Esoteric Testing Market Size, Share & Trends by Type (Endocrinology, Oncology, Neurology, Genetic Tests, Autoimmune, Infectious Diseases), Technology (ELISA, CLIA, Flow Cytometry, NGS, RT-PCR, Chromatography, Spectrometry), Specimen (Blood, Urine) - Global Forecast to 2029

Esoteric Testing Market Size, Share & Trends

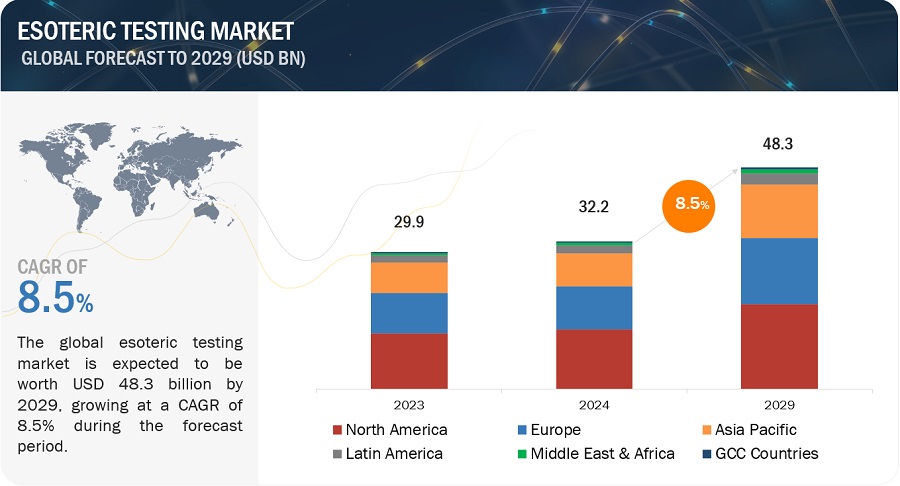

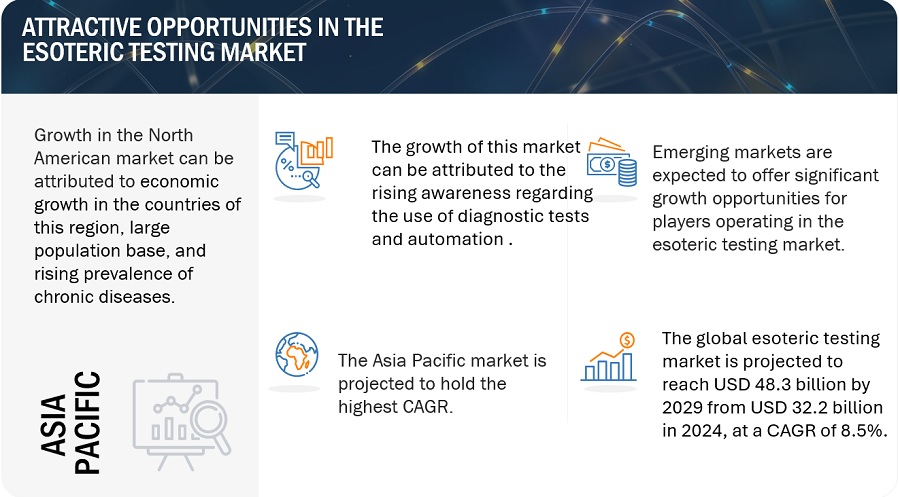

The size of global esoteric testing market in terms of revenue was estimated to be worth $32.2 billion in 2024 and is poised to reach $48.3 billion by 2029, growing at a CAGR of 8.5% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Growth in the market is primarily driven by the growing geriatric population, advancements in esoteric tests for personalized medicine, increasing research funding for precision medicine, and increase in drug and alcohol abuse and stringent laws mandating drug and alcohol testing.

Esoteric Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Esoteric Testing Market Dynamics

DRIVER: Increasing research funding for precision medicine, genetic analysis, and personalized medicine

Several research grants have been awarded for the research of genomics, precision medicine, and personalized medicine. These will support the understanding, diagnosis, and therapy development for rare molecules, helping esoteric testing laboratories to expand their diagnostic offerings.

Technological, diagnostic, and healthcare solution developments are being driven by the growing investments in finance for R&D activities in the market. This initiative has the potential to improve patient outcomes, increase diagnostic accuracy, and address global health issues, thus contributing to market growth in the coming years.

Recently, several organizations, authorities, and governments have deliberated their attention on personalized medicine. For instance, the new European Partnership for Personalised Medicine (EP PerMed), initiated on October 5, 2023, endeavors to enhance future healthcare provision for all individuals by focusing on personalized therapy.

Restraint: High capital investments and low-cost-benefit ratio for biomarkers

The development of esoteric testing methods often leads to the discovery of new biomarkers. Esoteric testing helps researchers and doctors better understand how these biomarkers relate to health and disease. Significant capital investments are required for the discovery, development, and validation of biomarkers. This is a major factor restraining the growth of the biomarkers market and other related markets such as diagnostics (in vitro diagnostics or companion diagnostics) and personalized medicine.

Opportunity: Emerging technologies and advanced tests for screening and risk identification in esoteric testing

The increasing number of research studies on rare molecules has resulted in the development of several new technologies that hold great diagnostic potential for rare molecules. For instance, COLD-PCR helps in the diagnosis of rare mutations with the use of CO-amplification at lower denaturation temperature polymerase chain reaction (COLD-PCR) methods. This helps in the selective denaturation of wild-type-mutant heteroduplexes using the critical temperature, allowing the enrichment of rare mutations. These mutations are then analyzed by using techniques such as digital PCR, NGS, pyrosequencing, or Sanger sequencing

Over the coming years, there will be notable growth in advanced tests for screening and risk assessment, spurred by the trend toward less invasive screening methods and their increasing clinical significance. In the longer term, as understanding deepens regarding the connections between genetic and proteomic markers and diseases, these tests will gain clinical relevance and actionable insights, leading to expanded utilization and positive healthcare outcomes.

Challenge: Inaccuracies and misdiagnosis in diagnostic testing

Inaccuracies and misdiagnoses in esoteric testing can arise from a variety of factors, including inadequate sample extraction and testing, inconsistent or lacking test reporting, and retesting. The most prevalent infectious disorders impacted by diagnostic errors include urinary tract infections (UTIs), pleuro-pulmonary infections, tuberculosis (TB), upper respiratory tract infections (URTIs), and infections of the central nervous system (CNS). There was a considerable impact on clinical outcomes linked with errors related to tuberculosis (TB) and intra-abdominal infections (IAI). In approximately 33% of cases involving errors related to upper respiratory tract infections (URTIs), the incorrect causative pathogen was under consideration.

According to the National Center for Biotechnology Information (NCBI), as of 2023, an estimated USD 50 billion to USD 60 billion is spent annually on unsuccessful cancer trials at the industry level. Improved target validation and more appropriate preclinical models are required to reduce attrition, with greater consideration for decision-making prior to the start of clinical trials.

Esoteric Testing Industry Ecosystem

In 2023, the infectious diseases testing segment accounted for the largest share of the esoteric testing industry, by type

Based on type, the esoteric testing market is segmented into infectious disease testing, autoimmune disease testing, endocrinology testing, oncology testing, genetic testing, toxicology and drug monitoring testing, neurology testing, and other types of testing. The high CAGR of this segment is attributed to the increasing prevalence of infectious diseases such as dengue, hepatitis B & C, malaria, HIV, and tuberculosis.

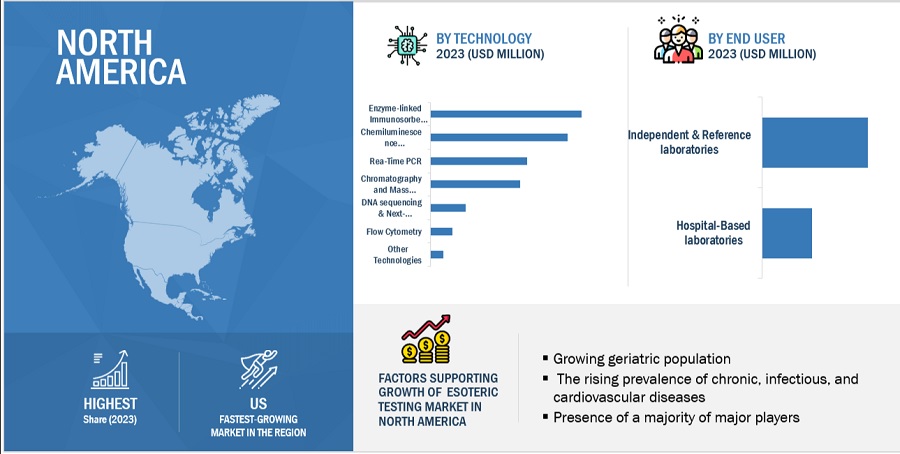

In 2023, the Enzyme-linked Immunosorbent Assay (ELISA) segment accounted for the largest share of the esoteric testing industry, by technology

Based on technology, the esoteric testing market is segmented into chemiluminescence immunoassay (CLIA), enzyme-linked immunosorbent assay (ELISA), real-time PCR, chromatography and mass spectrometry, flow cytometry, DNA sequencing and next-generation sequencing, and other technologies. Enhanced specificity and sensitivity via antigen-antibody reactions, coupled with high efficiency of simultaneous analyses, will drive the growth of this market.

In 2023, the market for Blood, serum and plasma specimens has the largest market share of the esoteric testing industry and is projected to have highest CAGR during the forecast period, by specimen

Based on specimens, the esoteric testing market is segmented into blood, serum, and plasma, urine, and other specimens. Blood is the most widely collected sample for esoteric testing procedures and is preferred for overall health screening as it provides information on various health conditions, such as genetic disorders, cardiovascular diseases, cancer, and diabetes. When used as a specimen in esoteric testing, blood, serum and plasma provides important insights into complex medical disorders, allowing for accurate diagnosis and customized treatment plans. Its importance in furthering medical research and customized treatment is highlighted by its capacity to identify complex biomarkers and genetic fingerprints.

In 2023, North America accounted for the largest share of the esoteric testing industry, followed by Europe, by region

The global esoteric testing market is segmented into six major regions namely, North America, Europe, the Asia Pacific, Middle East & Africa, Latin America, and the GCC Countries. North America accounted for the largest share of the market in 2023. The growth of the North American market is mainly driven by its well-established esoteric laboratories, high per capita healthcare expenditure, and technologically advanced healthcare infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are Labcorp (US), Quest Diagnostics (US), and H.U. Group Holdings (Japan), Sonic Healthcare (Australia), OPKO Health, Inc. (US). These players’ market leadership is due to their comprehensive product portfolios and expansive global footprint. These dominant market players have several advantages, including strong research and development budgets, strong marketing and distribution networks, and well-established brand recognition.

Scope of the Esoteric Testing Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$32.2 billion |

|

Projected Revenue by 2029 |

$48.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.5% |

|

Market Driver |

Increasing research funding for precision medicine, genetic analysis, and personalized medicine |

|

Market Opportunity |

Emerging technologies and advanced tests for screening and risk identification in esoteric testing |

This research report categorizes the esoteric testing market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- GCC Countries

By Type

- Autoimmune Diseases Testing

- Infectious Disease Testing

- Endocrinology Testing

- Genetic Testing

- Toxicology & Drug Monitoring Testing

- Oncology Testing

- Neurology Testing

- Other Types of Testing

By Technology

- Chemiluminescence Immunoassay

- Enzyme-linked Immunosorbent Assay

- Real-time PCR

- DNA Sequencing & Next-generation Sequencing

- Flow Cytometry

- Chromatography & Mass Spectrometry

- Other Technologies

By Specimen

- Blood, Serum, and Plasma

- Urine

- Other Specimens

By End User

- Independent and Reference laboratories

- Hospital-based laboratories

Recent Developments of the Esoteric Testing Industry:

- In April 2024, Labcorp launched glial fibrillary acidic protein (GFAP), a critical blood-based biomarker for the early detection of neurodegenerative diseases and neurological injuries.

- In April 2024, Quest launched a new blood biomarker test for phosphorylated tau 217, or p-tau217. P-tau217 is useful for the early diagnosis of AD.

- In March 2024, Labcorp launched pTau217 test to identify the presence or absence of phosphorylated tau 217 (pTau217), a pivotal blood biomarker designed to aid in the diagnosis of Alzheimer's disease and the subsequent monitoring of patients undergoing treatment with new Alzheimer's disease therapies.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global esoteric testing market?

The global esoteric testing market boasts a total revenue value of $48.3 billion by 2029.

What is the estimated growth rate (CAGR) of the global esoteric testing market?

The global esoteric testing market has an estimated compound annual growth rate (CAGR) of 8.5% and a revenue size in the region of $32.2 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

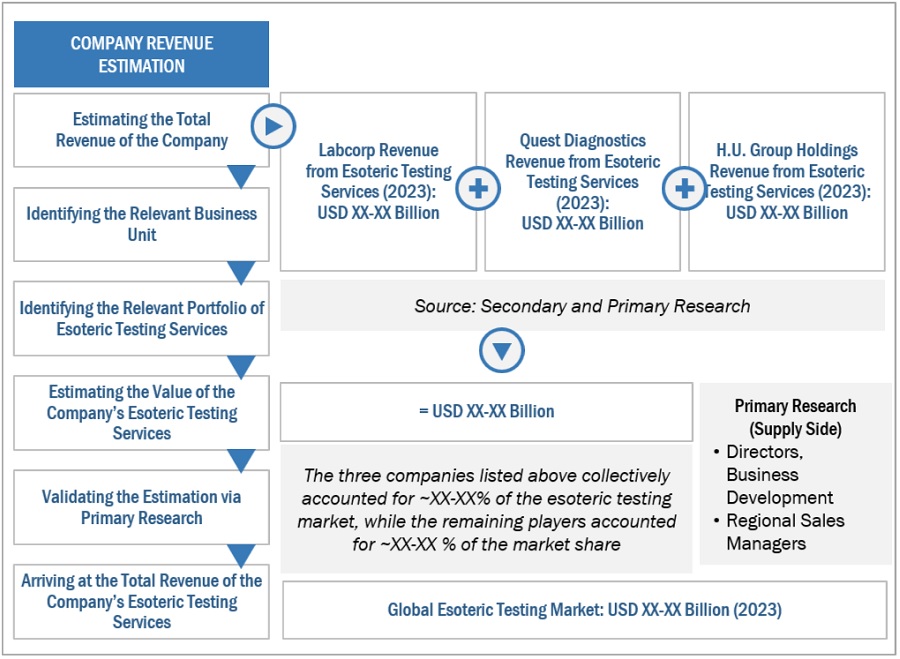

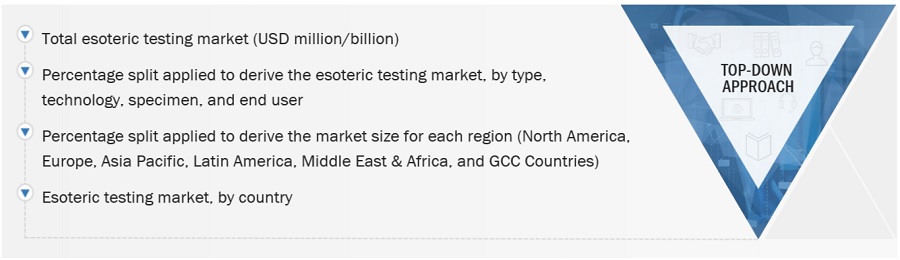

To determine the current size of the esoteric testing market, this study engaged in four main activities. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions, assumptions, and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

The four steps involved in estimating the market size are

Collecting Secondary Data

Within the secondary data collection process, a range of secondary sources were reviewed so as to identify and gather data for this study, including regulatory bodies, databases (like D&B Hoovers, Bloomberg Business, and Factiva), white papers, certified publications, articles by well-known authors, annual reports, press releases, and investor presentations of companies.

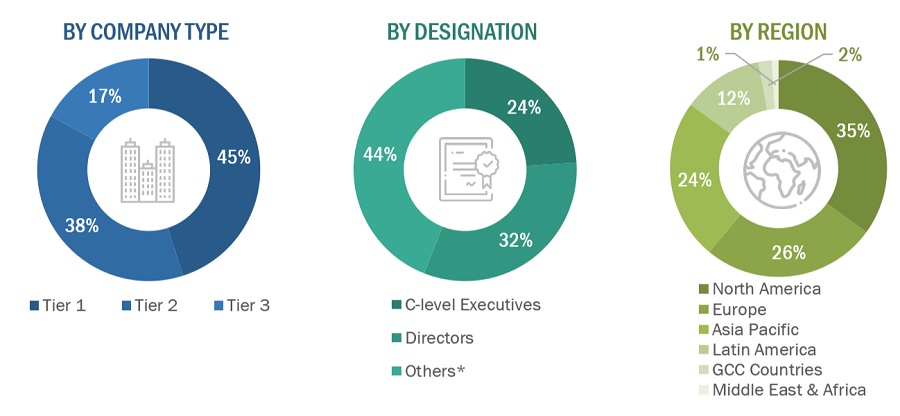

Collecting Primary Data

During the primary research phase, a comprehensive approach was adopted, involving interviews with a diverse array of sources from both the supply and demand sides. These interviews aimed to gather qualitative and quantitative data essential for compiling this report. Primary sources primarily comprised industry experts spanning core and related sectors, as well as favored suppliers, manufacturers, distributors, service providers, technology innovators, and entities associated with all facets of this industry's value chain. In-depth interviews were meticulously conducted with a range of primary respondents, including key industry stakeholders, subject-matter authorities, C-level executives representing pivotal market players, and industry advisors. The objective was to obtain and authenticate critical qualitative and quantitative insights and to evaluate future potentialities comprehensively.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenue. As of 2023, Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

HealthQuest Esoterics |

Strategic Manager |

|

Labcorp |

Advisor |

|

Sonic Healthcare |

Senior Director |

|

OPKO health |

VP Marketing |

Market Size Estimation

All major service providers offering various esoteric services were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value of esoteric testing market was also split into various segments and subsegments at the region and country level based on:

- Services mapping of various service providers for each type in esoteric testing market at the regional and country-level

- Relative adoption pattern of each esoteric testing market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Esoteric Testing Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Esoteric Testing Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Esoteric testing is the diagnosis, detection, or quantitation of rare analytes in a sample. These tests are offered by specialized laboratories equipped with sophisticated diagnostic instruments and reagents, such as reference & independent laboratories and hospital-based laboratories. Many large and medium-sized commercial laboratories, companies, and physician office laboratories outsource these complex tests to reference and independent laboratories. These laboratories are limited in number, and the tests offered are costlier than routine diagnostic tests.

Key Stakeholders

- Manufacturers and Vendors of Esoteric Testing Instruments and Consumables

- Esoteric Testing Laboratories and Service Providers

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostic Associations

- Research Associations Involved in the Research of Infectious and Chronic Diseases

- Various Research and Consulting Firms

- Distributors of Esoteric Instruments and Consumables

- Contract Research Manufacturers of Esoteric Testing Consumables

- Healthcare Institutes

- Research Institutes

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, trends, opportunities, and challenges)

- To define, describe, segment, and forecast the in esoteric testing market by type, by technology, by specimen, by end user, and by region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall esoteric testing market

- To forecast the size of the esoteric testing market in six main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, Middle East & Africa, and GCC Countries.

- To profile key players in the esoteric testing market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as service launches; expansions; acquisitions, and collaborations, of the leading players in the esoteric testing market.

- To benchmark players within the esoteric testing market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the esoteric testing market

Company profiles

- Additional 3 company profiles of players operating in the esoteric testing market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Esoteric Testing Market

What are the Size, Share, industry Growth, Statistics and opportunities in Esoteric Testing Market with forecasts including 2026, 2027, 2028, 2030

How the key players are dominating the global Esoteric Testing Market?

How much percent share does the each region holds of the Global Esoteric Testing Market?