Micro Mobile Data Center Market by Offering (Solutions, Services), Application (Edge Computing & IoT Deployment, Temporary & Remote Operations), Rack Unit, Organization Size, Form Factor, Type, Vertical and Region - Global Forecast to 2029

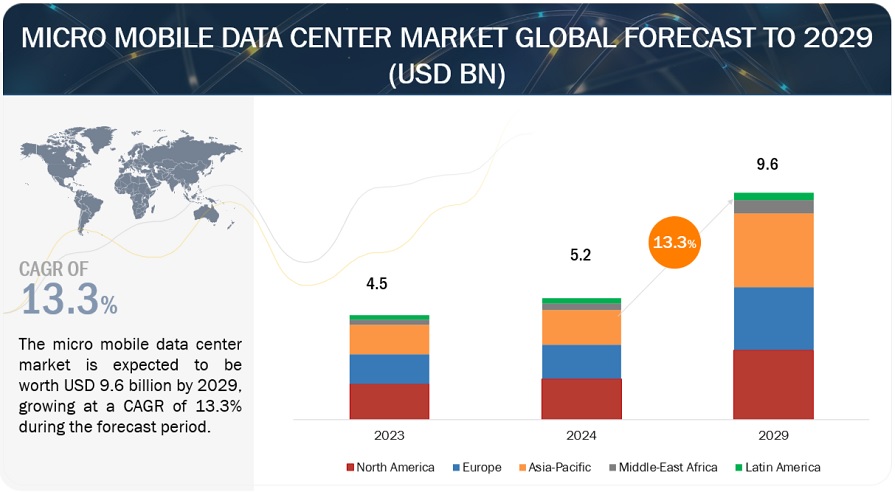

[312 Pages Report] The micro mobile data center market is expected to grow from USD 5.2 billion in 2024 to USD 9.6 billion by 2029, at a CAGR of 13.3% during the forecast period. Micromobile data centers represent a pivotal technological advancement, offering compact and portable solutions that encompass essential computing, storage, and networking infrastructure. These innovative units are designed to meet the escalating demand for edge computing applications, enabling organizations to deploy critical IT resources closer to the point of data generation. As the digital landscape evolves, micro mobile data centers facilitate low-latency data processing, enhance resilience, and support seamless business continuity across diverse environments.

The increasing need for efficient and agile computing solutions in modern business environments has driven the evolution of micro mobile data centers. Originally conceived as a response to the limitations of traditional data center architectures, micro mobile data centers have undergone significant advancements to address the unique challenges posed by edge computing requirements. With the proliferation of IoT, content delivery, and 5G technologies, there has been a surge in demand for low-latency access to data processing and storage. Traditional centralized data centers can not often meet these distributed workload use cases economically. In contrast, micro mobile data centers offer a cost-effective and scalable alternative, allowing organizations to deploy data processing resources near end-users, minimizing latency and improving overall performance.

Several technological trends have recently accelerated the demand for micro mobile data centers. The emergence of IoT, big data, and machine learning applications has led to large volumes of data that require real-time processing and analysis. Micro mobile data centers enable organizations to address these latency-sensitive workloads by bringing data processing closer to the source of data generation. Additionally, advancements in modular design and manufacturing techniques have enhanced the scalability and flexibility of micro mobile data centers, making them suitable for deployment in a wide range of environments, from industrial facilities to remote edge locations. Moreover, the increasing emphasis on sustainability and energy efficiency has prompted organizations to adopt micro mobile data centers as a more environmentally friendly alternative to traditional data center infrastructure.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Micro Mobile Data Center Market

The impact of a recession on the market is primarily medium-term. With economic downturns, businesses may hesitate to invest in large-scale data centers due to the high initial capital expenditure and ongoing operational costs. Instead, they may opt for more cost-effective solutions like micro mobile data centers. Despite the potential for increased demand, the overall market for micro mobile data centers could face challenges during a recession. Businesses may delay or scale back IT projects, including adopting new technologies like micro mobile data centers, as they prioritize essential spending and focus on maintaining core operations. Additionally, financing options for such projects may become more limited during economic downturns, further constraining the market's growth.

Micro Mobile Data Center Market Dynamics

Driver: High emphasis on security and threat detection integrated systems

As organizations increasingly prioritize data protection and cybersecurity, the demand for secure, resilient infrastructure solutions intensifies. With their compact and self-contained design, micro mobile data centers offer inherent advantages in mitigating security risks and enhancing threat detection capabilities. By integrating robust security measures such as encryption, access controls, and intrusion detection systems, these portable data centers provide a fortified environment for safeguarding critical assets and sensitive information. Moreover, their agility and scalability enable rapid deployment in remote or edge environments with heightened security challenges.

Restraint: Lack of standardization

Customers may encounter compatibility and interoperability challenges when integrating these devices into their infrastructure without universally accepted standards; this can result in higher costs as customized solutions may be necessary to ensure compatibility, particularly for smaller businesses with limited budgets. Moreover, the lack of standardized performance metrics hampers customers' ability to assess the reliability and performance of micro mobile data centers, leading to a lack of trust in the market. Industry collaboration is essential to establish standardized guidelines and specifications to overcome these barriers. This effort will ensure compatibility, reduce costs, and foster innovation and competition among vendors, driving market growth and customer confidence in micro mobile data center solutions.

Opportunity: Focus on flexible and scalable IT infrastructure

The rise of remote and distributed workforces presents a significant opportunity within the micro mobile data center market, reflecting the evolving needs of modern organizations. Micro mobile data centers offer a compelling solution to support remote and distributed work environments by providing flexible and scalable IT infrastructure at the edge. With their compact and portable design, these data centers can be easily deployed to remote locations, empowering organizations to extend their IT capabilities to employees working from home or in geographically dispersed settings; this enables seamless access to critical applications, data, and services, regardless of employees' physical location, thereby enhancing productivity and collaboration. Furthermore, micro mobile data centers offer high efficiency in power and cooling, ensuring reliable operation even in remote or challenging environments. As organizations continue to embrace remote work models, micro mobile data centers emerge as essential enablers, providing the agility and resilience required to support distributed workforces effectively.

Challenge: Deployment of micro mobile data centers in remote areas, limited access to power and networking infrastructure, and harsh environmental conditions

While micro mobile data centers offer the advantage of portability and flexibility, deploying them in remote areas can be complex due to limited access to power and networking infrastructure, harsh environmental conditions, and security concerns. Ensuring reliable power supply, adequate cooling, and robust connectivity in remote locations poses considerable challenges, as infrastructure may be unreliable or nonexistent. Additionally, logistical challenges such as transportation, installation, and maintenance in remote and often hard-to-reach areas further complicate the deployment process. Overcoming these challenges requires careful planning, investment in resilient infrastructure solutions, and collaboration with local stakeholders to address unique environmental and operational considerations.

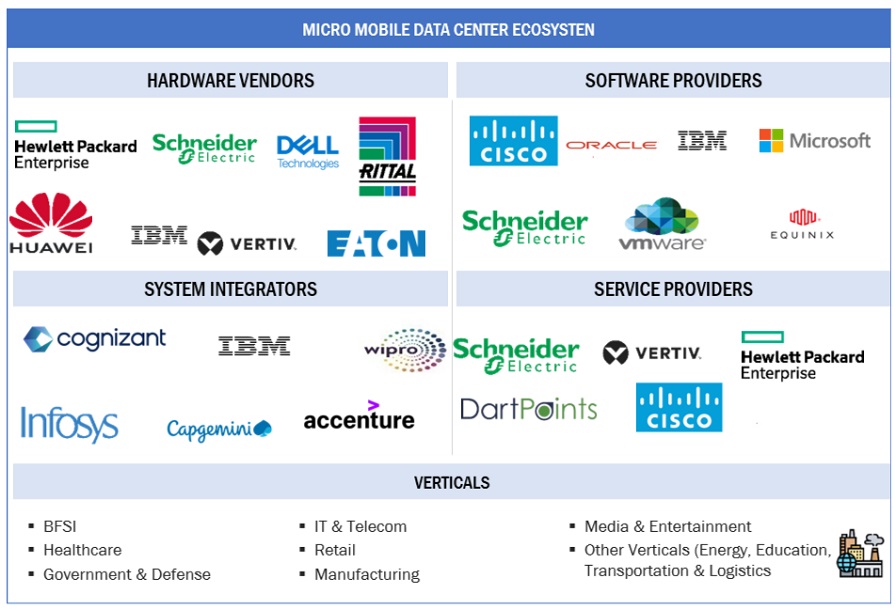

Micro Mobile Data Center Market Ecosystem

Based on application, the temporary and remote operations segment will grow to the second-largest market share during the forecast period.

Micro mobile data centers are invaluable for temporary and remote operations, providing compact and efficient IT infrastructure solutions that can be quickly deployed to remote locations or temporary sites. Micromobile data centers in remote areas lacking traditional infrastructure ensure seamless operations by providing essential computing, storage, and networking capabilities. Temporary construction sites leverage these solutions for project management, communication, and data processing, improving team efficiency and collaboration. Mobile offices and workspaces benefit from micro mobile data centers, enabling remote workers to access centralized IT resources and applications while on the move. Emergency response teams utilize these systems during disaster recovery to establish temporary command centers and communication hubs. Event organizers deploy micro mobile data centers to support temporary venues and festivals, ensuring reliable connectivity, ticketing services, and guest experiences. North America leads the micro mobile data center market for temporary and remote operations, driven by the widespread adoption of mobile workspaces and construction projects. Advancements in technology, such as edge computing and IoT, enhance the capabilities of micro mobile data centers by enabling real-time data analysis and autonomous operations in remote environments.

Based on the form factor, the rack-mounted micro mobile data center segment will hold the largest market size during the forecast period.

The rack-mounted micro mobile data center market is estimated to account for the largest market share of 51.3% in 2024. With the increasing adoption of edge computing and the proliferation of IoT devices generating vast amounts of data, businesses seek agile and scalable solutions to process and analyze information closer to the source. Rack-mounted micro mobile data centers provide a compact and modular infrastructure that meets these demands, allowing businesses to deploy computing resources precisely where needed. Additionally, the trend toward hybrid cloud architectures and the need for edge computing capabilities fuel the demand for rack-mounted solutions. As businesses strive to enhance their agility and efficiency in managing data-intensive workloads, the market for rack-mounted micro mobile data centers is poised for continued expansion, catering to enterprises across various sectors seeking to unlock the potential of distributed computing. As SMEs face growing data processing demands and limited physical space, rack-mounted solutions offer a compact and scalable option that fits seamlessly into existing environments.

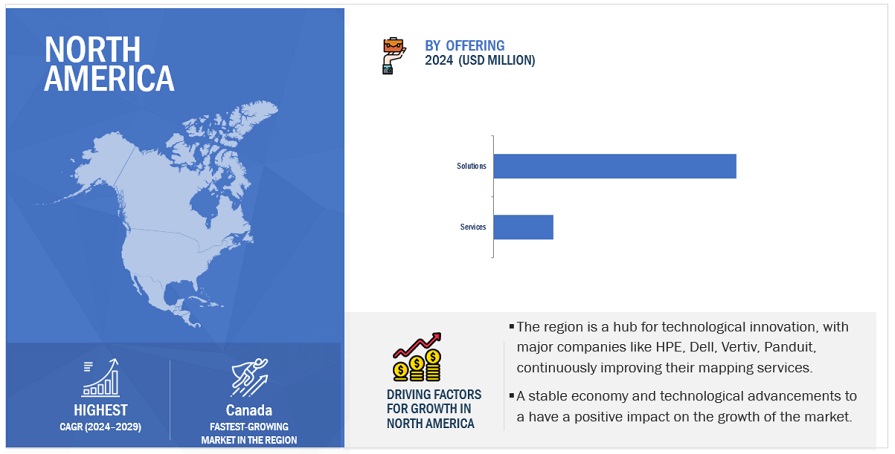

As per region, North America will witness the largest market share during the forecast period.

North America's micro mobile data center market is thriving, driven by the region's increasing adoption of advanced technologies and digital transformation. The rise of edge computing blurs the lines between traditional data centers and wireless infrastructure, prompting numerous companies to venture into the data center business. It has gained prominence, driven by the increasing need for low-latency processing in applications such as IoT, augmented reality, and autonomous vehicles; this has led to the development of edge data centers to bring computing resources closer to end-users. Sustainability and environmental considerations also influence the market, focusing on building energy-efficient and eco-friendly data centers. Major players such as Dell Technologies and IBM are at the forefront of this dynamic market, catering to the growing demand for compact and mobile data center solutions across the region.

Key Market Players

The micro mobile data center market is dominated by a few globally established players such as Schneider Electric (France), HPE(US), Dell (US), Vertiv(US), Huawei(China), Eaton(Ireland), IBM(US), Rittal (Germany), Panduit(US), and Stulz(Germany), among others, are the key vendors that secured micro mobile data center market contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have limited expertise. In the thriving micro mobile data center market, the rising demand for edge computing solutions is revolutionizing conventional data management strategies, leading to the adoption of compact and portable infrastructure solutions. These micro mobile data centers cater to diverse edge computing needs, providing flexibility and efficiency. Also, as the importance of disaster recovery solutions grows, micro mobile data centers emerge as essential tools, ensuring uninterrupted business operations with their compact and versatile design, adaptable to various environments.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Application, Rack Unit, Organization Size, Form Factor, Type, Verticals And Regions |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Schneider Electric (France), HPE(US), Dell(US), Vertiv(US), Huawei(China), Eaton(Ireland), IBM(US), Rittal (Germany), Panduit(US), and Stulz(Germany), Delta Electronics (Taiwan), Zella DC( Australia), ScaleMatrix (US), Canovate (Turkey), Dataracks(UK), Altron (Czech Republic), Canon Technologies (UK), KSTAR (China), Sicon (China), Hanley Energy (Ireland), Portwell(Taiwan), Axellio (US), Vapor IO (US), Vericom (US), and NDC Solutions (US) |

This research report categorizes the micro mobile data center map market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

-

Solution

- IT Modules

- Power Modules

- Cooling Modules

-

Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By Applications:

- Disaster Recovery & Emergency Response

- Temporary & Remote Operations

- Edge Computing & IoT Deployment

- Other Applications

By Rack Unit :

- Up to 20 RU

- 21 RU to 40 RU

- Above 40 RU

By Organization Size:

- Large Enterprises

- SMEs

By Form Factor:

- Rack-Mounted Micro Data Centers

- Containerized Micro Data Centers

- Wall-Mounted Micro Data Centers

By Type:

- Indoor

- Outdoor

By Vertical:

- BFSI

- IT & Telecom

- Media & Entertainment

- Healthcare

- Government & Defense

- Retail

- Manufacturing

- Other Verticals

By Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Developments:

- Schneider Electric introduced new model-based, automated sustainability reporting features within its EcoStruxure IT data center infrastructure management (DCIM) software. These enhancements offer advanced reporting capabilities powered by machine learning. Available to all EcoStruxure IT users, these features simplify reporting of sustainability metrics, including compliance with regulatory requirements such as the European Energy Efficiency Directive (EED). The software enables users to measure and report data center performance based on historical data analysis and trends, leveraging AI for actionable insights. With a focus on simplicity and efficiency, the new reporting engine allows for easy quantification and reporting of crucial sustainability metrics at the click of a button, empowering organizations to reduce their environmental impact and meet regulatory obligations.

- Digital Realty launched Data Hub, featuring HPE GreenLake Colocation on PlatformDIGITAL. Combining these two solutions on Digital Realty's global platform creates an ideal meeting place for enterprises to bring their data together and consume infrastructure on demand, helping unlock trapped value and drive innovation.

- Vertiv appointed Multimedia Technology (MMT) as Australia's power, cooling, and IT infrastructure solutions distributor. This partnership aims to strengthen MMT's presence in AI-driven digital transformation by providing access to Vertiv's entire product portfolio. The deal includes the distribution of Vertiv's self-contained data centers like the Vertiv™ SmartCabinet™ 2-M and the recently launched Vertiv™ SmartRow2™, tailored for edge computing applications.

- Eaton acquired Tripp Lite, a significant move that expanded its product portfolio in the power management sector. With this acquisition, Eaton gains access to Tripp Lite's offerings, including single-phase uninterruptible power supply systems, rack power distribution units, surge protectors, and data center enclosures. The deal, valued at USD 1.65 billion, positions Eaton to deliver a broader range of products to its partners, enhancing its competitiveness in the market.

Frequently Asked Questions (FAQ):

What is a Micro Mobile Data Center?

A micro mobile data center is a compact, portable solution that integrates essential computing, storage, networking, power, and cooling infrastructure into a self-contained unit. These units are designed to be easily deployable in diverse environments, ranging from edge computing locations to remote or temporary sites. Micro mobile data centers allow organizations to process and store data closer to the point of generation, reducing latency and improving overall performance for edge computing applications.

Which country is the leader in North America for micro mobile data center solutions?

The US leads the micro mobile data center solutions market in North America.

Which are the key vendors exploring micro mobile data center solutions?

Some of the significant vendors offering micro mobile data center solutions across the globe include Schneider Electric (France), HPE(US), Dell(US), Vertiv(US), Huawei(China), Eaton(Ireland), IBM(US), Rittal (Germany), Panduit(US), and Stulz(Germany), Delta Electronics (Taiwan), Zella DC( Australia), ScaleMatrix (US), Canovate (Turkey), Dataracks(UK), Altron (Czech Republic), Canon Technologies (UK), KSTAR (China), Sicon (China), Hanley Energy (Ireland), Portwell(Taiwan), Axellio (US), Vapor IO (US), Vericom (US), and NDC Solutions (US).

What is the total CAGR recorded for the micro mobile data center market during 2024-2029?

The micro mobile data center market will record a CAGR of 13.3% from 2024-2029.

What is the projected market value of the micro mobile data center market?

The micro mobile data center market will grow from USD 5.2 billion in 2024 to USD 9.6 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 13.3% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

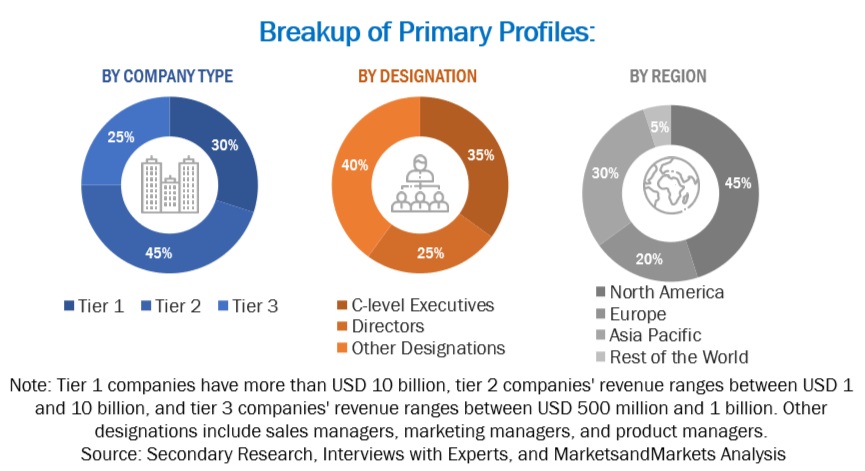

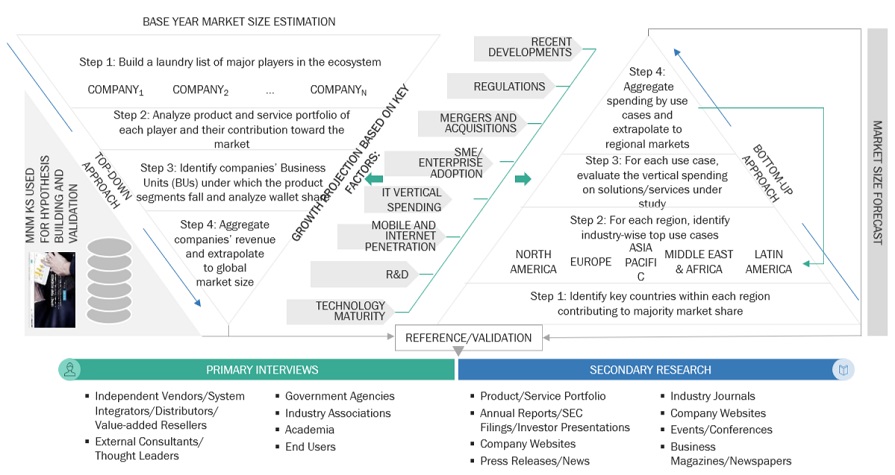

This research study used extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information for the technical, market-oriented, and commercial study of the micro mobile data center market. The primary sources are mainly several industry experts from core and related industries and suppliers, manufacturers, distributors, service providers, technology developers, technologists from companies, and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure shows the research methodology applied in this report on the micro mobile data center market.

The market has been predicted by analyzing the driving factors, such as the emergence of IoT, edge computing, the growing need for cost-effective businesses, business agility, and faster time to market.

Secondary Research

The market for the companies offering micro mobile data center solutions and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

We used secondary research to obtain critical information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, we interviewed various primary sources from both the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from micro mobile data center vendors, industry associations, and independent consultants; and key opinion leaders.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped us understand various trends related to technology, offerings, and regions. We interviewed stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using micro mobile data centers to understand the buyer's perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall micro mobile data center market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the micro mobile data center and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the micro mobile data center market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Micro Mobile Data Center Market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides in the micro mobile data center market.

Market Definition

Considering the views of various sources and associations, a micro mobile data center is a compact, self-contained solution designed to provide computing, storage, and networking capabilities in a portable and easily deployable form factor, unlike traditional data centers, which are typically large, stationary facilities, micro mobile data centers are designed to be transportable and can be deployed in a variety of environments, including remote locations, industrial settings, or temporary deployments.

Key Stakeholders

- IT infrastructure equipment providers

- Support infrastructure equipment providers

- Component providers

- Software providers

- System integrators

- Network service providers

- Monitoring service providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Colocation providers

- Enterprises

- Government and standardization bodies

- Telecom operators

- Healthcare organizations

- Financial organizations

- Data center vendors

Report Objectives

- To define, describe, and forecast the micro mobile data center market based on offering (solutions, services), rack unit, applications, form factor, type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five main regions-North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the micro mobile data center market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Micro Mobile Data Center Market

Understanding Micro Data centre in Australian Market.