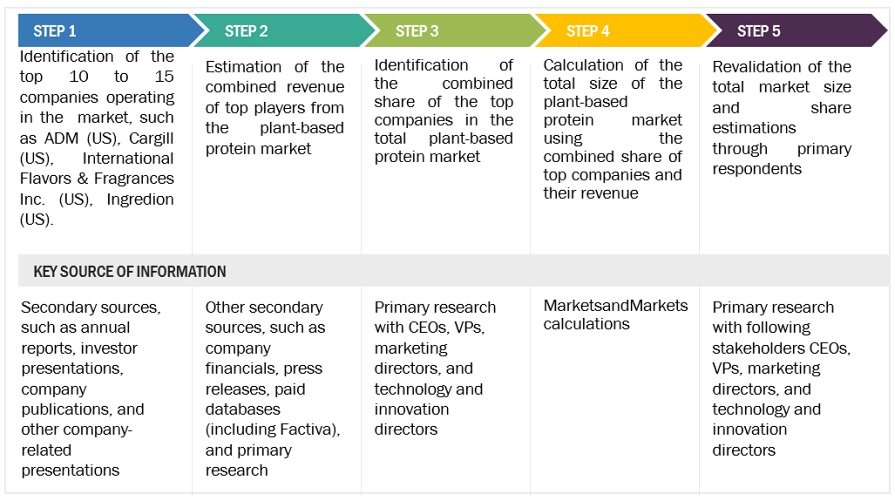

The study involved two major approaches in estimating the current size of the plant-based protein market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the plant-based protein market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to plant-based protein sources, nature, application, type, form, and region. Stakeholders from the demand side, such as processed food and functional food products manufacturers, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of plant-based protein and the outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

ADM (US) |

General Manager |

|

Cargill Incorporated (US) |

Sales Manager |

|

International Flavors & Fragrances Inc. (US) |

Manager |

|

Ingredion (US) |

Head of processing department |

|

Roquette Frères (France) |

Marketing Manager |

|

Wilmar International Ltd. (Singapore) |

Sales Executive |

Market Size Estimation

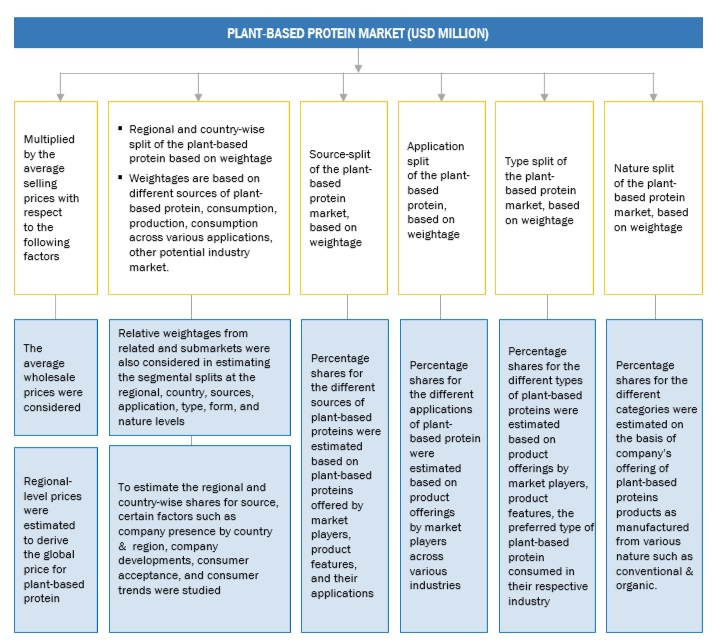

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plant-based protein market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Plant-based protein market: Supply-side analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Plant-based protein market: Top-Down Approach.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall plant-based protein market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Plant protein refers to the derivation of protein from plant-based sources, such as pulses, grains, and seeds. Different sources of plant-based protein include soy, wheat, pea, canola, oats, rice, and potato. Proteins are polymers of amino acids, which are used in various applications for their nutritional and functional properties. Their potential to increase the nutritional level and the resultant healthy diet makes them one of the key ingredients in both the food and feed industries.

According to the US Agency for International Development (USAID), “Soy protein concentrates (SPC), and soy protein isolates (SPI) are processed food ingredients produced from wholly defatted soy meal through a water extraction process. The resulting concentrates and isolates contain 65%-90% protein, respectively, and are used as ingredients to enrich other food products.”

Key Stakeholders

- Food & beverage manufacturers, suppliers, and processors

- Research & development institutions

- Traders & retailers

- Distributors, importers, and exporters

-

Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, and Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers

- Universities and industry bodies

- End users

Report Objectives

Market Intelligence

- To determine and project the size of the plant-based protein market with respect to the source, type, form, nature, application, and regions in terms of value and volume over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the plant-based protein market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the European plant-based protein market into key countries.

- Further breakdown of the Rest of Asia Pacific plant-based protein market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant-based Protein Market