Railway Management System Market by Offering (Solutions, Services), Solutions (Rail Operations Management, Rail Traffic Management, Rail Asset Management, In-train Intelligent Solutions) and Region - Global Forecast to 2029

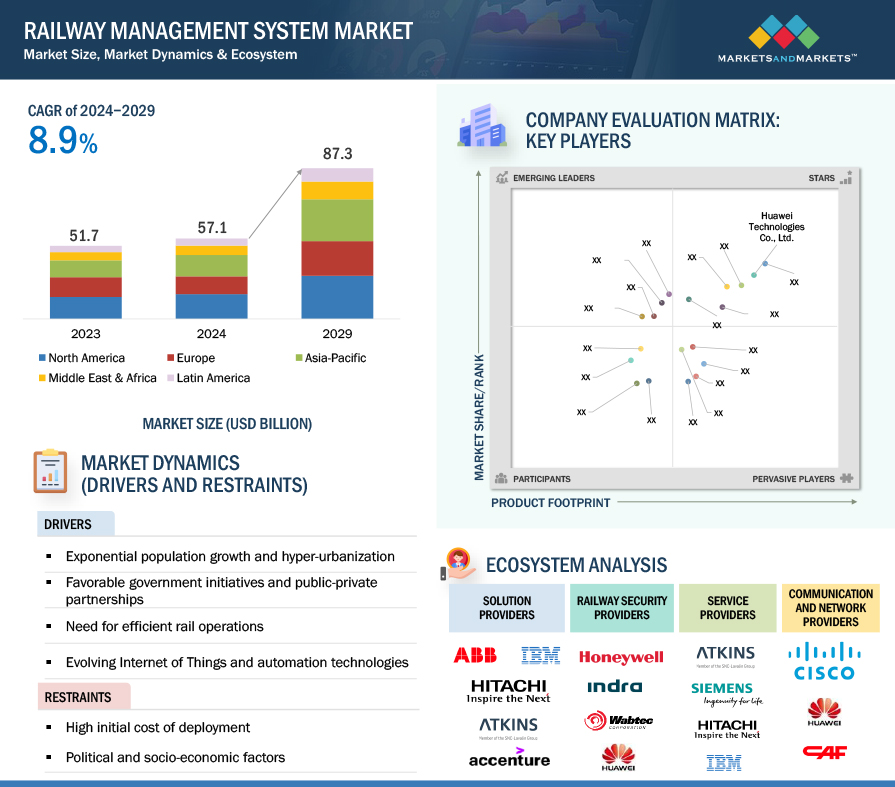

[219 Pages Report] MarketsandMarkets forecasts that the railway management system market size is projected to grow from USD 57.1 billion in 2024 to USD 87.3 billion by 2029, at a CAGR of 8.9% during the forecast period. Government initiatives aimed at modernizing transportation infrastructure and promoting sustainable mobility often involve substantial investments in railway projects. Funding support for railway management system upgrades and expansions contributes to market growth. Concerns about environmental pollution and carbon emissions are prompting a shift towards greener transportation options. Railways are inherently more energy-efficient and eco-friendly compared to other modes of transport, driving investment in railway management systems.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Railway Management System Market Dynamics

Driver: Need for efficiency in rail operations

An efficient rail operation needs the proper scheduling, monitoring, and maintenance of rail assets. Maintenance schedules reduce asset productivity due to downtime. This downtime is further elongated as a result of manual diagnostics with a low success rate. To enhance efficiency and reduce time consumption, rail authorities heavily focus on condition-based and predictive maintenance solutions. These solutions help in timely monitoring and efficiently scheduling of assets, thus minimizing downtime.

Predictive and condition-based maintenance reduce reliance on manual diagnostics by using analytics in real time. The widespread use of GPS sensors, detectors, and Radio Frequency Identification (RFID) in rail assets and infrastructures has been made possible by IoT technology. This in turn makes it possible to gather, transfer, and analyze many attributes, including condition, location, temperature, heat, and pressure. This helps improve the maintenance cycle of rail assets. The data from rail assets can be used to optimize rail asset utilization. It also enables the scheduled maintenance of assets, and resource intensities and costs.

Restraint: Political and socio-economic factors

Political and socio-economic factors exert significant influence on the railway management system market. Government policies and funding allocations play a pivotal role in determining the pace and scope of infrastructure development, often subjecting projects to shifts in political priorities and budget constraints. Regulatory frameworks, including safety and environmental standards, shape the design and implementation of management systems, adding complexity and cost. Public-private partnerships, crucial for financing and operation, are sensitive to political stability and policy consistency, impacting private sector involvement. Economic conditions, such as GDP growth and inflation, directly affect investment decisions, with downturns potentially delaying projects and technology upgrades due to budget constraints. Socio-economic development goals, often driving railway projects, must navigate competing interests and community concerns, influencing project planning and execution. Regional disparities in wealth and access to resources can exacerbate technological gaps, widening inequalities in transportation services. Moreover, public perception and stakeholder engagement, critical for project acceptance, can be influenced by socio-economic factors, shaping political decisions and project outcomes.

Opportunity: Increase in the demand for cloud-based services

With their dependable security environment and effective IT administration, cloud-based services, analytics, and internet technologies are becoming more and more in demand. The largest opportunity for rail transport to accept data's evolving architecture and make the most of it is through the big data cloud framework. It provides all rail management businesses with the opportunity to make a significant change that will allow them to improve rail operations and infrastructure. Big data applications are predicted to expand in complexity at a quick rate because of the growing amount of data, new technologies, and the growing requirement for optimum cost-efficiency. These factors would influence the growth of new analytics platforms and data storage.

Challenge: Maintenance and Support

1Maintenance and support pose significant challenges in the railway management system market due to the intricate nature of railway operations. The complexity of these systems, comprising a multitude of interconnected hardware and software components, demands specialized skills for effective diagnosis and troubleshooting. Moreover, diverse technologies integrated into railway networks, such as signaling systems and rolling stock, require coordinated maintenance efforts, often complicated by interoperability issues and legacy infrastructure. Ensuring compliance with stringent safety and regulatory standards further adds complexity to maintenance workflows, necessitating meticulous inspection and documentation processes. Accessing remote or inaccessible locations, common in railway infrastructure, presents logistical hurdles for maintenance crews, driving the need for innovative solutions like remote monitoring technologies. Additionally, aging infrastructure and budget constraints exacerbate maintenance challenges, underscoring the importance of proactive strategies and workforce training to optimize asset performance and reliability.

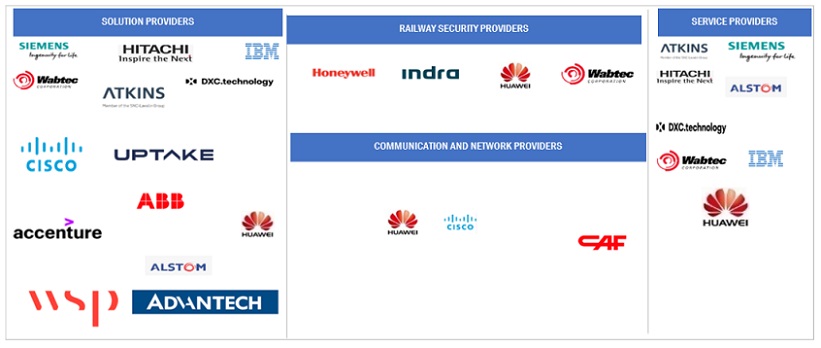

Railway Management System Market Ecosystem

Prominent companies in this market have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain).

Based on solution, the rail operations management segment is expected to grow with the highest CAGR during the forecast period

The rail operations management system offers solutions to enhance daily operations by analyzing the current status of all railway facilities and infrastructure in real-time. It ensures minimal disruptions in operations by centrally controlling and managing various aspects such as rail infrastructure, traffic flow, freight and passenger handling, revenue and ticketing, workforce, and rail automation. One of its key benefits is the prevention of unwanted incidents or accidents through real-time monitoring of rail movements. Major companies providing solutions for rail operations management include Alstom, Hitachi, Huawei, Wabtec, and IBM.

By services, the support and maintenance segment to hold the largest market size during the forecast period.

The support and maintenance services include round-the-clock troubleshooting assistance, seamless upgrading of current solutions, adept problem-solving, and timely repair or replacement of faulty components. Moreover, proactive services, along with technical support provided by skilled technicians, enhance operational resilience. Additionally, comprehensive test scenario management, facility inspections, and customized training programs contribute to the effectiveness of railway management system solutions. By adopting support and maintenance services, organizations mitigate business risks and reinforce the reliability of their railway management systems, ensuring uninterrupted operations and safeguarding critical assets.

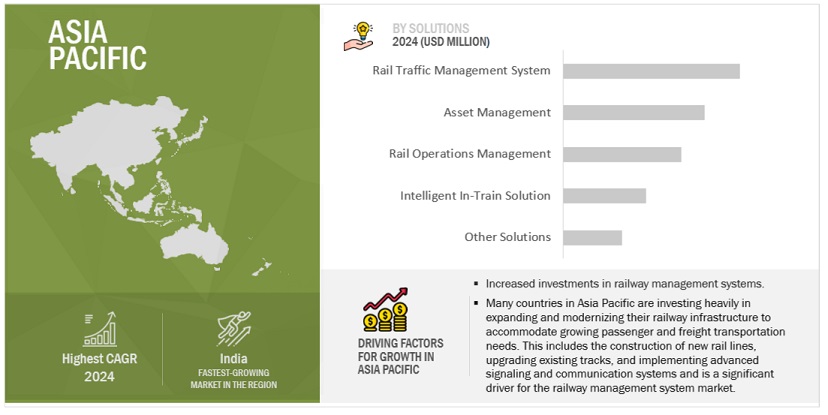

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period.

The railway management market in Asia Pacific is experiencing robust growth, fueled by factors such as rapid urbanization, population expansion, and the pressing need for efficient transportation solutions. Countries across the region are investing heavily in expanding and modernizing their railway infrastructure, with a particular emphasis on high-speed rail networks to enhance connectivity and stimulate economic development. Technology adoption is on the rise, with the integration of IoT, predictive analytics, and automation aimed at improving operational efficiency and passenger experience. Public-private partnerships play a significant role in project development, facilitating innovative financing models and accelerated implementation. Sustainability is also a key focus, with initiatives aimed at reducing carbon emissions and promoting modal shift from road to rail. With a diverse range of market players and intense competition, the railway management market in Asia Pacific presents vast opportunities for growth and innovation, shaping the future of transportation in the region.

Market Players:

The major players in the Railway management system market Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the railway management system market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Solutions(Rail Operations Management, Rail Traffic Management (Signaling Solutions, Real-Time Train Planning And Route Scheduling/Optimizing, Centralized Traffic Control, Positive Train Control, Rail Communications-Based Train Control (CBTC), Other Traffic Management Solutions), Asset Management (Enterprise Asset Management, Field Service Management, Asset Performance Management, Other Aseet Management Systems), Intelligent In-Train Solutions, Other Solutions), Services (Consulting Services, System Integration and Deployment Services, Support And Maintenance Services), and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), Honeywell International Inc. (US), CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRéalis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), RAILCUBE (Netherlands), Uptake Technologies Inc. (US), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), and Arcadis Gen Holdings Limited (UK) |

This research report categorizes the railway management system market based on offering, test solution, type of test, end user, and region.

Based on Offering:

-

Solutions

- Rail Operations Management

-

Rail Traffic Management

- Signaling Solutions

- Real-Time Train Planning And Route Scheduling/Optimizing

- Centralized Traffic Control

- Positive Train Control

- Rail Communications-Based Train Control (CBTC)

- Other Traffic Management Solutions

-

Asset Management

- Enterprise Asset Management

- Field Service Management

- Asset Performance Management

- Other Aseet Management Systems

- Intelligent In-Train Solutions

- Other Solutions

-

Services

- Consulting Services

- System Integration And Deployment Services

- Support And Maintenance Services

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2024, Siemens partnered with Metrolinx, the regional public transit operator for the Greater Toronto and Hamilton Area, to handle their track, signal, and right-of-way maintenance for the Central Region of Toronto's passenger railway infrastructure system. This partnership builds upon Siemens Mobility's existing maintenance services in the West Region and signal and communications services at the Metrolinx Network Operations Center.

- In March 2024, Hitachi Rail announced the launch of Train Maintenance DX as a Service, the industry's first "as a Service" solution to improve the work environment and the quality of train maintenance for railway operators, using the digital expertise in train manufacturing that it has accumulated at its Kasado Works in Kudamatsu City, Yamaguchi Prefecture in Japan.

- In February 2024, Alstom has signed a central service agreement with PKP Polskie Linie Kolejowe S.A, managing the Polish national railway network. The contract aims to offer post-warranty maintenance for railway traffic control devices and computer systems produced by Alstom. This includes Alstom’s railway traffic control systems, track vacancy system (SOL) and power supply. Alstom will provide service support for 328 facilities in 17 Railway Line plants located throughout Poland.

- In February 2024, Huawei launched its Smart Railway Perimeter Detection solution, to empower high-speed, secure, intelligent, and sustainable development across the transportation industry, facilitating intelligent railway transformation.

- In December 2023, Alstom launched India’s first Digital Experience Centre ever built by a rail OEM. Located in Bangalore and spread over 5000 sq.ft., the Digital Experience is a hub for executing Urban, Mainline, Freight & Mining (specific market) projects along with the integrated cybersecurity, Security & Telecom and SCADA features. With this center, Alstom has its largest signaling lab infrastructure spread over 60000 sq.ft. in India that aids the company’s vision of making India a global hub for technology and innovation.

Frequently Asked Questions (FAQ):

What is the definition of the railway management system market?

A railway management system combines solutions and associated services for improving the speed, safety, and reliability of rail services, leading to smarter railway infrastructure utilization. The railway management system leverages a combination and integration of technology, planning, and greater intelligence to harness the power of data to meet consumers’ demand for better services and safer travel, and help rail management authorities manage optimal routes, schedules, and capacity on a real-time basis.

What is the market size of the railway management system market?

The railway management system market size is projected to grow USD 57.1 billion in 2024 to USD 87.3 billion by 2029, at a CAGR of 8.9% during the forecast period.

What are the major drivers in the railway management system market?

The major drivers of the railway management system market are high demographic growth and hyper-urbanization enhancing the need for efficient railway systems, increase in government initiatives and public-private partnerships, need for efficiency in rail operations, adoption of IoT and other automation technologies to enhance optimization, and rise in congestion due to aging railway infrastructure.

Who are the key players operating in the railway management system market?

The major players in the railway management system market are Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM Corporation (US), Honeywell International Inc. (US), CAF (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRéalis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), RAILCUBE (Netherlands), Uptake Technologies Inc. (US), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), and Arcadis Gen Holdings Limited (UK).

What are the opportunities for new market entrants in the railway management system market?

The major opportunities of the railway management system market are increase in globalization and need for advanced transportation infrastructure, and demand for cloud-based services. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

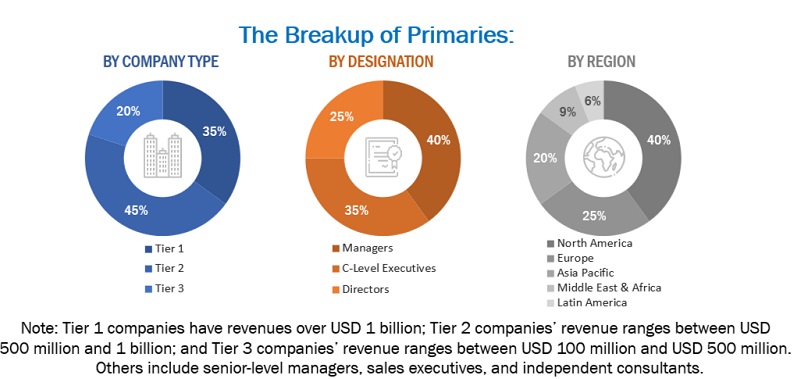

The study involved four major activities in estimating the current size of the global railway management system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total railway management system market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the railway management system market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Siemens |

Senior Manager |

|

Nway Technology |

VP |

|

Hitachi |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the railway management system market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global railway management system market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Railway management system market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Railway management system market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Railway management system market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

A railway management system combines solutions and associated services for improving the speed, safety, and reliability of rail services, leading to smarter railway infrastructure utilization. The railway management system leverages a combination and integration of technology, planning, and greater intelligence to harness the power of data to meet consumers’ demand for better services and safer travel, and help rail management authorities manage optimal routes, schedules, and capacity on a real-time basis.

Key Stakeholders

- Railway management system vendors

- Network and System Integrators (SIs)

- Cloud service providers

- Railway infrastructure providers

- Railway support service providers

- National railway governing authorities/regulators/bodies

- Railway operators and agencies

- Value-Added Resellers (VARs) and distributors

Report Objectives

- To determine, segment, and forecast the global railway management system market based on offering, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the railway management system market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the railway management system market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total railway management system market.

- To analyze the industry trends, patents, and innovations related to the railway management system market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the railway management system market.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Railway Management System Market