Medical Sensors Market by Sensor Type (Pressure, Temperature, ECG, Image, Touch, Blood Oxygen, Blood Glucose Sensor), End-Use Product, Medical Procedure (Invasive, Noninvasive), Device Classification, Medical Facility & Region - Global Forecast to 2029

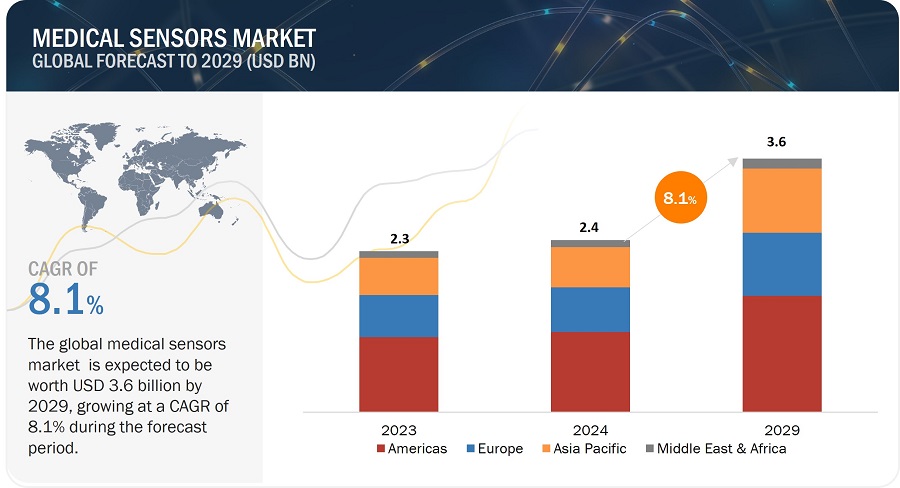

[247 Pages Report] The medical sensors market is valued at USD 2.4 billion in 2024 and is projected to reach USD 3.6 billion by 2029; it is expected to grow at a CAGR of 8.1% from 2024 to 2029. Factors such as increased adoption of surgical robots, and advancements in sensors and digital technologies create lucrative opportunities whereas complexity in designing compatible medical sensors is a major restraint for the growth of the medical sensors market.

Medical Sensors Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rising demand for wearable medical devices

In recent years, there has been a significant increase in the adoption of wearable sensors due to their simplified design, the comfort offered, and the ability to provide access to patient care from any location.

The advancements in wireless technologies have provided opportunities for people to track and monitor their health and reduce the expenditure incurred in medical facilities for treatment. The increased use of wearable sensors can be attributed to the consumers who prefer to improve their health by having easy access to healthcare professionals through remote monitoring facilities. For instance, many people are using the automated device for asthma monitoring and management (ADAMM), a wearable smart asthma monitor that detects the symptoms of an asthma attack before its onset, allowing the user to take preventive measures.

Wearable sensors are also being extensively used to monitor chronic diseases such as diabetes and cardiovascular diseases. For instance, continuous glucose monitors are wearable sensors that detect and measure blood glucose levels for the entire day. The increased use of wearable sensors for various patient monitoring applications is driving the growth of the medical sensors market globally.

Restraint: Low penetration of medical devices in developing countries

Procurement and maintenance of advanced medical devices incur high costs. The expenditure on healthcare depends on factors such as the elderly population, per capita disposable income, and lifestyle. The developing countries are not as economically strong as the developed countries. Low per capita income and poor quality of life make it difficult for developing economies to spend more on healthcare.

South Asia is home to many developing countries, and according to WHO, the expenditure on healthcare as a percentage of GDP in South Asia is expected to reach 4.8% in 2024, which is very less compared with North America, which comprises developed countries such as the US and Canada. Expenditure on healthcare as a percentage of GDP in North America is expected to reach 19.5% in 2024. The increased expenditure on healthcare in North America can also be attributed to the higher population of people above 60 years of age.

Advanced medical technologies such as IoT-based medical devices and sensors need stable internet connectivity. The penetration and adoption of the Internet in developing countries are lower than that of developed countries. Hence, advanced devices are not accessible to the majority of the population in developing countries. Inferior economic conditions and technology penetration are reducing the accessibility of medical devices in developing countries, thereby impeding the market's growth.

Opportunity: Increased adoption of surgical robots

In the last decade, general surgeries and their subspecialties have witnessed an increase in minimally invasive procedures being performed with the assistance of robots. The adoption of robots for surgeries provides advantages such as increased surgeon control and autonomy, improved 3D visualization, and superior instrument dexterity. According to a report by MnM, the global surgical robots market is projected to reach USD 18.5 billion. Surgical robots are generally used in minimally invasive and low-risk procedures such as colorectal surgery, gastric surgical oncology, hernia repairs, and spine surgeries. Different kinds of sensors, such as image sensors and force sensors, are used in the manufacturing of surgical robots. The increasing adoption of surgical robots for minimally invasive procedures is providing a significant growth opportunity for the market.

Challenges: Data leakages associated with connected medical devices

Industry 4.0 has brought digitalization in the field of manufacturing by providing opportunities for the integration of technologies such as AI, IoT, and robotics, among others. However, data security and privacy have become the major areas of concern due to the adoption of wireless medical devices, especially after the cyberattack on National Healthcare Service in 2017, which paralyzed the healthcare computer systems in the UK.

With the rapidly increasing use of IoT-based connected medical devices in the global healthcare sector, the risk of being exposed to the threats of cyberattacks has also increased. Connected medical devices are prone to hacking. IoT-based medical devices are hardware systems that operate over the Internet. The data collected by these devices is stored on the cloud. Since there is an increased chance of data hacking, significant attention is required toward patient data security, which incurs a significant amount of additional spending. Therefore, the manufacturers of these medical devices must adhere to stringent standards to ensure patient data privacy and safety.

Medical Sensors Market Map:

Class II medical devices segment accounts for the largest market share of the medical sensors market during the forecast period.

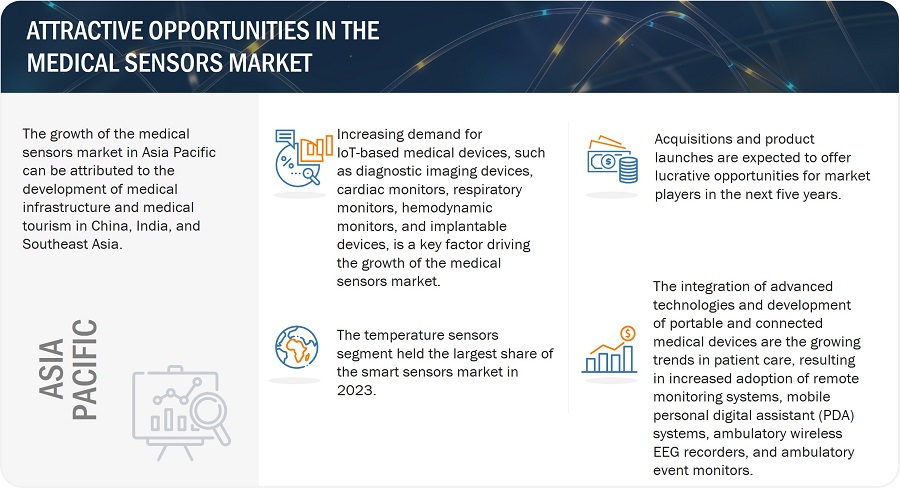

Most medical devices in the scope of the medical sensors market fall under the Class II category. Hence, the market for medical sensors used in Class II devices is not only expected to hold the largest share in the medical sensors market but also expected to register the highest growth during the forecast period. Investments by governments and other organizations in healthcare, adoption of advanced technologies, including IoT, and the exponential increase in the demand for ventilators due to the global pandemic and post-pandemic scenario have provided sensor manufacturers with new growth opportunities in various noninvasive and minimally-invasive medical devices.

Patient monitoring devices in Americas accounts for the largest market share of the medical sensors market during forecast period.

The Americas, which includes North America and South America, hold the largest market share of the medical sensors market for patient monitoring devices during the forecast period. North America has a well-established healthcare system that performs a large number of medical procedures, resulting in a higher demand for patient monitoring devices. Major medical device manufacturers are present in the region, which stimulates innovation and the development of advanced patient monitoring technologies. Several countries in North America have reimbursement policies that encourage the adoption of new and advanced medical technologies, including patient monitoring devices. The high prevalence of chronic diseases in the region creates a need for continuous patient monitoring solutions. The trend towards remote patient monitoring has led to a market for wearable and implantable devices for continuous health data collection.

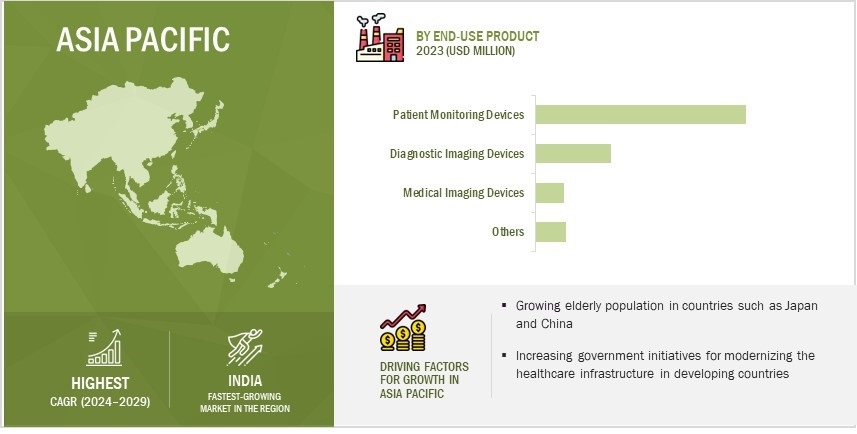

The Asia Pacific region is expected to grow at the highest growth rate during the forecast period.

The market in Asia Pacific is projected to register the highest growth during the forecast period. This region consists of Asian countries and Pacific countries such as Australia and New Zealand. Market players are expanding their presence in emerging economies such as India, China, and other Southeast Asian countries. The increase in awareness about advanced medical systems is expected to drive market growth in this region.

Chia accounted for the largest share of the global medical sensors market in 2023, and a similar trend is expected to continue during the forecast period. Some of the important factors driving the market growth in China include the growing elderly population and support from the government for healthcare services. An increase in discretionary income is also propelling the growth of the market.

The medical sensors market in Asia Pacific is driven by the increasing demand for diagnostic imaging and patient monitoring devices. India is projected to register the highest growth during the forecast period. In developing countries such as India, there has been an increase in demand for advanced and connected devices, especially for patient monitoring purposes, for reducing the expenses incurred in hospitals. Due to expensive treatment in hospitals, there has been an increase in the adoption of remote monitoring systems, leading to a rise in demand for medical sensors.

Medical Sensors Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Analog Devices, Inc. (US), TE Connectivity (Switzerland), Medtronic (Ireland), STMicroelectronics (Switzerland), Texas Instruments Incorporated (US) , among others, are some key players operating in the medical sensors companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

Sensor Type, End-use Product, Medical Procedure, Medical Facility, Medical Device Classification, and Region |

|

Regions covered |

Americas, Asia Pacific, Europe, and Middle East & Africa |

|

Companies covered |

Some of the leading companies operating in the medical sensors market are TE Connectivity (Switzerland), Medtronic (Ireland), Analog Devices, Inc. (US), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), Tekscan, Inc. (US), NXP Semiconductors (Netherlands), Sensirion AG (Switzerland), ON Semiconductor Corporation (US), and Amphenol Corporation (US) are the key players in the medical sensors market. Koninklijke Philips N.V. (Netherlands), ams-OSRAM AG (Austria), Abbott (US), Honeywell International Inc. (US), Cirtec (US), Innovative Sensor Technology IST AG (Switzerland), KELLER Druckmesstechnik AG (Switzerland), OMNIVISION (US), Merit Medical Systems, Inc. (US), Infineon Technologies AG (Germany), Masimo (US), VivaLNK, Inc. (US), Siemens Healthineers AG (Germany), Microchip Technology Inc. (US), and Renesas Electronics Corporation (Japan). |

Medical Sensors Market Highlights

This research report categorizes the medical sensors market based on Sensor Type, End-use Product, Medical Procedure, Medical Facility, Medical Device Classification, and Region

|

Segment |

Subsegment |

|

By Sensor Type |

|

|

By Medical Procedure |

|

|

By End-Use Product |

|

|

By Medical Device Classification |

|

|

By Medical Facility |

|

|

By Region |

|

Recent Developments

- In August 2023, NXP Semiconductors (Netherlands), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Robert Bosch GmbH (Germany), and Infineon Technologies AG (Germany) are investing in European Semiconductor Manufacturing Company (ESMC) GmbH to provide advanced semiconductor manufacturing services. ESMC aims to build a 300mm fab to support fast-growing automotive and industrial sectors with a production capacity of 40,000 300mm (12-inch) wafers. The fab will use advanced FinFET transistor technology and is expected to start production by the end of 2027.

- In July 2023, Tekscan, Inc. (US) announced partnerships with DigiKey (US), and Mouser Electronics (US) to increase product availability for FlexiForce sensors in the electronics marketplaces.

- In March 2023, Sensirion AG (Switzerland) has joined the ST Partner Program by STMicroelectronics. This brings Sensirion's latest humidity and temperature technology to ST’s customers, enriching ST’s portfolio and enabling more customers to benefit from high-quality components for innovative and reliable applications.

Frequently Asked Questions (FAQs)

What are the key strategies adopted by key companies in the medical sensors market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies the key players adopted to grow in the medical sensors market.

What region dominates the medical sensors market?

The Americas region will dominate the medical sensors market.

What end-use product segment dominates the medical sensors market?

Patient monitoring devices segment is expected to dominate the medical sensors market.

Which sensor type segment dominates the medical sensors market?

The temperature sensor segment is expected to have the largest market size during the forecast period.

Who are the major medical sensors market companies?

Analog Devices, Inc. (US), TE Connectivity (Switzerland), Medtronic (Ireland), STMicroelectronics (Switzerland), Texas Instruments Incorporated (US) , among others, are some key players operating in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

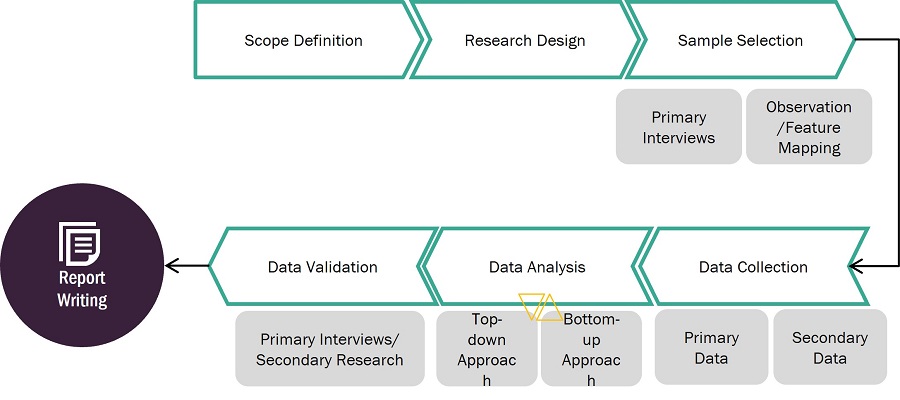

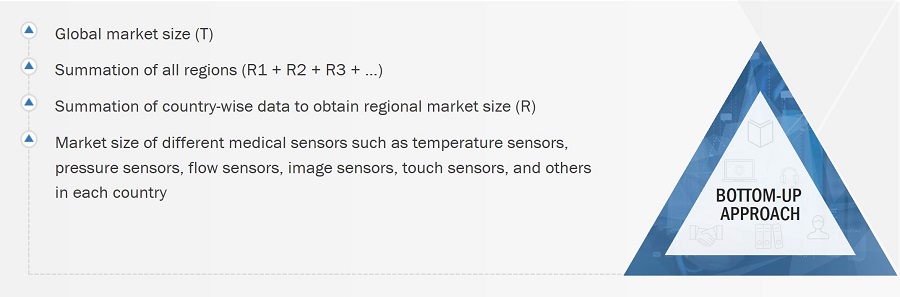

The study involved four major activities in estimating the current size of the medical sensors market —exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include high-speed data converter technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the medical sensors market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the medical sensors market and other dependent submarkets listed in this report.

- Extensive secondary research has identified key players in the industry and market.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Medical Sensors Market: Bottom-Up Approach

Medical Sensors Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

Medical sensors detect electrical or optical signals and provide a method for those signals to be measured and recorded. The physical properties that can be measured using these sensors include temperature, pressure, vibration, flow rates of liquids and gases, amplitudes of electrical and magnetic signals, and concentration of various substances. The medical sensors market is likely to witness significant growth owing to the increasing demand for advanced and connected medical devices. Increasing investments by governments and private organizations in healthcare have enabled device manufacturers to provide advanced medical devices for improved patient monitoring and diagnosis. The integration of advanced technologies, such as IoT, in medical devices has increased the demand for medical sensors.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Original device manufacturers (ODMs)

- Sensor manufacturers

- Manufacturers of semiconductor components and devices

- Providers of medical technologies

- Providers of medical devices software validation and testing services

- Government bodies such as regulatory authorities and policymakers

- Industry associations, organizations, forums, and alliances related to semiconductors, sensors, and medical equipment

- Research institutes and organizations

Report Objectives

The following are the primary objectives of the study.

- To forecast the size of the medical sensors market, in terms of value, based on sensor type, end-use product, medical procedure, medical facility, medical device classification, and region

- To define, describe, and forecast the medical sensors market size, in terms of volume, based on sensor type

- To describe and forecast the market, in terms of value, for various segments across four main regions: Americas, Asia Pacific, Europe, and the Middle East & Africa

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and conduct a value chain analysis of the medical sensors market landscape

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s Five Forces, import and export scenarios for products covered under HS code 901813 trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the medical sensors market

- To analyze strategic approaches adopted by the leading players in the medical sensors market, including product launches/developments and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Sensors Market

I am collecting information on medical sensor industry for a case study on the industry and not a particular company to use the info. Would be interested in receiving sample and brochure for this report.

Interested in knowing about sensors in medical industry like tempertaure sensors, pressure sensors, ingestible sensors, and blood monitoring sensors.

Have you included wearable elctonics sensors in your study ? Would be interested in knowing major companies manufacturing these type of component?

What level of information have been provided with respect to startup operating in this market. Do you provide competitor analysis data for startups companies.

Consulting for small tech company interested in Pressure & Position Sensors for Monitoring and Diagnostic Market Segments (US Primary, Global secondary).

I am looking into medical sensors that may be used for my individual project for my fourth year Product Design Engineering degree. What discount is available for student copy ?

I am interested to learn if the application segmentation in the Medical Sensors report goes one level deeper than: Diagnostics, Monitoring, Medical therapeutics, Imaging, Wellness and fitness.

Looking for specific data for sensors for temperature, heart beat and skill conduction. Currently, researching on human emotion detection system. What level of information you can provide to us ?

Would like to know the trends and business opportunities world wide for various medical sensors prevailing in this industry. Also would like to know the feasibility of a start-up in the medical sensors industry.

Hi, we are a startup, working on different medical devices what can be used simultanious on smartphones tablets and smartwatches, with a patents filled. I would be intersting how big is the market for fever thermometers in US EU world If you could help us this would be very nice, best regards Hubertus

I am developing a network :Wireless body area networks (WBANs) signify emerging technology with the potential to revolutionize health care by allowing unobtrusive health monitoring for extended periods of time.I need wireless sensors for :A typical WBAN consists of a number of inexpensive, lightweight, and miniature sensor platforms, each featuring one or more physiological sensors: motion sensors, EEGs, EMGs, electrocardiographs (ECGs). The sensors could be located on the body as tiny intelligent patches, integrated into clothing, or implanted below the skin or muscles. Have you covered this level of detail analysis in your project ?

Data required for the following 3 sensor types: 1)respiratory gas monitors 2)oximetry (pulse oximeters) 3)capnography (capnometry) . What level of information is available for these products?