Biopharmaceutical Process Analytical Technology Market Size by Technology (LC, GC, MS, qPCR, NGS, NMR, Raman, IR Spectroscopy), Product (Analyzer, Sensor, Software), Application (Vaccine, Biologics, CGT), and End User - Global Forecast to 2029

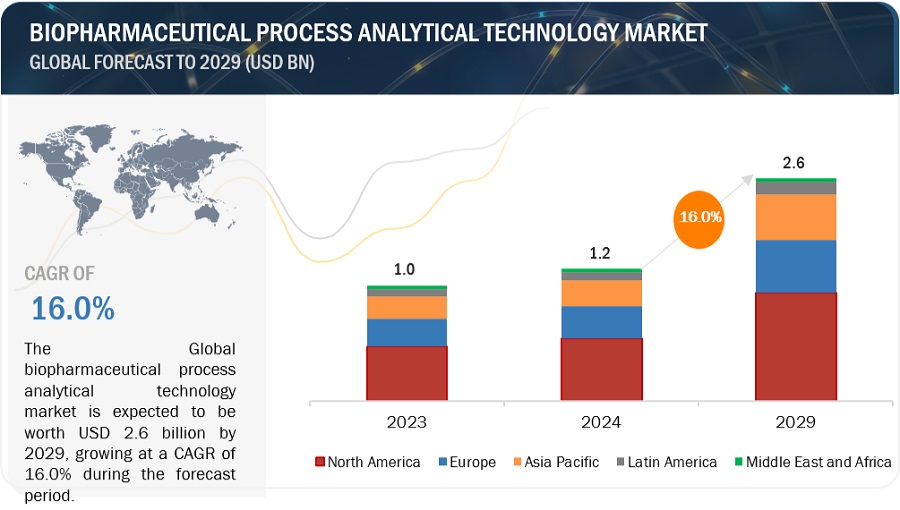

The size of global biopharmaceutical process analytical technology market in terms of revenue was estimated to be worth $1.2 billion in 2024 and is poised to reach $2.6 billion by 2029, growing at a CAGR of 16.0% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The market is witnessing a surge in growth propelled by rising investments, both direct and indirect, in analytical instruments, coupled with strategic partnerships aimed at advancing drug discovery. Furthermore, the global biosimilar sector is on an upward trajectory, driven by these factors alongside the increasing number of conferences and symposia dedicated to analytical technologies. Looking forward, emerging markets are expected to offer promising opportunities for industry players in the coming five years.

Biopharmaceutical Process Analytical Technology Market

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Biopharmaceutical Process Analytical Technology Market: Market Dynamics

Driver: Increasing demand for enhancing the quality of manufacturing processes

PAT instruments are sturdy instruments utilized for analyzing and managing Critical Quality Attributes (CQAs) within biopharmaceutical manufacturing workflows by assessing Critical Process Parameters (CPPs). These instruments play a pivotal role in enhancing production efficiency, ensuring top-notch product quality, and enhancing overall product performance. Through PAT, continuous monitoring of biopharmaceutical manufacturing is enabled, furnishing real-time insights into product quality and mitigating the need for batch reprocessing or disposal. This technology not only facilitates cost control but also accelerates product release by circumventing post-production testing, thereby offering financial advantages. Moreover, it diminishes cycle times and energy consumption associated with equipment operation. Automation within the process further trims labor expenses, contributing to overall cost savings.

Restraint: High cost of PAT deployment

Technological advancements have led to an escalation in the prices of various systems. For example, the price range for a new spectroscopy instrument is between USD 75,000 and USD 500,000. An HPLC system can cost anywhere from USD 10,000 to USD 40,000, while a dynamic light-scattering particle size analyzer may be priced in the range of USD 30,000 to USD 60,000, depending on accompanying accessories. Despite the operational advantages and potential cost savings associated with implementing Process Analytical Technology (PAT) in the biopharmaceutical sector, its uptake has been sluggish in emerging markets.

Opportunity: Healthcare costs are on the rise in developing nations

Emerging markets across Asia, including China, South Korea, Indonesia, and India, are poised to offer significant growth prospects for Process Analytical Technology (PAT). This is primarily driven by more lenient regulatory frameworks, a rising number of biopharmaceutical firms, a skilled workforce, and governmental efforts to bolster local manufacturing. Specifically, China and India represent key opportunities for PAT market expansion. These nations exhibit substantial demand for devices like spectrometers and chromatography instruments, driven by the establishment of new projects across various industries. Moreover, the robust biopharmaceutical sectors in China and India are expected to notably contribute to the growth of spectroscopy and chromatography markets in the foreseeable future.

Challenge: Lack of skilled professionals

The biopharmaceutical industry faces challenges due to a lack of skilled professionals in the field of process analytical technology (PAT). PAT involves the use of advanced analytical tools and techniques to monitor and control biopharmaceutical manufacturing processes in real time. The shortage of skilled professionals in PAT can hinder the implementation and optimization of these technologies, leading to inefficiencies in manufacturing processes, increased costs, and potential delays in bringing new therapies to market. Addressing this shortage requires investment in education and training programs to develop the necessary expertise in PAT among scientists, engineers, and technicians within the biopharmaceutical industry.

Biopharmaceutical Process Analytical Technology Industry Ecosystem/Map

By type, the mass spectrometry segment of the biopharmaceutical process analytical technology industry accounted for the largest share in 2024.

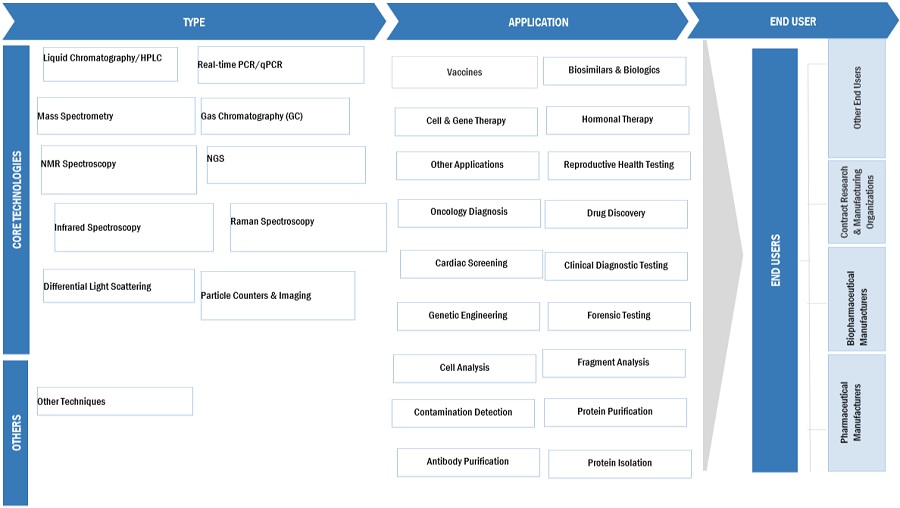

Based on type, the biopharmaceutical process analytical technology market is segmented into liquid chromatography/HPLC, GAS chromatography, mass spectrometry, real-time PCR/QPCR, NGS, NMR spectroscopy, raman spectroscopy, infrared spectroscopy, particle counters and imaging, differential light scattering, and other techniques. In 2024, the liquid chromatography/HPLC segment accounted for the largest market share. Liquid chromatography is essential for gathering quantitative data in drug development, particularly regarding pharmacokinetics and pharmacodynamics, in conjunction with chromatography. Its widespread use in both qualitative and quantitative analyses of pharmaceutical and biopharmaceutical products is anticipated to drive substantial growth in the spectroscopy sector in the foreseeable future.

By product type, the analyzers segment of the biopharmaceutical process analytical technology industry accounted for the largest share during the forecast period.

Biopharmaceutical process analytical products include analyzers, sensors & probes, samplers, and software. In 2023, the analyzer segment accounted for the largest share of the biopharmaceutical process analytical technology market. The need for analyzers in pharmaceutical production is mainly driven by the necessity for smoother and more effective manufacturing procedures, strict regulations guaranteeing product quality and performance, and the increasing amount of research and development initiatives within the biopharmaceutical industry.

By application, the medical application market will register significant growth of the biopharmaceutical process analytical technology industry in the near future.

Based on application, the biopharmaceutical process analytical technology market is broadly segmented into vaccines, cell and gene therapy, biosimilars & biologics, hormonal therapy, and other applications. The biosimilars & biologics segment to register the highest growth from 2024 to 2029. In recent times, research has become pivotal in the advancement of pharmaceuticals, offering pathways for addressing a multitude of medical ailments such as cancer, rheumatoid arthritis, psoriasis, Crohn's disease, and diabetes, among various others. As a result, the growing incidence of chronic illnesses, coupled with heightened research endeavors aimed at vaccine development, is driving the growth of this industry.

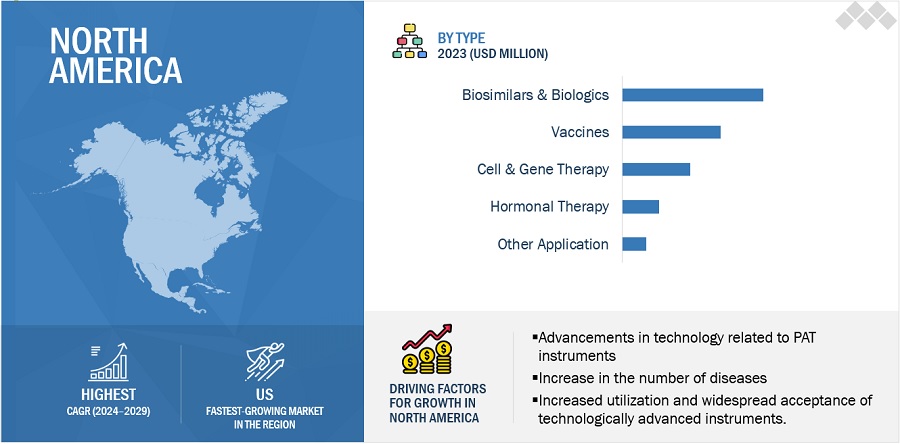

By region, North America is expected to be the largest market of the biopharmaceutical process analytical technology industry during the forecast period .

North America, comprising the US and Canada, accounted for the largest share of the biopharmaceutical process analytical technology market in 2023. The significant growth of the North American market can largely be attributed to the strict FDA regulations overseeing drug approval and safety, the strong presence of pharmaceutical companies, and the swift adoption of cutting-edge technologies. Other factors contributing to the market's expansion in North America include increased investment in biotechnology research and a growing demand for biologics.

To know about the assumptions considered for the study, download the pdf brochure

As of 2023, the key players operating in the global process analytical technology market are Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), Waters Corporation (US), Bruker Corporation (US), Emerson Electric Co. (US), ABB Ltd. (Switzerland), PerkinElmer, Inc. (US), Mettler-Toledo International Inc. (US), and Carl Zeiss AG (Germany), among others.

Scope of the Biopharmaceutical Process Analytical Technology Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$1.2 billion |

|

Projected Revenue by 2029 |

$2.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 16.0% |

|

Market Driver |

Increasing demand for enhancing the quality of manufacturing processes |

|

Market Opportunity |

Healthcare costs are on the rise in developing nations |

This report has segmented the biopharmaceutical process analytical technology market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Liquid Chromatography/HPLC

- GAS Chromatography (GC)

- Mass Spectrometry

- Real-Time PCR/QPCR

- NGS

- NMR Spectroscopy

- Raman Spectroscopy

- Infrared Spectroscopy

- Particle Counters and Imaging

- Differential Light Scattering

- Other Techniques

By Product Type

- Analyzers

- Sensor and Probes

- Samples

- Software

By Mode

- On-line Measurement

- Off-line Measurement

- At-line Measurement

- In-line Measurement

By Application

- Vaccines

- Cell and Gene Therapy

- Biosimilars & Biologics

- Hormonal Therapy

- Other Application

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

Recent Developments of the Biopharmaceutical Process Analytical Technology Industry:

- In Feb 2024, Thermo Fisher Scientific Inc. introduced the Thermo Scientific Dionex Inuvion Ion Chromatography (IC) system, aimed at simplifying, and enhancing ion analysis across laboratories of varying scales. This innovative analytical instrument offers easy reconfiguration, serving as a comprehensive solution for the precise determination of ionic and small polar compounds, ensuring consistent and reliable results.

- In April 2022, Thermo Fisher Scientific Inc. has introduced the Ramina Process Analyzer, a Raman spectroscopic analyzer aimed at simplifying Raman spectroscopy measurements to enhance user accessibility by reducing complexity.

- In June 2021, Agilent Technologies Inc. launched three InfinityLab Bio LC systems have been introduced by the company, tailored to address the increasing demands of the biopharmaceutical sector.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biopharmaceutical process analytical technology market?

The global biopharmaceutical process analytical technology market boasts a total revenue value of $2.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global biopharmaceutical process analytical technology market?

The global biopharmaceutical process analytical technology market has an estimated compound annual growth rate (CAGR) of 16.0% and a revenue size in the region of $1.2 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

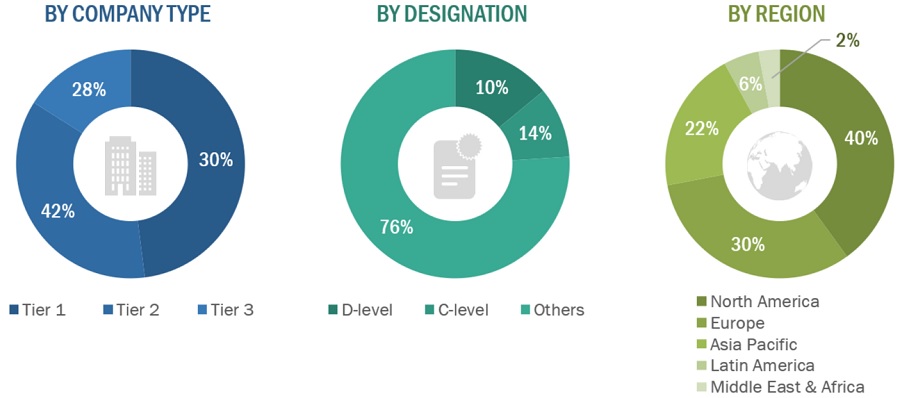

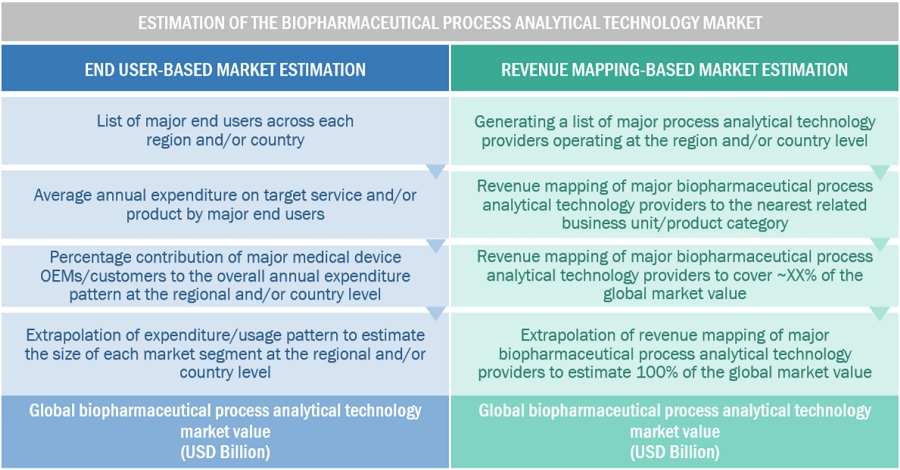

The study involved four major activities in estimating the current size of the biopharmaceutical process analytical technology market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial biopharmaceutical process analytical technology market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the biopharmaceutical process analytical technology market. The primary sources from the demand side include biopharmaceutical manufacturer companies, research organizations, academic institutes, and process analytical service providing companies, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the global biopharmaceutical process analytical technology market's size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the PAT business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- A list of major players operating in the biopharmaceutical process analytical technology market at the regional/country level

- Product mapping of various manufacturers for each type of process analytical technology product at the regional/country level

- Mapping of annual revenue generated by listed major players from PAT products segments (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least ~60% of the global market share as of 2023

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global process analytical technology market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global biopharmaceutical process analytical technology market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the biopharmaceutical process analytical technology market was validated using both top-down and bottom-up approaches.

Market Definition

The biopharmaceutical process analytical technology (PAT) market encompasses the tools, techniques, and systems used to monitor, control, and optimize the manufacturing processes of biopharmaceuticals. It involves advanced analytical methods aimed at ensuring product quality, efficiency, and compliance in the production of biopharmaceutical drugs.

Key Stakeholders

- Process analytical technology manufacturers, suppliers, and providers

- Biopharmaceutical firms

- Contract research and manufacturing organizations

- Academic and private research institutions

- Research and Development (R&D) Companies

- Medical Research Laboratories

- Academic institutions and private research institutions

- Regulatory Agencies

- Quality Control and Assurance

- Contract Manufacturing Organizations (CMOs)

- Environmental and Safety Regulatory Bodies

- Public and Private Research Institutions

- Third-party Testing Laboratories

Objectives of the Study

- To define, describe, and forecast the biopharmaceutical process analytical technology market based on type, product type, mode, application, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global biopharmaceutical process analytical technology market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global biopharmaceutical process analytical technology market

- To analyze key growth opportunities in the global biopharmaceutical process analytical technology market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global biopharmaceutical process analytical technology market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global biopharmaceutical process analytical technology market, such as product launches; agreements; expansions; and mergers & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present x-ray detectors market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe x-ray detectors market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific diagnostic imaging market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

Growth opportunities and latent adjacency in Biopharmaceutical Process Analytical Technology Market