Insulation Products Market by Insulation Type (Thermal, Acoustic), Material Type (Mineral Wool, Polyurethane Foam, Flexible Elastomeric Foam), End-use (Building & Construction, Industrial, Transportation, Consumer) - Global Forecast to 2029

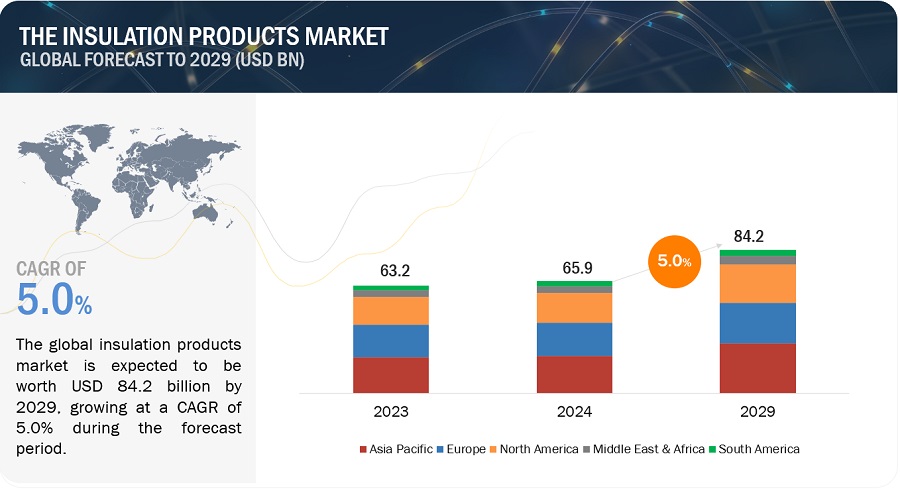

The insulation products market is projected to grow from USD 65.9 billion in 2024 to USD 84.2 billion by 2029, at a CAGR of 5.0% from 2024 to 2029. Rapid urbanization and the global focus on sustainable practices have fueled the demand for insulation products in the construction sector. As people prioritize health and comfort in their spaces, the demand for high-performance insulation products that address these concerns continues to grow.

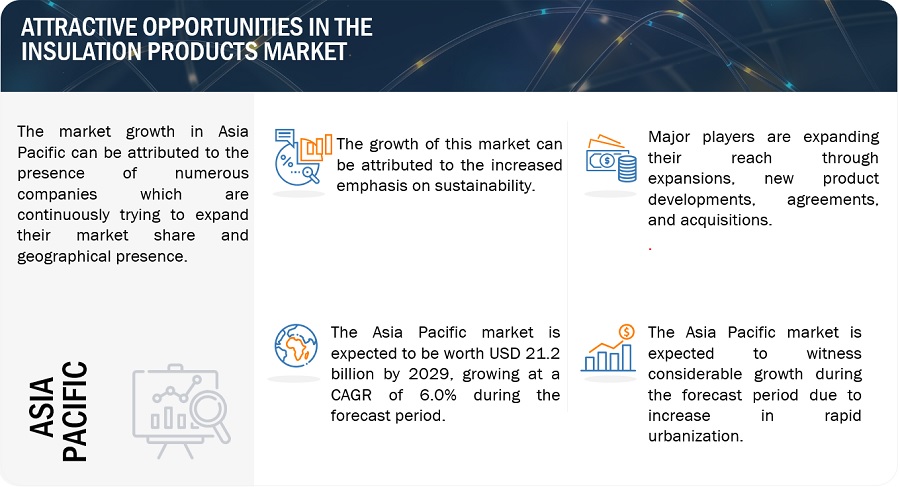

Attractive Opportunities in the Insulation Products Market

To know about the assumptions considered for the study, Request for Free Sample Report

Insulation Products Market Dynamics

Driver: Growing steel and aluminum industries in developing nations

Developing nations are experiencing rapid industrialization, with significant investments in infrastructure projects, including steel and aluminum manufacturing facilities. As these industries expand to meet the growing demand for construction materials, there is a parallel need for insulation products to enhance energy efficiency and maintain optimal operating conditions within industrial facilities.

Restraint: Toxic chemicals used as raw materials lead to health risk and ineffective insulation

Toxic chemicals used in insulation products can pose risks to human health and safety during manufacturing, installation, and use. Exposure to these chemicals may lead to respiratory problems, skin irritations, allergic reactions, and other adverse health effects for workers and occupants of buildings. As awareness of health risks associated with toxic chemicals increases, consumers, regulators, and industry stakeholders demand safer and more sustainable insulation alternatives.

Opportunity: Various government schemes to boost manufacturing sector in Asia Pacific

Many countries in the Asia Pacific region offer investment incentives to attract foreign direct investment (FDI) and stimulate domestic manufacturing activities. These incentives may include tax breaks, subsidies, grants, and preferential treatment for manufacturing projects. Insulation product manufacturers can leverage these incentives to establish production facilities, expand operations, and invest in research and development to innovate and improve product offerings.

Challenge: High training cost associated with application engineers and contractors

The specialized knowledge and skills required for the proper installation and application of insulation products often necessitate extensive training and experience. However, the high cost of training can deter individuals from pursuing careers as application engineers and contractors in the insulation industry. As a result, there may be shortages of qualified professionals available to perform insulation installations, leading to delays, quality issues, and increased project costs for manufacturers and end-users.

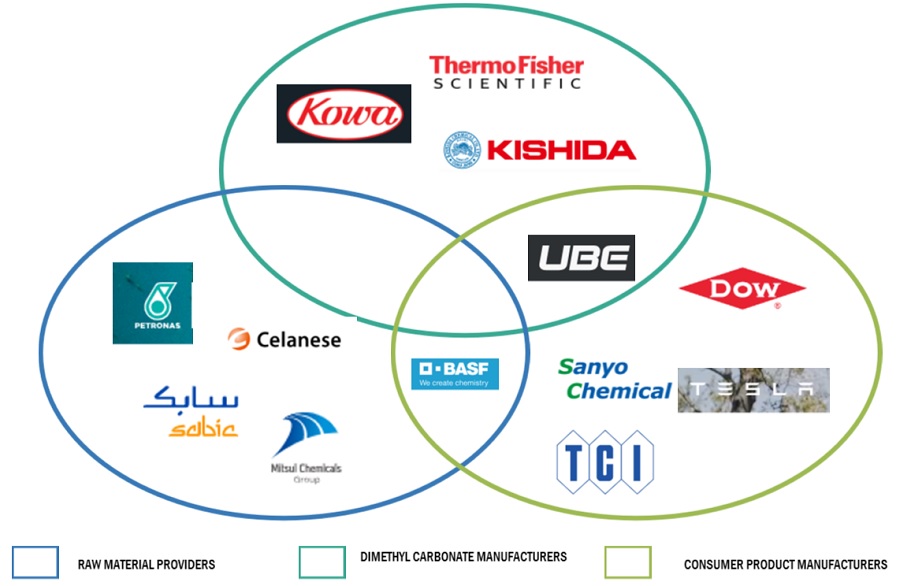

Insulation products Market: Ecosystem

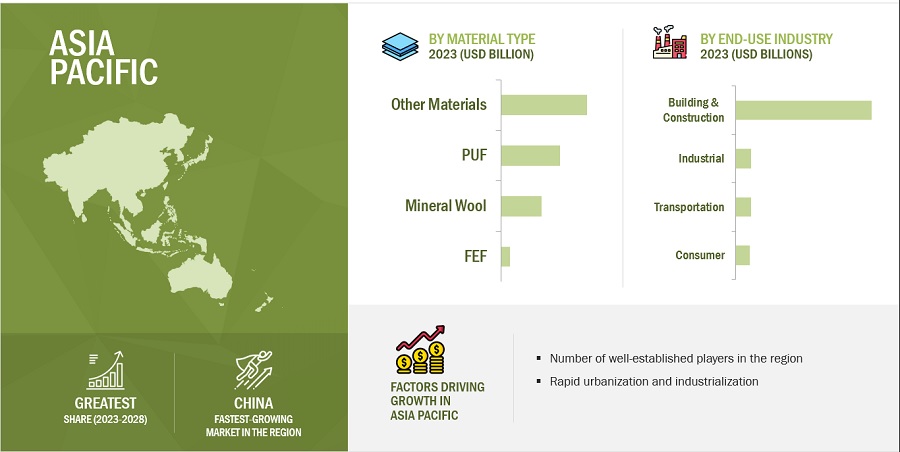

Based on the material type, the mineral wool segment will hold the most significant share during the forecast period.

Based on material type, the mineral wool segment held the largest share in 2023. The demand for mineral wool insulation is particularly strong in emerging economies within the Asia Pacific and Eastern European regions, where rapid urbanization and construction activities are driving market growth. As governments in these regions introduce stricter building codes and regulations regarding energy efficiency and fire safety, the adoption of mineral wool insulation is expected to increase to meet compliance requirements and address growing consumer preferences for high-quality building materials.

Based on end-use industry, building & construction is expected to be the largest insulation products market segment during the forecast period.

By end-use industry, in 2023, the building & construction segment held the most significant portion of the insulation products market. Insulation products are increasingly integrated with other building systems to enhance overall performance and efficiency. For example, insulation materials with vapor barriers are essential for moisture control in building envelopes, ensuring durability and preventing issues such as mold growth. Similarly, advancements in building automation and smart technology allow for the optimization of insulation performance through dynamic control of heating, cooling, and ventilation systems. As building systems become more interconnected, the demand for advanced insulation solutions that complement these technologies grows. The factors led to increase the market for insulation products.

Asia Pacific is projected to hold the most significant market share during the forecast period.

Asia Pacific accounted for the most significant global insulation products market share in 2023, followed by Europe and North America. The Asia Pacific region is prone to various climate-related challenges, including extreme heat, cold, and humidity. As a result, there is a growing awareness of the need for better insulation to ensure thermal comfort and mitigate the impact of climate variability on indoor environments. This drives the demand for insulation products in the region that offer superior thermal insulation properties.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), Knauf Insulation (US), Huntsman Corporation (US), Armacell International S.A. (Luxembourg), Johns Manville Corporation (US), Kingspan Group (Ireland), Soprema Group (France), Cellofoam International GmbH (Germany), Recticel NV/SA (Belgium), and China Jushi Co. Ltd. (China) are one of the major players in the global insulation products market. These players have been focusing on expansion, acquisition, and agreement strategies that help them expand their businesses in untapped and potential markets. They have adopted various organic and inorganic growth strategies to enhance their position in the insulation products market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019 to 2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Material type, Insulation type, End-use industry, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies Covered |

Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), Knauf Insulation (US), Huntsman Corporation (US), Armacell International S.A. (Luxembourg), Johns Manville Corporation (US), Kingspan Group (Ireland), Soprema Group (France), Cellofoam International GmbH (Germany), Recticel NV/SA (Belgium), China Jushi Co. Ltd. (China), and Rogers Corporation (US), and others. |

This research report categorizes the insulation products market based on insulation type, material type, end-use industry, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on end-use industry, the insulation products market is segmented into:

- Building & Construction

- Industrial

- Transportation

- Consumer

Based on material type, the insulation products market is segmented into:

- Mineral Wool

- Polyurethane Foam

- Flexible Elastomeric Foam

- Others

Based on insulation type, the insulation products market is segmented into:

- Thermal

- Acoustic & others

Based on the region, the insulation products market has been segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

South America

- Brazil

- Rest of South America

-

Middle East & Africa

-

GCC Countries

- UAE

- Saudi Arabia

- Rest of GCC

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

Recent Developments

- In January 2022, Covestro AG and Fairphone (Netherlands) collaborated for using Covestro's circular material solutions for smartphones. Fully and partly recycled TPU are used in the protective case of the Fairphone 3 and Fairphone 4, and partly recycled polycarbonates are additionally used in the newer device.

- In February 2024, Saint-Gobain has agreed to acquire CSR Limited, a leading Australian building products company, for USD 5.92 per share in cash, totaling 2.96 billion. This acquisition strengthens Saint-Gobain's position in the construction industry, particularly in Australia and the Asia-Pacific region.

- In August 2022, Owens Corning acquired Natural Polymers, LLC, a manufacturer of spray polyurethane foam insulation. This acquisition strengthens Owens Corning's portfolio with sustainable solutions and expands its presence in higher-growth segments of the insulation market.

Frequently Asked Questions (FAQ):

What is the key driver and opportunity for the insulation products market?

Growing steel and alluminium industry in developning nation and various government scheme to boost manufacturing sector in Asia Pacific are the primary drivers and opportunities.

Which region is expected to hold the highest market share in the insulation products market?

The insulation products market in the Asia Pacific is expected to dominate the market share in 2029 due to rapid development and investment in the construction sector.

What material type of insulation products accounts for a significant share?

Mineral wool accounts for a significant share of the insulation products market.

Who are the major service providers of insulation products?

The key manufacturers operating in the market are Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), and Knauf Insulation (US).

What total CAGR is expected for the insulation products from 2024 to 2029?

The market is expected to record a CAGR of 5.0% from 2024-2029, in terms of value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the insulation products market—extensive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of insulation products through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to to identify and collect information for this study. These secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

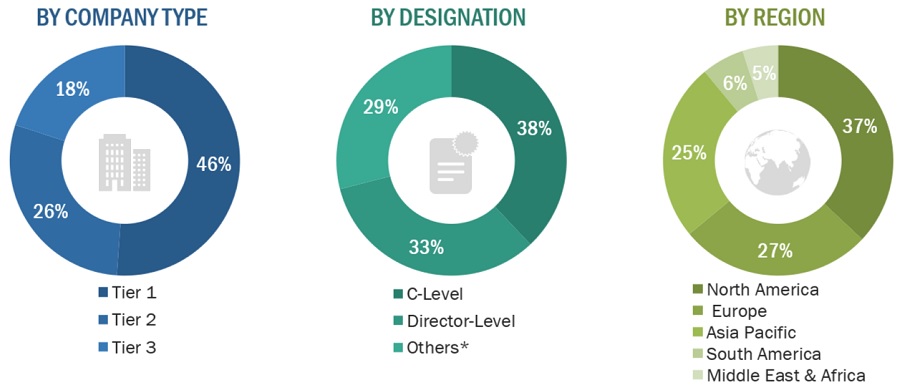

The insulation products market comprises several stakeholders in the supply chain, such as manufacturers, end-users, traders, associations, and regulatory organizations. The development of various end-use industries characterizes the demand side of this market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the insulation products market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the insulation products market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Insulation products Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Insulation products Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The market definition of insulation products refers to The market for insulation products encompasses a wide range of materials and solutions designed to enhance the thermal, acoustic, and moisture control performance of buildings and industrial facilities. These products include but are not limited to fiberglass, mineral wool, foam plastics (such as expanded polystyrene, extruded polystyrene, and polyurethane), cellulose, aerogels, and reflective insulation materials. Insulation products are utilized across various segments of the construction industry, including residential, commercial, and industrial applications, as well as in HVAC (Heating, Ventilation, and Air Conditioning) systems and refrigeration equipment. The market is driven by factors such as energy efficiency regulations, environmental concerns, technological advancements, and the need for improved comfort and indoor air quality. As construction activity continues to rise globally, coupled with growing awareness of energy conservation and sustainability, the demand for insulation products is expected to remain robust, driving market expansion and innovation.

Key Stakeholder

- Manufacturers of insulation products

- Traders, distributors, and suppliers of insulation products

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives:

- To define, describe, and forecast the size of the global insulation products market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the insulation products market.

- To analyze and forecast the size of various segments (material type, insulation type and end-use industry) of the insulation products market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, product launches to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Additional country-level analysis of the insulation products market

Profiling of additional market players (up to 5)

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insulation Products Market