Distribution Automation Market by Offering (Field Devices, Software, Services), Communication Technology (Wired (Fiber Optic, Ethernet, Powerline Carrier, IP), Wireless), Utility (Public Utilities, Private Utilities) and Region - Global Forecast to 2029

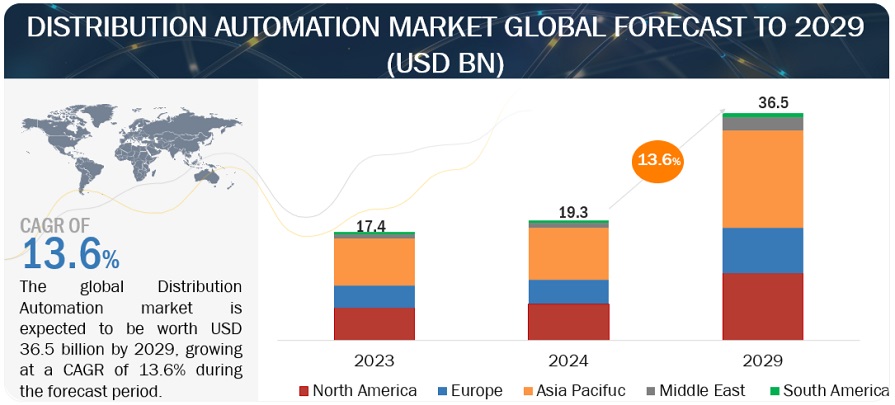

[316 Pages Report] The global distribution automation market is estimated to be valued at USD 19.3 billion in 2024 and is projected to reach USD 36.5 billion by 2029, growing at a CAGR of 13.6% for the forecast period. The factors driving the market include the demand for can be attributed to rising technological advancements particularly in power sector and intensive need for the grid reliability.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Distribution Automation Market Dynamics

Driver: Boost in Smart Grid Infrastructure

Smart Grids, which aim to address issues such as aging infrastructure, increasing energy demands, and the overuse of non-renewable resources like fossil fuels, are an essential technological approach for upgrading traditional power grids. This comprehensive approach involves real-time monitoring systems, decision-making algorithms, control systems, forecasting, and optimized algorithms. Distribution Automation (DA) is a critical component of smart grids, responsible for monitoring, controlling, and managing power distribution grids. DA provides real-time operational information about distribution grid components such as voltage regulators, capacitor bank controllers, fault detectors, and switches. By automating smart grids, operational efficiency is improved, leading to cost savings and increased customer satisfaction. Additionally, environmental impacts are minimized, and system reliability, resilience, flexibility, and stability are maximized. Several major economies have announced significant investments to modernize and digitize their electricity grids.

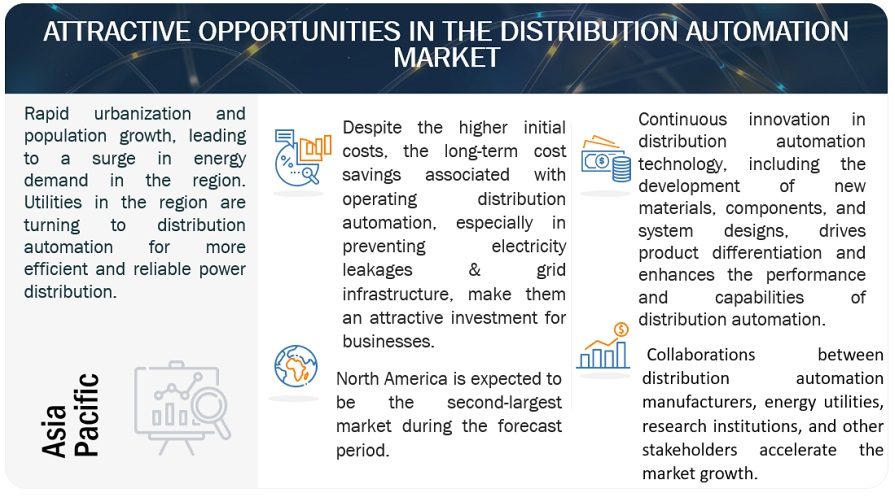

Restraints: High installation costs of distribution automation systems

Restraint in distribution automation stem from the substantial upfront expenses associated with deploying core infrastructure like SCADA systems and communication networks. These investments typically entail significant capital outlays, which may only be recouped once secondary functions begin utilizing these infrastructures. The initial costs encompass acquiring, installing, testing, and commissioning various SCADA-compatible, medium-voltage power equipment, such as line switches, capacitor banks, and voltage regulators. Additionally, integrating new sensors and implementing intelligent controls to manage the operation of these components are part of the expenditure. Substantial enhancements to the electric distribution system infrastructure, like linking existing radial feeders to backup power sources and reconductoring feeders, are necessary to prevent overloads and undervoltage post-feeder reconfiguration.

Opportunities: Technological advancements such as AI & IoT

Advancements in Smart technology, includes AI, IoT, and Autonomous Mobile Robots (AMRs), which offers promising prospects in the Distribution Automation (DA) sector. Leveraging new technologies is crucial for boosting the efficiency and reliability of DA systems. Integrating AI algorithms with IoT sensor data enables smart cities to efficiently analyze vast amounts of information. IoT devices such as sensors, processors, and communication networks empower utilities to collect, automate, and optimize data, improving operational efficiency. AI plays a pivotal role in DA systems, facilitating intelligent verification and monitoring of distribution automation terminals, enhancing safety, reliability, and reducing operational costs. Researchers are exploring various AI-based methods and algorithms for distribution automation terminals. Additionally, the utilization of AMRs in DA systems offers an innovative approach to improving operational efficiency and reliability.

Challenges: Lack of standards and interoperability

The absence of standardized communication protocols in Distribution Automation (DA) systems for electricity distribution poses a significant challenge, impacting operational efficiency, reliability, and interoperability. Without standardized protocols, compatibility issues arise among different vendors and equipment providers, impeding seamless integration and communication between devices and systems. Choosing the appropriate communication infrastructure during the implementation of distribution automation systems is crucial. This infrastructure plays a pivotal role in collecting essential field data necessary for system operation and management. Factors such as data transfer frequency, volume, and criticality must be carefully evaluated when selecting the communication infrastructure. Also, the lack of interoperability in electricity supply's Distribution Automation system poses a significant challenge, impacting the power system's reliability, efficiency, and security. Smart grid integration requires a robust information and communication platform to harmonize "power flow, information flow, and business flow." Without interoperability, connecting devices from diverse manufacturers becomes problematic, and standard open substation automation communication systems are absent, complicating interoperability between devices.

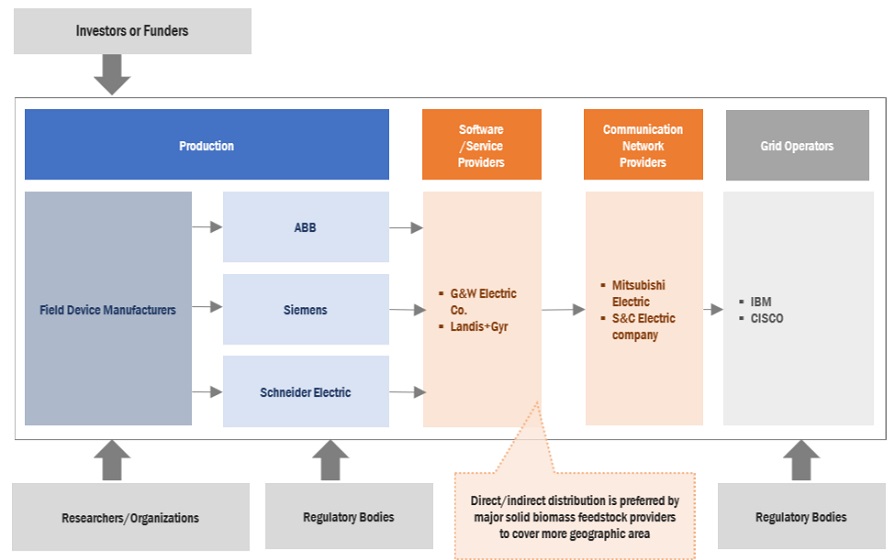

Distribution Automation Market Ecosystem

Prominent businesses in this industry stick out as reputable suppliers of Distribution Automation goods and services that have a solid track record and finances. These seasoned businesses have a wide range of products, state-of-the-art technologies, and strong international networks for sales and marketing. Customers looking for Distribution Automation solutions can rely on them as dependable and trustworthy partners because of their established track record in the field. These businesses are leaders in satisfying the needs of the energy and power industry because they have proven their capacity to adjust to changing market conditions and continuously provide high-quality goods and services. Prominent businesses in this industry stick out as reputable suppliers of Distribution Automation goods and services that have a solid track record and finances. These seasoned businesses have a wide range of products, state-of-the-art technologies, and strong international networks for sales and marketing. Customers looking for Distribution Automation solutions can rely on them as dependable and trustworthy partners because of their established track record in the field. These businesses are leaders in satisfying the needs of the energy and power industry because they have proven their capacity to adjust to changing market conditions and continuously provide high-quality goods and services.Prominent businesses in this industry stick out as reputable suppliers of Distribution Automation goods and services that have a solid track record and finances. These seasoned businesses have a wide range of products, state-of-the-art technologies, and strong international networks for sales and marketing. Customers looking for Distribution Automation solutions can rely on them as dependable and trustworthy partners because of their established track record in the field. These businesses are leaders in satisfying the needs of the energy and power industry because they have proven their capacity to adjust to changing market conditions and continuously provide high-quality goods and services. Prominent companies in this market include include ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and General Electric Company (US)are the market leaders in the Distribution Automation market.

By offering, field devices is estimated to be fastest segment in distribution automation market

The distribution automation market, by offering, is bifurcated into field devices, software and services. The field devices segment is expected to fastest growing in terms of CAGR during the forecast period. Field gadgets are becoming increasingly popular due to their numerous features. The growing demand for real-time data interchange and data-driven decisions is propelling the use of field devices. Field devices, including as smart transformers and voltage regulators, are used to improve power distribution and eliminate waste. In addition, they are utilized to improve grid resilience and shorten power outages.

By communication technology, wired is expected to be largest market during forecast period

Wired and wireless are the two segments of the distribution automation industry based on communication technology. The market for wired is expanding because of its greater efficiency and ease of use. The transfer of data using a wire-based communication system is referred to as wired communication. It mainly includes fiber optic, Ethernet, powerline carriers, and IP. Fiber optic and Ethernet are the most preferred medium for networking in distribution automation. Fiber optics offer higher bandwidth support and speed, which helps in providing high performance, reliability, and improved coverage. Moreover, fiber-optic communication is widely used in substations as it can operate at high voltages.

Asia Pacific is expected to be the largest market during the forecast period.

Asia Pacific is the largest and second fastest-growing region in the distribution automation market during the forecast period. The market in this region has been further segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific There is a high electricity demand in Asia Pacific, which is also the most populated region in the world. Countries such as China, Japan, and South Korea are continuously investing in grid expansion projects to increase the reliability and resilience of distribution grids, which is likely to drive the demand for distribution automation solutions and related services in the coming years. Besides, the smart grid market in the Asia Pacific region is expected to grow substantially in the coming years. Asia Pacific is also moving toward clean energy on a large scale to meet the growing energy needs of the region.

Key Market Players

The major players in the global distribution automation market are include ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and General Electric Company (US). These authentication and brand protection companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the authentication and brand protection market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

|

Market Size available for years |

2019–2029 |

|

|

Base year considered |

2023 |

|

|

Forecast period |

2024–2029 |

|

|

Forecast units |

Value (USD Million/Billion) |

|

|

Segments covered |

By Offering, By Communication Technology, and By Utility |

|

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

|

Companies covered |

|

This research report categorizes the Distribution automation market based on offering, communication technology, utility, and region.

On the basis of offering:

-

Field Devices

- Remote Fault Indicators

- Smart Relays

- Automated Feeder Switches/Reclosers

- Automated Capacitors

- Automated Voltage Regulators

- Transformer Monitors

- Feeder Monitors

- Remote Terminal Unit

- Software

- Services

On the basis of communication technology:

-

Wired

- Fiber Optic

- Ethernet

- Powerline Carrier

- IP

-

Wireless

- Radio Frequency Mesh

- Cellular Network

- WiMAX

On the basis of utility:

- Public Utilities

- Private Utilities

On the basis of region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In March 2024, Itron Inc. has completed the acquisition of Elpis Squared for USD 35 million. This acquisition equips Itron with the capability to integrate real-time, high-resolution "grid edge" data into the power grid planning, operations, and engineering processes, marking a pioneering advancement for the industry. The grid edge represents the intersection where smart or connected infrastructure intersects with the electric power grid, as defined by the energy-efficiency advocacy group Alliance to Save Energy.

- In March 2024, Hitachi, Ltd. announced an investment exceeding USD 32 million in the expansion and modernization of its power transformer manufacturing plant in Bad Honnef, Germany. Scheduled for completion by 2026, the project is anticipated to create up to 100 new positions in the area and cater to the increasing need for transformers to facilitate Europe's transition to clean energy. This investment entails expanding the facility to more than 15,000 square meters. Alongside process improvements, the upgraded plant aims to enhance operational efficiency and elevate overall manufacturing capacity to meet escalating demands. The expansion of this facility mirrors Hitachi Energy's broader initiative to scale up its presence in Europe.

- In March 2023, S&C Electric Company has revealed its plans to enlarge its manufacturing presence in the United States with a new 275,000-square-foot facility situated in Palatine, Illinois. Located approximately 25 miles away from S&C's existing 47-acre manufacturing campus in Rogers Park, Chicago, this expansion underscores our dedication to U.S. manufacturing and the Chicagoland region. It enables us to enhance our support for customers by providing solutions that drive forward a robust and smart electrical grid.

- In March 2023, TOSHIBA CORPORATION has invested in Open Utility Ltd., a startup headquartered in the UK that specializes in offering a platform for the flexible trading of distributed energy resources (DER). This strategic investment, along with efforts to bolster ties with Piclo, aims to enhance Toshiba ESS's insight into the present landscape of related industries and the institutional frameworks in Europe and the United States, leveraging Piclo's business operations and ecosystem. Additionally, the company intends to craft services tailored for DER flexibility markets anticipated to emerge in the future.

- In March, 2022 ABB has opened a R&D and engineering facility, ABB Innovation Center (AIC) in Bengaluru, India. The AIC facility focusses on the development of ABB digital solutions and on the electrification and motion business segments of the company. Additionally, the facility provides engineering and support services for process automation business globally.

Frequently Asked Questions (FAQ):

What is the current size of the distribution automation market?

The current market size of the global distribution automation market is USD 17.4 billion in 2023.

What are the major drivers for the distribution automation market?

Governmental initiatives to provide last mile connectivity of electricity will boost the distribution automation market

Which is the fastest-growing region during the forecasted period in the distribution automation market?

The Middle East & Africa distribution automation market is estimated to be the fastest-growing region, during the forecast period.

Which is the fastest-growing segment, by utility during the forecasted period in the distribution automation market?

The private utilities segment is estimated to be the fastest-growing segment, by utility.

What can be restraints for the distribution automation market to grow?

High initial investment cost that is required for installation of infrastructure is one of the key restraint for the market to grow. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

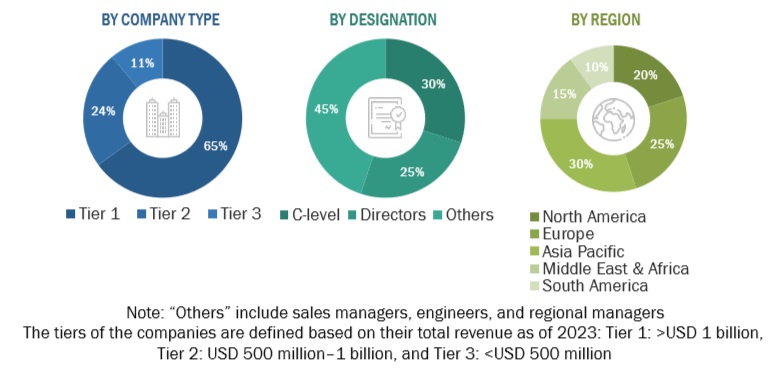

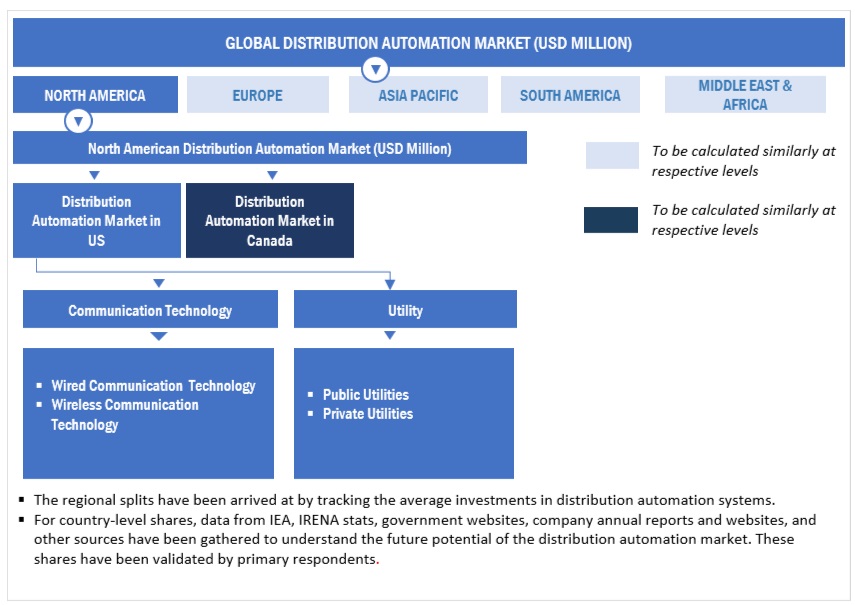

This study involved major activities in estimating the current size of the distribution automation market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was the validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, IEA and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Distribution automation market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The Distribution automation market comprises several stakeholders, such as project developers, exchanges, traders/brokers and auction platforms, and end users/carbon emitters in the supply chain. The demand-side of this market is characterized by end-users. Moreover, the demand is also fueled by the growing demand of industrial and utilities. The supply side is characterized by rising demand for contracts from the industrial sector and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

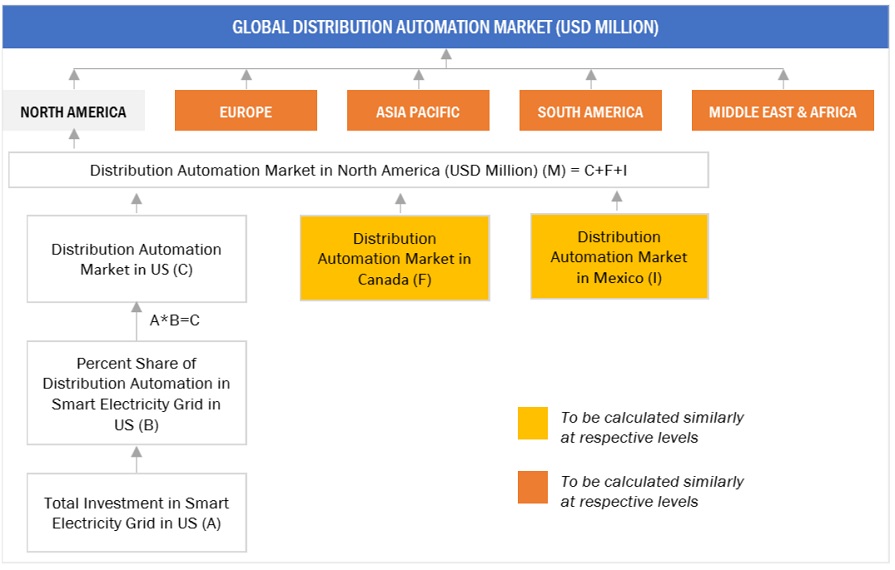

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the solid biomass feedstock market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Distribution automation Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Distribution Automation Market Size: Bottom-Up Approach

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by the splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the distribution automation market ecosystem.

Market Definition

Distribution automation is a key component of modern grid infrastructure as it enables the real-time monitoring and control of distribution assets to maximize grid efficiency and reliability. It uses digital sensors and switches with advanced control and communication technologies to automate feeder switching, voltage monitoring and control, outage management, reactive power management, preventative equipment maintenance for critical substation equipment, and grid integration of distributed energy resources. This helps utilities in collecting and analyzing data to improve the operational efficiency of power distribution systems.

The distribution automation market refers to the year-on-year investments in distribution automation across the five main regions, namely, North America, South America, Europe, Asia Pacific, and Middle East & Africa.

Key stakeholders

- Field device manufacturers

- Public and private electric utilities

- Distribution companies (DISCOMS)

- Energy & power sector consulting companies

- Government & research organizations

- Independent power producers

- Investment banks

- Electrical equipment associations

- Network and communication service providers

- Support and maintenance service providers

- Smart grid players

Objectives of the Study

- To describe and forecast the distribution automation market based on offering, communication technology, utility and region in terms of value

- To describe and forecast the market for five key regions: Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, along with their country-level market sizes in terms of value

- To forecast the distribution automation market by offering and region, in terms of volume

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, ecosystem analysis, tariffs and regulations, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s five forces analysis, key stakeholders and buying criteria, and regulatory analysis of the distribution automation market

- To analyze opportunities for stakeholders in the distribution automation and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the distribution automation market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Distribution Automation Market