TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 56)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 IOT NODE AND GATEWAY MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.9 IMPACT OF RECESSION

FIGURE 2 GDP GROWTH PROJECTION DATA FOR MAJOR ECONOMIES, 2021–2023

1.1 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES UNTIL 2024

2 RESEARCH METHODOLOGY (Page No. - 64)

2.1 RESEARCH DATA

FIGURE 3 IOT NODE AND GATEWAY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key participants in primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Insights of industry experts

2.1.2.4 Breakdown of primaries

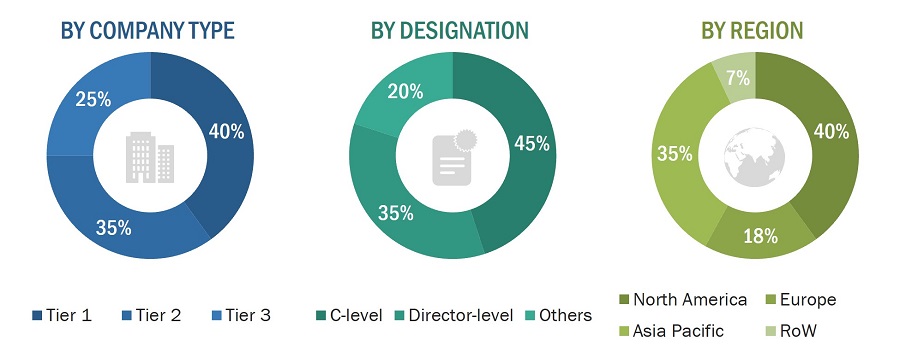

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH (DEMAND SIDE): BOTTOM-UP APPROACH TO ESTIMATE IOT NODE AND GATEWAY MARKET SIZE

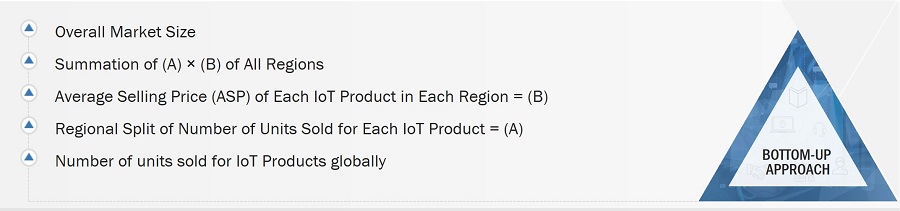

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up approach (demand side)

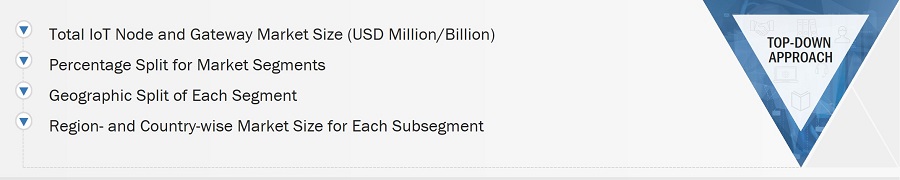

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS OF RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

2.6 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON MARKET

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 77)

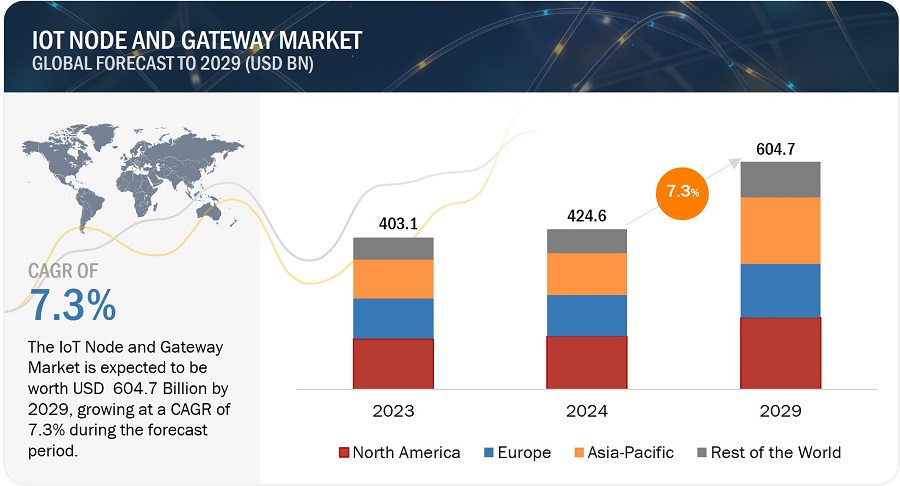

FIGURE 9 CONNECTIVITY ICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 CONSUMER SEGMENT TO DOMINATE IOT NODE AND GATEWAY MARKET FROM 2024 TO 2029

FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 81)

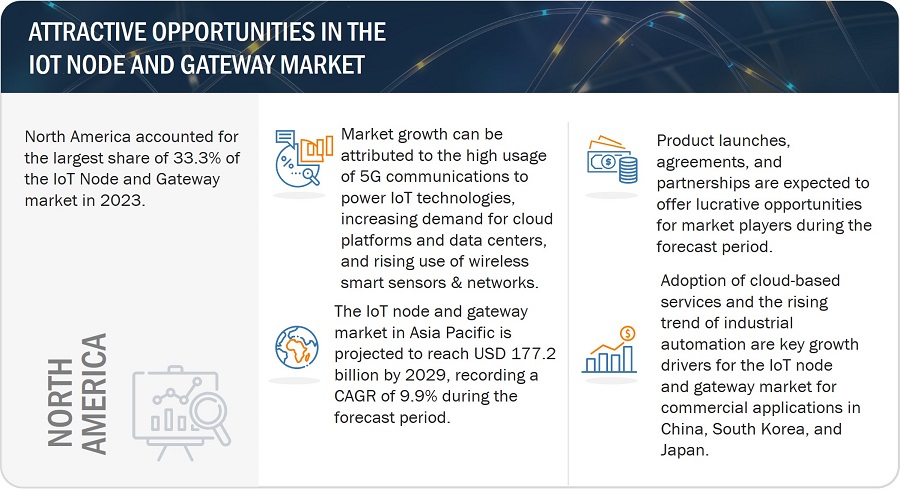

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN IOT NODE AND GATEWAY MARKET

FIGURE 12 INCREASING USE OF 5G TO POWER IOT TECHNOLOGIES TO BOOST MARKET

4.2 IOT NODE AND GATEWAY MARKET, BY HARDWARE

FIGURE 13 LOGIC DEVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION

FIGURE 14 CONSUMER ELECTRONICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4.4 IOT NODE AND GATEWAY MARKET, BY COUNTRY

FIGURE 15 IOT NODE AND GATEWAY MARKET IN CHINA TO RECORD HIGHEST CAGR FROM 2024 TO 2029

5 MARKET OVERVIEW (Page No. - 83)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 IOT NODE AND GATEWAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Emergence of 5G technology

FIGURE 17 GLOBAL INTERNET PENETRATION RATE

5.2.1.2 Growing use of wireless smart sensors and networks

5.2.1.3 Provision of increased IP address space through IPv6

FIGURE 18 CONNECTION OF NODES TO CLOUD VIA IPV6

5.2.1.4 Increasing need for data centers

5.2.1.5 Growing market for connected devices

5.2.1.6 Focus on industrial automation and Industry 4.0

FIGURE 19 IOT NODE AND GATEWAY MARKET: IMPACT OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Concerns regarding security and data privacy

5.2.2.2 High power consumption by wireless sensor terminals and connected devices

FIGURE 20 IOT NODE AND GATEWAY MARKET: IMPACT OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Cross-domain collaborations

FIGURE 21 CROSS-DOMAIN IOT COLLABORATIONS

5.2.3.2 Government support for research and development of IoT technologies

5.2.3.3 Accelerated IoT adoption in healthcare sector

FIGURE 22 HEALTHCARE APPLICATIONS OF IOT

FIGURE 23 IOT NODE AND GATEWAY MARKET: IMPACT OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of common protocols and communication standards

TABLE 2 KEY PLATFORMS SUPPORTING MULTIPLE COMMUNICATION STANDARDS

5.2.4.2 Requirement for wireless spectrum and licensed spectrum

TABLE 3 TYPES OF BANDS USED IN IOT MARKET

5.2.4.3 Project delays due to shortage of skilled personnel and connectivity issues

FIGURE 24 IOT NODE AND GATEWAY MARKET: IMPACT OF CHALLENGES

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE (ASP) TREND, BY HARDWARE

TABLE 4 AVERAGE SELLING PRICE (ASP) TREND, BY HARDWARE, 2020–2029 (USD)

FIGURE 26 AVERAGE SELLING PRICE (ASP) TREND, BY HARDWARE, 2020–2029 (USD)

5.4.2 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY HARDWARE

FIGURE 27 AVERAGE SELLING PRICE (ASP) TREND FOR HARDWARE OFFERED BY KEY PLAYERS (USD)

TABLE 5 AVERAGE SELLING PRICE (ASP) TREND FOR HARDWARE OFFERED BY KEY PLAYERS (USD)

5.4.3 AVERAGE SELLING PRICE (ASP) TREND, BY REGION

FIGURE 28 AVERAGE SELLING PRICE (ASP) TREND FOR CONNECTIVITY ICS, BY REGION, 2020–2029 (USD)

FIGURE 29 AVERAGE SELLING PRICE (ASP) TREND FOR PROCESSORS, BY REGION, 2020–2029 (USD)

5.5 VALUE CHAIN ANALYSIS

FIGURE 30 IOT NODE AND GATEWAY MARKET: VALUE CHAIN ANALYSIS

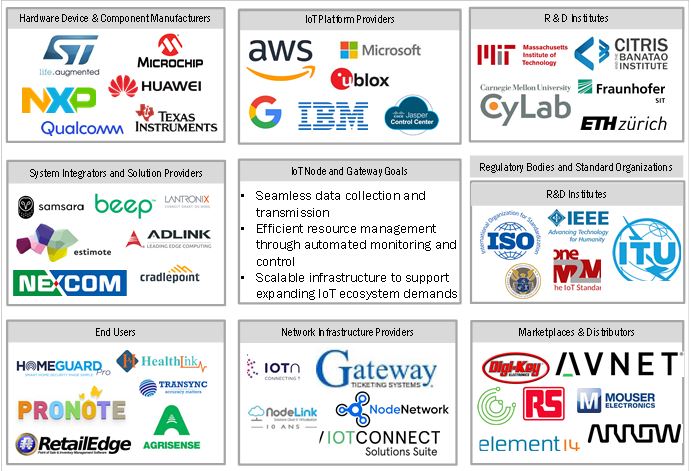

5.6 ECOSYSTEM ANALYSIS

FIGURE 31 IOT NODE AND GATEWAY ECOSYSTEM

TABLE 6 ROLES OF COMPANIES IN IOT NODE AND GATEWAY ECOSYSTEM

5.7 INVESTMENT AND FUNDING SCENARIO

FIGURE 32 INVESTMENT AND FUNDING SCENARIO FOR STARTUPS, 2020–2023 (USD MILLION)

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGIES

5.8.1.1 Edge computing

5.8.1.2 Wireless communication protocols

5.8.2 COMPLEMENTARY TECHNOLOGIES

5.8.2.1 Artificial intelligence

5.8.2.2 Machine learning

5.8.2.3 Digital twin

5.8.2.4 Big data analytics

5.8.3 ADJACENT TECHNOLOGIES

5.8.3.1 Cloud computing

5.9 PATENT ANALYSIS

TABLE 7 IOT NODE AND GATEWAY-RELATED PATENT REGISTRATIONS

FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR, 2014–2024

FIGURE 34 COMPANIES WITH MAXIMUM PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.10 TRADE ANALYSIS

5.10.1 HVAC SYSTEMS

5.10.1.1 Import scenario (HS code 8415 and HS code 841510)

FIGURE 35 IMPORT DATA FOR AIR CONDITIONING MACHINES DESIGNED TO BE FIXED TO WINDOW, WALL, CEILING OR FLOOR, SELF-CONTAINED OR ‘SPLIT-SYSTEM’, BY COUNTRY, 2018–2022 (USD MILLION)

5.10.1.2 Export scenario (HS code 8415 and HS code 841510)

FIGURE 36 EXPORT DATA FOR AIR CONDITIONING MACHINES DESIGNED TO BE FIXED TO A WINDOW, WALL, CEILING OR FLOOR, SELF-CONTAINED OR ‘SPLIT-SYSTEM’, BY COUNTRY, 2018–2022 (USD MILLION)

5.10.2 VIDEO SURVEILLANCE SYSTEMS

5.10.2.1 Import scenario (HS code 8525 and HS code 852580)

FIGURE 37 IMPORT DATA FOR TELEVISION CAMERAS, DIGITAL CAMERAS, AND VIDEO CAMERA RECORDERS, BY COUNTRY, 2018–2022 (USD MILLION)

5.10.2.2 Export scenario (HS code 8525 and HS code 852580)

FIGURE 38 EXPORT DATA FOR TELEVISION CAMERAS, DIGITAL CAMERAS, AND VIDEO CAMERA RECORDERS, BY COUNTRY, 2018–2022 (USD MILLION)

5.10.3 FIRE PROTECTION SYSTEMS

5.10.3.1 Import scenario (HS code 8424 and HS code 842410)

FIGURE 39 IMPORT DATA FOR FIRE EXTINGUISHERS, WHETHER OR NOT CHARGED, BY COUNTRY, 2018–2022 (USD MILLION)

5.10.3.2 Export scenario (HS code 8424 and HS code 842410)

FIGURE 40 EXPORT DATA FOR FIRE EXTINGUISHERS, WHETHER OR NOT CHARGED, BY COUNTRY, 2018–2022 (USD MILLION)

5.11 KEY CONFERENCES AND EVENTS, 2024–2025

TABLE 9 IOT NODE AND GATEWAY MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

5.12 CASE STUDY ANALYSIS

5.12.1 OPTIMIZING IOT GATEWAY DEPLOYMENT FOR SMART CAMPUSES

5.12.2 IMPROVING IOT GATEWAY PERFORMANCE FOR REMOTE MONITORING SYSTEMS

5.12.3 DEVELOPING IOT GATEWAY SOLUTION FOR SMART CITY INFRASTRUCTURE

5.12.4 IMPLEMENTING EDGE COMPUTING SOLUTIONS FOR INDUSTRIAL IOT

5.12.5 ENHANCING IOT GATEWAY PERFORMANCE FOR INDUSTRIAL APPLICATIONS

5.13 REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 STANDARDS AND REGULATIONS RELATED TO IOT NODES AND GATEWAYS

TABLE 14 NORTH AMERICA: SAFETY STANDARDS FOR IOT NODES AND GATEWAYS

TABLE 15 EUROPE: SAFETY STANDARDS FOR IOT NODES AND GATEWAYS

TABLE 16 ASIA PACIFIC: SAFETY STANDARDS FOR IOT NODES AND GATEWAYS

TABLE 17 ROW: SAFETY STANDARDS FOR IOT NODES AND GATEWAYS

5.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 18 IMPACT OF PORTER’S FIVE FORCES ON IOT NODE AND GATEWAY MARKET

FIGURE 41 IOT NODE AND GATEWAY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 THREAT OF SUBSTITUTES

5.14.3 BARGAINING POWER OF SUPPLIERS

5.14.4 BARGAINING POWER OF BUYERS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

5.15.2 BUYING CRITERIA

FIGURE 43 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

TABLE 20 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

6 IOT NODE AND GATEWAY MARKET, BY HARDWARE (Page No. - 143)

6.1 INTRODUCTION

FIGURE 44 IOT NODE AND GATEWAY MARKET, BY HARDWARE

TABLE 21 IOT NODE AND GATEWAY MARKET, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 22 IOT NODE AND GATEWAY MARKET, BY HARDWARE, 2024–2029 (MILLION UNITS)

FIGURE 45 CONNECTIVITY ICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

6.2 PROCESSORS

TABLE 23 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 24 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY TYPE, 2024–2029 (MILLION UNITS)

6.2.1 MICROCONTROLLER UNIT (MCU)

6.2.1.1 Rising integration of MCUs in wearable devices

6.2.2 MICROPROCESSOR UNIT (MPU)

6.2.2.1 Growing proliferation of MPUs in industrial automation

6.2.3 DIGITAL SIGNAL PROCESSOR (DSP)

6.2.3.1 Increasing demand for DSPs in aerospace & defense

6.2.4 APPLICATION PROCESSOR (AP)

6.2.4.1 Rising deployment of APs in wearable devices

TABLE 25 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 26 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 27 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 28 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 29 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 30 IOT NODE AND GATEWAY MARKET FOR PROCESSORS, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

6.3 SENSORS

6.3.1 USED TO MEASURE VARIOUS PARAMETERS IN IOT DEVICES

TABLE 31 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 32 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY TYPE, 2024–2029 (MILLION UNITS)

6.3.2 ACCELEROMETER

6.3.3 INERTIAL MEASUREMENT UNIT (IMU)

6.3.4 HEART RATE SENSOR

6.3.5 PRESSURE SENSOR

6.3.6 TEMPERATURE SENSOR

6.3.7 BLOOD GLUCOSE SENSOR

6.3.8 BLOOD OXYGEN SENSOR

6.3.9 ELECTROCARDIOGRAM (ECG) SENSOR

6.3.10 HUMIDITY SENSOR

6.3.11 IMAGE SENSOR

6.3.12 AMBIENT LIGHT SENSOR

6.3.13 FLOW SENSOR

6.3.14 LEVEL SENSOR

6.3.15 CHEMICAL SENSOR

6.3.16 CARBON MONOXIDE SENSOR

6.3.17 MOTION AND POSITION SENSOR

6.3.18 CAMERA MODULE

6.3.19 OTHER SENSORS

TABLE 33 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 34 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 35 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 36 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 37 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 38 IOT NODE AND GATEWAY MARKET FOR SENSORS, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

6.4 CONNECTIVITY INTEGRATED CIRCUITS (ICS)

6.4.1 CONNECTIVITY TECHNOLOGY

TABLE 39 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 40 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

6.4.1.1 Wired

6.4.1.1.1 Ethernet/IP

6.4.1.1.1.1 Increasing demand for seamless connectivity in vehicles

6.4.1.1.2 Modbus

6.4.1.1.2.1 Growing applications across industries

6.4.1.1.3 Process Field Network (PROFINET)

6.4.1.1.3.1 Widespread adoption in various sectors

6.4.1.1.4 Foundation Fieldbus (FF)

6.4.1.1.4.1 Increasing use for process automation, monitoring, and control

TABLE 41 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRED CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 42 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRED CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

6.4.1.2 Wireless

6.4.1.2.1 ANT+

6.4.1.2.1.1 Rising demand due to preference for battery-powered devices

6.4.1.2.2 Bluetooth

6.4.1.2.2.1 Wide adoption due to low power consumption and versatility

6.4.1.2.3 Bluetooth Smart/Bluetooth Low Energy (BLE)

6.4.1.2.3.1 Suited for smart devices like speakers, wearables, and wireless earbuds

6.4.1.2.4 ZigBee

6.4.1.2.4.1 Increasing applications across devices requiring short-range transmission

6.4.1.2.5 Wireless Fidelity (Wi-Fi)

6.4.1.2.5.1 Continued popularity due to elevated data transfer rates

FIGURE 46 KEY WI-FI ENABLED IOT DEVICES

6.4.1.2.6 Near-field Communication (NFC)

6.4.1.2.6.1 Enables two-way communication between devices

6.4.1.2.7 Cellular network

6.4.1.2.7.1 Ideal for IoT applications operating over long distances

6.4.1.2.8 WirelessHART

6.4.1.2.8.1 Used to collect data from sensors in different locations

6.4.1.2.9 Global Positioning System (GPS)/Global Navigation Satellite System (GNSS) module

6.4.1.2.9.1 Utilizes satellites to provide positioning information

6.4.1.2.10 ISA100

6.4.1.2.10.1 Allows swift creation and modification of wireless networks for critical applications

6.4.1.2.11 Bluetooth/WLAN

6.4.1.2.11.1 Facilitates real-time monitoring and data sharing in healthcare industry

TABLE 43 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 44 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 45 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 46 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 47 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 48 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 49 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 50 IOT NODE AND GATEWAY MARKET FOR CONNECTIVITY INTEGRATED CIRCUITS, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

6.5 MEMORY DEVICES

6.5.1 ON-CHIP MEMORY

6.5.1.1 Offers high-speed performance with reduced power consumption

TABLE 51 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 52 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY TYPE, 2024–2029 (MILLION UNITS)

6.5.2 OFF-CHIP MEMORY/EXTERNAL MEMORY

6.5.2.1 Provides significantly larger storage capacity

FIGURE 47 FLOW OF DATA FROM EDGE DEVICES/NODES TO STORAGE CENTERS VIA GATEWAYS

TABLE 53 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 54 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 55 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 56 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 57 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 58 IOT NODE AND GATEWAY MARKET FOR MEMORY DEVICES, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

6.6 LOGIC DEVICES

6.6.1 FIELD-PROGRAMMABLE GATE ARRAY (FPGA)

6.6.1.1 Development of low-power FPGAs for energy-efficient operation

TABLE 59 IOT NODE AND GATEWAY MARKET FOR LOGIC DEVICES, 2020–2023 (MILLION UNITS)

TABLE 60 IOT NODE AND GATEWAY MARKET FOR LOGIC DEVICES, 2024–2029 (MILLION UNITS)

TABLE 61 IOT NODE AND GATEWAY MARKET FOR LOGIC DEVICES, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 62 IOT NODE AND GATEWAY MARKET FOR LOGIC DEVICES, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

7 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION (Page No. - 185)

7.1 INTRODUCTION

FIGURE 48 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION

TABLE 63 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION, 2020–2023 (USD BILLION)

TABLE 64 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION, 2024–2029 (USD BILLION)

TABLE 65 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 66 IOT NODE AND GATEWAY MARKET, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

FIGURE 49 CONSUMER SEGMENT TO LEAD IOT NODE AND GATEWAY MARKET FROM 2024 TO 2029

TABLE 67 IOT NODE AND GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 68 IOT NODE AND GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (USD MILLION)

FIGURE 50 CONSUMER ELECTRONICS SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

TABLE 69 IOT NODE AND GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 70 IOT NODE AND GATEWAY MARKET , BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 71 IOT NODE MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 72 IOT NODE MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 73 IOT NODE MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 74 IOT NODE MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 75 IOT GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 76 IOT GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 77 IOT GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2020–2023 (THOUSAND UNITS)

TABLE 78 IOT GATEWAY MARKET, BY INDUSTRIAL AND CONSUMER END-USE APPLICATION, 2024–2029 (MILLION UNITS)

7.2 INDUSTRIAL

7.2.1 HEALTHCARE

7.2.1.1 Increasing digitalization to boost demand

TABLE 79 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 80 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 81 IOT NODE MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 82 IOT NODE MARKET FOR HEALTHCARE, BY DEVICE TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 83 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 84 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 85 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 86 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 87 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY PROCESSOR TYPE, 2020–2023 (MILLION UNITS)

TABLE 88 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY PROCESSOR TYPE, 2024–2029 (MILLION UNITS)

TABLE 89 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

TABLE 90 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

TABLE 91 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 92 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 93 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 94 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 95 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 96 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 97 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 98 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 99 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 100 IOT NODE AND GATEWAY MARKET FOR HEALTHCARE IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.1.2 Device types

7.2.1.2.1 Fitness and heart rate monitors

7.2.1.2.2 Blood pressure monitors

7.2.1.2.3 Blood glucose meters

7.2.1.2.4 Continuous glucose monitors

7.2.1.2.5 Pulse oximeters

7.2.1.2.6 Automated external defibrillators

7.2.1.2.7 Programmable syringe pumps

7.2.1.2.8 Wearable injectors

7.2.1.2.9 Multiparameter monitors

7.2.1.2.10 Fall detectors

7.2.1.2.11 Smart pill dispensers

7.2.1.2.12 Gateways

7.2.2 AUTOMOTIVE & TRANSPORTATION

7.2.2.1 Autonomous cars and intelligent transportation trends to fuel market growth

TABLE 101 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 102 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 103 IOT NODE MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2020–2023 (MILLION UNITS)

TABLE 104 IOT NODE MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2024–2029 (MILLION UNITS)

TABLE 105 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 106 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2024–2029 (MILLION UNITS)

TABLE 107 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 108 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 109 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2020–2023 (USD MILLION)

TABLE 110 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2024–2029 (USD MILLION)

TABLE 111 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 112 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 113 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 114 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 115 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 116 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 117 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 118 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 119 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 120 IOT NODE AND GATEWAY MARKET FOR AUTOMOTIVE & TRANSPORTATION IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.2.2 Device types

7.2.2.2.1 Connected cars

7.2.2.2.1.1 Level 1 – driver assistance

7.2.2.2.1.1.1 Adaptive cruise control (ACC)

7.2.2.2.1.1.2 Lane departure warning system (LDWS)

7.2.2.2.1.1.3 Parking assist (PA) system

7.2.2.2.1.2 Level 2 – partial automation

7.2.2.2.1.2.1 Lane keeps assist (LKA) and ACC (improved)

7.2.2.2.1.2.2 PA (improved)

7.2.2.2.1.3 Level 3 – conditional automation

7.2.2.2.1.3.1 Traffic jam chauffeur

7.2.2.2.1.3.2 Highway driving

7.2.2.2.1.4 Level 4 – high automation

7.2.2.2.1.4.1 Sensor fusion

7.2.2.2.1.4.2 Automatic pilot highway

7.2.2.2.2 Ultrasonic sensors

7.2.2.2.3 Cameras/image sensors

7.2.2.2.4 Radar

7.2.2.2.5 LiDAR

7.2.2.2.6 Infrared (IR) detectors

7.2.2.3 In-car infotainment

7.2.2.4 Traffic management systems

7.2.2.4.1 Vehicle detection sensor

7.2.2.4.2 Pedestrian presence sensor

7.2.2.4.3 Speed sensor

7.2.2.4.4 Thermal camera

7.2.2.4.5 Automated incident detection (AID) camera

7.2.2.5 Public transport/mass transit systems

7.2.2.6 E-tolls/E-highways

7.2.2.7 Gateways

7.2.3 BUILDING AUTOMATION

7.2.3.1 Need for energy efficiency and enhanced security to drive market

TABLE 121 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 122 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 123 IOT NODE MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2020–2023 (MILLION UNITS)

TABLE 124 IOT NODE MARKET FOR BUILDING AUTOMATION, BY DEVICE TYPE, 2024–2029 (MILLION UNITS)

TABLE 125 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 126 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY TYPE, 2024–2029 (MILLION UNITS)

TABLE 127 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 128 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 129 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY PROCESSOR TYPE, 2020–2023 (MILLION UNITS)

TABLE 130 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY PROCESSOR TYPE, 2024–2029 (MILLION UNITS)

TABLE 131 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY REGION, 2020–2023 (USD MILLION)

TABLE 132 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION, BY REGION, 2024–2029 (USD MILLION)

TABLE 133 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 134 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 135 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 136 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 137 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 138 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 139 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 140 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 141 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 142 IOT NODE AND GATEWAY MARKET FOR BUILDING AUTOMATION IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.3.2 Device types

7.2.3.2.1 Occupancy sensors

7.2.3.2.2 Daylight sensors

7.2.3.2.3 Smart thermostats

7.2.3.2.4 IP cameras

7.2.3.2.5 Smart meters

7.2.3.2.6 Smart locks

7.2.3.2.7 Smoke detectors

7.2.3.2.8 Gateways

7.2.4 MANUFACTURING

7.2.4.1 Growing adoption of Industry 4.0 to drive demand

TABLE 143 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 144 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 145 IOT NODE MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2020–2023 (MILLION UNITS)

TABLE 146 IOT NODE MARKET FOR MANUFACTURING, BY DEVICE TYPE, 2024–2029 (MILLION UNITS)

TABLE 147 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 148 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY TYPE, 2024–2029 (MILLION UNITS)

TABLE 149 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 150 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 151 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 152 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 153 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY WIRED CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 154 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY WIRED CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 155 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 156 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 157 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY REGION, 2020–2023 (USD MILLION)

TABLE 158 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING, BY REGION, 2024–2029 (USD MILLION)

TABLE 159 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 160 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 161 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 162 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 163 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 164 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 165 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 166 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 167 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 168 IOT NODE AND GATEWAY MARKET FOR MANUFACTURING IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.4.2 Device types

7.2.4.2.1 Temperature sensors

7.2.4.2.2 Pressure sensors

7.2.4.2.3 Level sensors

7.2.4.2.4 Flow sensors

7.2.4.2.5 Chemical sensors

7.2.4.2.6 Humidity sensors

7.2.4.2.7 Motion & position sensors

7.2.4.2.8 Image sensors

7.2.4.2.9 Gateways

7.2.5 RETAIL

7.2.5.1 Growing popularity of digital signage and intelligent vending machines to drive market

TABLE 169 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 170 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 171 IOT NODE MARKET FOR RETAIL, BY DEVICE TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 172 IOT NODE MARKET FOR RETAIL, BY DEVICE TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 173 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 174 IO IOT NODE AND GATEWAY MARKET FOR RETAIL, BY TYPE, 2024–2029 (MILLION UNITS)

TABLE 175 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 176 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 177 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY REGION, 2020–2023 (USD MILLION)

TABLE 178 IOT NODE AND GATEWAY MARKET FOR RETAIL, BY REGION, 2024–2029 (USD MILLION)

TABLE 179 IOT NODE AND GATEWAY MARKET FOR RETAIL IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 180 IOT NODE AND GATEWAY MARKET FOR RETAIL IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 181 IOT NODE AND GATEWAY MARKET FOR RETAIL IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 182 IOT NODE AND GATEWAY MARKET FOR RETAIL IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 183 IOT NODE AND GATEWAY MARKET FOR RETAIL IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 184 IOT NODE AND GATEWAY MARKET FOR RETAIL IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 185 IOT NODE AND GATEWAY MARKET FOR RETAIL IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 186 IOT NODE AND GATEWAY MARKET FOR RETAIL IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 187 IOT NODE AND GATEWAY MARKET FOR RETAIL IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 188 IOT NODE AND GATEWAY MARKET FOR RETAIL IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.5.2 Device types

7.2.5.2.1 Intelligent vending machines

FIGURE 51 INTELLIGENT VENDING MACHINE USING IOT GATEWAY

7.2.5.2.2 Contactless checkout/Point of sale systems

7.2.5.2.3 Smart mirrors

7.2.5.2.4 Smart shopping carts

7.2.5.2.5 Digital signage

7.2.5.2.6 Smart tags

7.2.5.2.7 Wireless beacons

7.2.5.2.8 Gateways

7.2.6 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

7.2.6.1 Rising adoption of mPOS and smart kiosks to boost market

FIGURE 52 KEY APPLICATIONS OF IOT IN BFSI

TABLE 189 IOT NODE AND GATEWAY MARKET FOR BFSI, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 190 IOT NODE AND GATEWAY MARKET FOR BFSI, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 191 IOT NODE MARKET FOR BFSI, BY DEVICE TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 192 IOT NODE MARKET FOR BFSI, BY DEVICE TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 193 IOT NODE & GATEWAY MARKET FOR BFSI, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 194 IOT NODE AND GATEWAY MARKET FOR BFSI, BY TYPE, 2024–2029 (MILLION UNITS)

TABLE 195 IOT NODE AND GATEWAY MARKET FOR BFSI, BY HARDWARE, 2020–2023 (THOUSAND UNITS)

TABLE 196 IOT NODE AND GATEWAY MARKET FOR BFSI, BY HARDWARE, 2024–2029 (THOUSAND UNITS)

TABLE 197 IOT NODE AND GATEWAY MARKET FOR BFSI, BY REGION, 2020–2023 (USD MILLION)

TABLE 198 IOT NODE AND GATEWAY MARKET FOR BFSI, BY REGION, 2024–2029 (USD MILLION)

TABLE 199 IOT NODE AND GATEWAY MARKET FOR BFSI IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 200 IOT NODE AND GATEWAY MARKET FOR BFSI IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 201 IOT NODE AND GATEWAY MARKET FOR BFSI IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 202 IOT NODE AND GATEWAY MARKET FOR BFSI IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 203 IOT NODE AND GATEWAY MARKET FOR BFSI IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 204 IOT NODE AND GATEWAY MARKET FOR BFSI IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 205 IOT NODE AND GATEWAY MARKET FOR BFSI IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 206 IOT NODE AND GATEWAY MARKET FOR BFSI IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 207 IOT NODE AND GATEWAY MARKET FOR BFSI IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 208 IOT NODE AND GATEWAY MARKET FOR BFSI IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.6.2 Device types

7.2.6.2.1 Mobile point of sale (mPOS) solutions

7.2.6.2.2 Smart/Interactive kiosks

7.2.6.2.3 Gateways

7.2.7 OIL & GAS

7.2.7.1 Need for remote monitoring of operations to propel market growth

TABLE 209 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY SENSOR TYPE, 2020–2023 (USD THOUSAND)

TABLE 210 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY SENSOR TYPE, 2024–2029 (USD THOUSAND)

TABLE 211 IOT NODE MARKET FOR OIL & GAS, BY SENSOR TYPE, 2020–2023 (MILLION UNITS)

TABLE 212 IOT NODE MARKET FOR OIL & GAS, BY SENSOR TYPE, 2024–2029 (MILLION UNITS)

TABLE 213 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY TYPE, 2020–2023 (MILLION UNITS)

TABLE 214 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY TYPE, 2024–2029 (MILLION UNITS)

TABLE 215 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 216 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 217 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 218 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 219 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY WIRED CONNECTIVITY TECHNOLOGY, 2020–2023 (MILLION UNITS)

TABLE 220 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY WIRED CONNECTIVITY TECHNOLOGY, 2024–2029 (MILLION UNITS)

TABLE 221 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2020–2023 (THOUSAND UNITS)

TABLE 222 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2024–2029 (THOUSAND UNITS)

TABLE 223 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY REGION, 2020–2023 (USD MILLION)

TABLE 224 IOT NODE AND GATEWAY MARKET FOR OIL & GAS, BY REGION, 2024–2029 (USD MILLION)

TABLE 225 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 226 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 227 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 228 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 229 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 230 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 231 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 232 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 233 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 234 IOT NODE AND GATEWAY MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.7.2 Device types

7.2.7.2.1 Temperature sensors

7.2.7.2.2 Pressure sensors

7.2.7.2.3 Level sensors

7.2.7.2.4 Flow sensors

7.2.7.2.5 Image sensors

7.2.7.2.6 Other sensors

7.2.7.2.7 Gateways

7.2.8 AGRICULTURE

7.2.8.1 Increasing adoption of smart farming practices to drive market

FIGURE 53 KEY APPLICATIONS OF IOT IN AGRICULTURE

TABLE 235 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2020–2023 (USD MILLION)

TABLE 236 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2024–2029 (USD MILLION)

TABLE 237 IOT NODE MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 238 IOT NODE MARKET FOR AGRICULTURE, BY SENSOR TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 239 IOT NODE & GATEWAY MARKET FOR AGRICULTURE, BY TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 240 IOT NODE & GATEWAY MARKET FOR AGRICULTURE, BY TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 241 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY HARDWARE, 2020–2023 (THOUSAND UNITS)

TABLE 242 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY HARDWARE, 2024–2029 (THOUSAND UNITS)

TABLE 243 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY REGION, 2020–2023 (USD THOUSAND)

TABLE 244 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE, BY REGION, 2024–2029 (USD THOUSAND)

TABLE 245 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD THOUSAND)

TABLE 246 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD THOUSAND)

TABLE 247 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN EUROPE, BY COUNTRY, 2020–2023 (USD THOUSAND)

TABLE 248 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN EUROPE, BY COUNTRY, 2024–2029 (USD THOUSAND)

TABLE 249 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD THOUSAND)

TABLE 250 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD THOUSAND)

TABLE 251 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN ROW, BY COUNTRY, 2020–2023 (USD THOUSAND)

TABLE 252 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN ROW, BY COUNTRY, 2024–2029 (USD THOUSAND)

TABLE 253 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD THOUSAND)

TABLE 254 IOT NODE AND GATEWAY MARKET FOR AGRICULTURE IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD THOUSAND)

7.2.8.2 Device types

7.2.8.2.1 Climate sensors

7.2.8.2.2 Soil moisture sensors

7.2.8.2.3 Level sensors

7.2.8.2.4 Gateways

7.2.9 AEROSPACE & DEFENSE

7.2.9.1 Increasing demand for enhanced national security to boost market

TABLE 255 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 256 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 257 IOT NODE MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 258 IOT NODE MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 259 IOT NODE & GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 260 IOT NODE & GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 261 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY HARDWARE, 2020–2023 (THOUSAND UNITS)

TABLE 262 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY HARDWARE, 2024–2029 (THOUSAND UNITS)

TABLE 263 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2023 (USD MILLION)

TABLE 264 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2024–2029 (USD MILLION)

TABLE 265 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 266 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 267 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 268 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 269 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 270 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 271 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 272 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 273 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 274 IOT NODE AND GATEWAY MARKET FOR AEROSPACE & DEFENSE IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.2.9.2 Device types

7.2.9.2.1 Smart baggage tags

7.2.9.2.2 Smart beacons

7.2.9.2.3 Drones/Unmanned aerial vehicles (UAVs)

7.2.9.2.4 Gateways

7.3 CONSUMER

7.3.1 WEARABLE DEVICES

7.3.1.1 Growing adoption of smartwatches to support market growth

FIGURE 54 KEY APPLICATIONS OF IOT IN WEARABLE DEVICES

TABLE 275 IOT NODE MARKET FOR WEARABLE DEVICES, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 276 IOT NODE MARKET FOR WEARABLE DEVICES, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 277 IOT NODE MARKET FOR WEARABLE DEVICES, BY DEVICE TYPE, 2020–2023 (MILLION UNITS)

TABLE 278 IOT NODE MARKET FOR WEARABLE DEVICES, BY DEVICE TYPE, 2024–2029 (MILLION UNITS)

TABLE 279 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 280 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 281 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES, BY REGION, 2020–2023 (USD MILLION)

TABLE 282 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES, BY REGION, 2024–2029 (USD MILLION)

TABLE 283 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 284 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 285 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 286 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 287 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 288 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 289 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 290 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 291 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 292 IOT NODE AND GATEWAY MARKET FOR WEARABLE DEVICES IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.3.1.2 Device types

7.3.1.2.1 Activity monitors

7.3.1.2.2 Smartwatches

7.3.1.2.3 Smart glasses

7.3.1.2.4 Body-worn cameras

7.3.2 CONSUMER ELECTRONICS

7.3.2.1 Rising demand for smart appliances to drive market

TABLE 293 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2020–2023 (USD MILLION)

TABLE 294 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2024–2029 (USD MILLION)

TABLE 295 IOT NODE MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 296 IOT NODE MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 297 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2020–2023 (THOUSAND UNITS)

TABLE 298 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2024–2029 (THOUSAND UNITS)

TABLE 299 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY HARDWARE, 2020–2023 (MILLION UNITS)

TABLE 300 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY HARDWARE, 2024–2029 (MILLION UNITS)

TABLE 301 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2023 (USD MILLION)

TABLE 302 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2024–2029 (USD MILLION)

TABLE 303 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 304 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 305 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 306 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 307 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 308 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 309 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 310 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 311 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN MIDDLE EAST, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 312 IOT NODE AND GATEWAY MARKET FOR CONSUMER ELECTRONICS IN MIDDLE EAST, BY COUNTRY, 2024–2029 (USD MILLION)

7.3.2.2 Device types

7.3.2.2.1 Smart lighting

7.3.2.2.2 Smart TVs

7.3.2.2.3 Smart washing machines

7.3.2.2.4 Smart dryers

7.3.2.2.5 Smart refrigerators

7.3.2.2.6 Smart ovens

7.3.2.2.7 Smart cooktops

7.3.2.2.8 Smart cookers

7.3.2.2.9 Smart deep freezers

7.3.2.2.10 Smart dishwashers

7.3.2.2.11 Smart coffee makers

7.3.2.2.12 Smart kettles

7.3.2.2.13 Gateways

8 IOT NODE AND GATEWAY MARKET, BY REGION (Page No. - 322)

8.1 INTRODUCTION

FIGURE 55 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2024 TO 2029

TABLE 313 IOT NODE AND GATEWAY MARKET, BY REGION, 2020–2023 (USD BILLION)

TABLE 314 IOT NODE AND GATEWAY MARKET, BY REGION, 2024–2029 (USD BILLION)

TABLE 315 IOT NODE AND GATEWAY MARKET, BY REGION, 2020–2023 (MILLION UNITS)

TABLE 316 IOT NODE AND GATEWAY MARKET, BY REGION, 2024–2029 (MILLION UNITS)

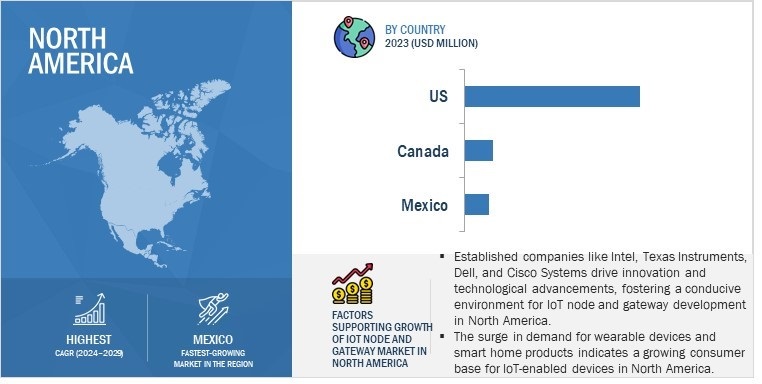

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA: RECESSION IMPACT

FIGURE 56 NORTH AMERICA: IOT NODE AND GATEWAY MARKET SNAPSHOT

FIGURE 57 MEXICO TO RECORD HIGHEST CAGR IN NORTH AMERICAN IOT NODE AND GATEWAY MARKET FROM 2024 TO 2029

TABLE 317 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 318 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 319 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 320 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 321 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 322 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 323 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2020–2023 (USD MILLION)

TABLE 324 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2024–2029 (USD MILLION)

TABLE 325 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 326 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 327 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2020–2023 (USD MILLION)

TABLE 328 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2024–2029 (USD MILLION)

TABLE 329 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 330 IOT NODE AND GATEWAY MARKET IN NORTH AMERICA, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

8.2.2 US

8.2.2.1 Presence of leading IoT companies to drive market

8.2.3 CANADA

8.2.3.1 Increasing investment in IoT by enterprises to boost market

8.2.4 MEXICO

8.2.4.1 Growing penetration of IoT in telecommunications industry to propel market

8.3 EUROPE

8.3.1 EUROPE: RECESSION IMPACT

FIGURE 58 EUROPE: IOT NODE AND GATEWAY MARKET SNAPSHOT

FIGURE 59 GERMANY TO HOLD MAJOR SHARE OF EUROPEAN IOT NODE AND GATEWAY MARKET DURING FORECAST PERIOD

TABLE 331 IOT NODE AND GATEWAY MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 332 IOT NODE AND GATEWAY MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 333 IOT NODE AND GATEWAY MARKET IN EUROPE, BY END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 334 IOT NODE AND GATEWAY MARKET IN EUROPE, BY END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 335 IOT NODE AND GATEWAY MARKET IN EUROPE, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 336 IOT NODE AND GATEWAY MARKET IN EUROPE, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 337 IOT NODE AND GATEWAY MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2020–2023 (USD MILLION)

TABLE 338 IOT NODE AND GATEWAY MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2024–2029 (USD MILLION)

TABLE 339 IOT NODE AND GATEWAY MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 340 IOT NODE AND GATEWAY MARKET IN EUROPE, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 341 IOT NODE AND GATEWAY MARKET IN EUROPE, BY CONSUMER APPLICATION, 2020–2023 (USD MILLION)

TABLE 342 IOT NODE AND GATEWAY MARKET IN EUROPE, BY CONSUMER APPLICATION, 2024–2029 (USD MILLION)

TABLE 343 IOT NODE AND GATEWAY MARKET IN EUROPE, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 344 IOT NODE AND GATEWAY MARKET IN EUROPE, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

8.3.2 UK

8.3.2.1 Government initiatives to drive market

8.3.3 GERMANY

8.3.3.1 Adoption of Industry 4.0 to create market opportunities

8.3.4 FRANCE

8.3.4.1 Increased investment in industrial R&D to fuel demand

8.3.5 REST OF EUROPE

8.4 ASIA PACIFIC

8.4.1 ASIA PACIFIC: RECESSION IMPACT

FIGURE 60 ASIA PACIFIC: IOT NODE AND GATEWAY MARKET SNAPSHOT

FIGURE 61 IOT NODE AND GATEWAY MARKET IN CHINA TO RECORD HIGHEST CAGR FROM 2024 TO 2029

TABLE 345 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

TABLE 346 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 347 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 348 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 349 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 350 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 351 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY INDUSTRIAL APPLICATION, 2020–2023 (USD MILLION)

TABLE 352 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY INDUSTRIAL APPLICATION, 2024–2029 (USD MILLION)

TABLE 353 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 354 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 355 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY CONSUMER APPLICATION, 2020–2023 (USD MILLION)

TABLE 356 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY CONSUMER APPLICATION, 2024–2029 (USD MILLION)

TABLE 357 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 358 IOT NODE AND GATEWAY MARKET IN ASIA PACIFIC, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

8.4.2 CHINA

8.4.2.1 Government support for IoT to accelerate market growth

8.4.3 JAPAN

8.4.3.1 Developments in telecom industry to drive market

8.4.4 SOUTH KOREA

8.4.4.1 Advancements in consumer electronics to fuel market

8.4.5 REST OF ASIA PACIFIC

8.5 REST OF THE WORLD (ROW)

8.5.1 ROW: RECESSION IMPACT

FIGURE 62 SROW: IOT NODE AND GATEWAY MARKET SNAPSHOT

FIGURE 63 IOT NODE AND GATEWAY MARKET IN SOUTH AMERICA TO RECORD HIGHEST CAGR FROM 2024 TO 2029

TABLE 359 IOT NODE AND GATEWAY MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

TABLE 360 IOT NODE AND GATEWAY MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

TABLE 361 IOT NODE AND GATEWAY MARKET IN ROW, BY END-USE APPLICATION, 2020–2023 (USD MILLION)

TABLE 362 IOT NODE AND GATEWAY MARKET IN ROW, BY END-USE APPLICATION, 2024–2029 (USD MILLION)

TABLE 363 IOT NODE AND GATEWAY MARKET IN ROW, BY END-USE APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 364 IOT NODE AND GATEWAY MARKET IN ROW, BY END-USE APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 365 IOT NODE AND GATEWAY MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2020–2023 (USD MILLION)

TABLE 366 IOT NODE AND GATEWAY MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2024–2029 (USD MILLION)

TABLE 367 IOT NODE AND GATEWAY MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 368 IOT NODE AND GATEWAY MARKET IN ROW, BY INDUSTRIAL APPLICATION, 2024–2029 (MILLION UNITS)

TABLE 369 IOT NODE AND GATEWAY MARKET IN ROW, BY CONSUMER APPLICATION, 2020–2023 (USD MILLION)

TABLE 370 IOT NODE AND GATEWAY MARKET IN ROW, BY CONSUMER APPLICATION, 2024–2029 (USD MILLION)

TABLE 371 IOT NODE AND GATEWAY MARKET IN ROW, BY CONSUMER APPLICATION, 2020–2023 (MILLION UNITS)

TABLE 372 IOT NODE AND GATEWAY MARKET IN ROW, BY CONSUMER APPLICATION, 2024–2029 (MILLION UNITS)

8.5.2 MIDDLE EAST

8.5.2.1 Rapid urbanization to boost IoT adoption

TABLE 373 IOT NODE AND GATEWAY MARKET IN MIDDLE EAST, BY REGION, 2020–2023 (USD MILLION)

TABLE 374 IOT NODE AND GATEWAY MARKET IN MIDDLE EAST, BY REGION, 2024–2029 (USD MILLION)

8.5.2.2 GCC countries

8.5.2.3 Rest of Middle East

8.5.3 AFRICA

8.5.3.1 Increasing mobile internet penetration to bolster market

8.5.4 SOUTH AMERICA

8.5.4.1 Focus on semiconductor industry to drive market

9 COMPETITIVE LANDSCAPE (Page No. - 362)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

TABLE 375 IOT NODE AND GATEWAY MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2020–2024

9.3 REVENUE ANALYSIS, 2019–2023

FIGURE 64 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN IOT NODE AND GATEWAY MARKET, 2019–2023

9.4 MARKET SHARE ANALYSIS, 2023

TABLE 376 IOT NODE HARDWARE MARKET: DEGREE OF COMPETITION

FIGURE 65 IOT NODE HARDWARE MARKET SHARE ANALYSIS, 2023

TABLE 377 IOT GATEWAY MARKET: RANKING ANALYSIS

9.5 COMPANY VALUATION AND FINANCIAL METRICS

FIGURE 66 IOT NODE AND GATEWAY MARKET: COMPANY VALUATION, 2024

FIGURE 67 IOT NODE AND GATEWAY MARKET: FINANCIAL METRICS (EV/EBITDA), 2024

9.6 BRAND/PRODUCT COMPARISON

FIGURE 68 IOT NODE AND GATEWAY MARKET: BRAND/PRODUCT COMPARISON

9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

9.7.1 STARS

9.7.2 EMERGING LEADERS

9.7.3 PERVASIVE PLAYERS

9.7.4 PARTICIPANTS

FIGURE 69 IOT NODE AND GATEWAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

9.7.5.1 Company footprint

FIGURE 70 IOT NODE AND GATEWAY MARKET: COMPANY FOOTPRINT

9.7.5.2 Hardware footprint

TABLE 378 IOT NODE AND GATEWAY MARKET: HARDWARE FOOTPRINT

9.7.5.3 End-use application footprint

TABLE 379 IOT NODE AND GATEWAY MARKET: END-USE APPLICATION FOOTPRINT

9.7.5.4 Region footprint

TABLE 380 IOT NODE AND GATEWAY MARKET: REGION FOOTPRINT

9.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 71 IOT NODE AND GATEWAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

9.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

9.8.5.1 List of key start-ups/SMEs

TABLE 381 IOT NODE AND GATEWAY MARKET: LIST OF KEY STARTUPS/SMES

9.8.5.2 Competitive benchmarking of key startups/SMEs

TABLE 382 IOT NODE AND GATEWAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

9.9 COMPETITIVE SCENARIO AND TRENDS

9.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 383 IOT NODE AND GATEWAY MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JUNE 2022–JANUARY 2024

9.9.2 DEALS

TABLE 384 IOT NODE AND GATEWAY MARKET: DEALS, JUNE 2021–DECEMBER 2023

10 COMPANY PROFILES (Page No. - 384)

10.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats)*

10.1.1 INTEL CORPORATION

TABLE 385 INTEL CORPORATION: BUSINESS OVERVIEW

FIGURE 72 INTEL CORPORATION: COMPANY SNAPSHOT

TABLE 386 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 387 INTEL CORPORATION: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 388 INTEL CORPORATION: DEALS

TABLE 389 INTEL CORPORATION: OTHERS

10.1.2 QUALCOMM TECHNOLOGIES, INC.

TABLE 390 QUALCOMM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 73 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 391 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 392 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 393 QUALCOMM TECHNOLOGIES, INC.: DEALS

10.1.3 TEXAS INSTRUMENTS INCORPORATED

TABLE 394 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

FIGURE 74 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

TABLE 395 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 396 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 397 TEXAS INSTRUMENTS INCORPORATED: DEALS

10.1.4 STMICROELECTRONICS

TABLE 398 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 75 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 399 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 400 STMICROELECTRONICS: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 401 STMICROELECTRONICS: DEALS

10.1.5 MICROCHIP TECHNOLOGY INC.

TABLE 402 MICROCHIP TECHNOLOGY INC.: BUSINESS OVERVIEW

FIGURE 76 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

TABLE 403 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 404 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 405 MICROCHIP TECHNOLOGY INC.: DEALS

10.1.6 HUAWEI TECHNOLOGIES CO., LTD.

TABLE 406 HUAWEI TECHNOLOGIES CO., LTD.: BUSINESS OVERVIEW

FIGURE 77 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

TABLE 407 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 408 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 409 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

10.1.7 NXP SEMICONDUCTORS N.V.

TABLE 410 NXP SEMICONDUCTORS N.V.: BUSINESS OVERVIEW

FIGURE 78 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

TABLE 411 NXP SEMICONDUCTORS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 412 NXP SEMICONDUCTORS N.V.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 413 NXP SEMICONDUCTORS N.V.: DEALS

10.1.8 CISCO SYSTEMS, INC.

TABLE 414 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 79 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 415 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 416 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 417 CISCO SYSTEMS, INC.: DEALS

10.1.9 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

TABLE 418 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: BUSINESS OVERVIEW

FIGURE 80 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

TABLE 419 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 420 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 421 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

10.1.10 TE CONNECTIVITY LTD.

TABLE 422 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

FIGURE 81 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

TABLE 423 TE CONNECTIVITY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 424 TE CONNECTIVITY LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 425 TE CONNECTIVITY LTD.: DEALS

TABLE 426 TE CONNECTIVITY LTD.: OTHERS

10.1.11 ADVANTECH CO., LTD.

TABLE 427 ADVANTECH CO., LTD.: BUSINESS OVERVIEW

FIGURE 82 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

TABLE 428 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 429 ADVANTECH CO., LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 430 ADVANTECH CO., LTD.: DEALS

TABLE 431 ADVANTECH CO., LTD.: OTHERS

10.1.12 DELL TECHNOLOGIES

TABLE 432 DELL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 83 DELL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 433 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 434 DELL TECHNOLOGIES: PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 435 DELL TECHNOLOGIES: DEALS

*Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 SIEMENS

10.2.2 HELIUM SYSTEMS INC.

10.2.3 SAMSARA NETWORKS INC.

10.2.4 BEEP INC.

10.2.5 ESTIMOTE, INC.

10.2.6 AAEON TECHNOLOGY INC.

10.2.7 NEXCOM INTERNATIONAL CO., LTD.

10.2.8 EUROTECH

10.2.9 ADLINK TECHNOLOGY INC.

10.2.10 VOLANSYS

10.2.11 EMBITEL TECHNOLOGIES

10.2.12 MITSUBISHI ELECTRIC CORPORATION

10.2.13 LANTRONIX, INC.

10.2.14 CRADLEPOINT, INC.

11 APPENDIX (Page No. - 481)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Node and Gateway Market