Biostimulants Market Report by Active Ingredients (Humic Substances, Seaweed Extracts, Amino Acids, Microbial Amendments, Minerals & Vitamins), Crop Type, Mode of Application, Form (Dry, Liquid) and Region - Global Forecast to 2029

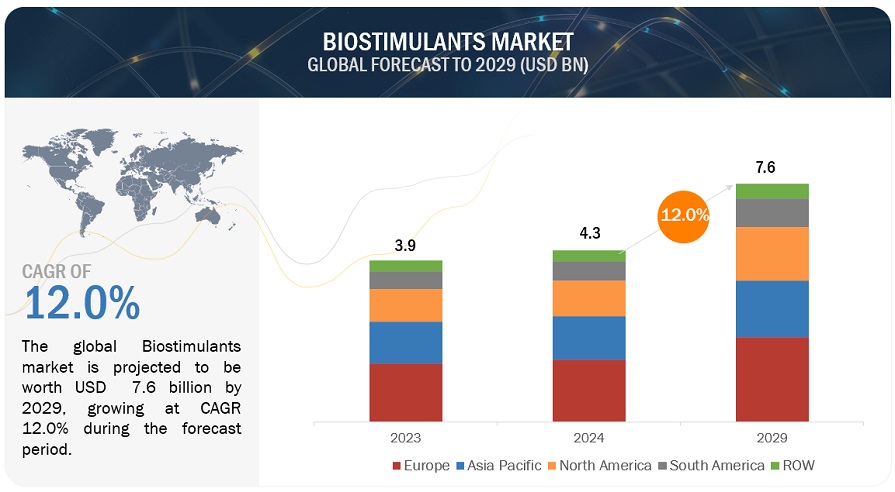

[340 Pages Report] According to MarketsandMarkets, the biostimulants market is projected to reach USD 7.6 billion by 2029 from USD 4.3 billion by 2024, at a CAGR of 12.0% during the forecast period in terms of value. Biostimulants contain substances that stimulate plant growth, enhance nutrient uptake, and improve stress tolerance, leading to higher crop yields and improved quality. Farmers are increasingly adopting biostimulants to maximize their crop productivity and profitability. Many biostimulants are derived from natural sources and are compatible with organic farming practices. They offer organic growers effective tools to enhance crop productivity and resilience while adhering to organic certification standards.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rise in demand for sustainable agricultural practices

One major driver fueling the growth of the biostimulants market is the increasing demand for sustainable agricultural practices. As awareness of environmental issues grows and consumers demand more eco-friendly products, there is a rising interest in agricultural solutions that minimize chemical inputs, reduce environmental impact, and promote long-term sustainability. Biostimulants, with their ability to enhance crop productivity while minimizing the use of synthetic fertilizers and pesticides, align well with this trend towards sustainable agriculture. As a result, the market for biostimulants is experiencing significant growth as farmers seek out solutions that support both environmental stewardship and economic viability.

Restraint: Lack of regulations

One restraint of the biostimulants market is the lack of standardized regulations and definitions. Unlike conventional agricultural inputs such as fertilizers and pesticides, biostimulants often encompass a diverse range of products with varying compositions and modes of action. This lack of uniformity makes it challenging for regulators to establish clear guidelines for product registration, labeling, and usage. Additionally, the absence of standardized definitions can lead to confusion among farmers, retailers, and consumers regarding the efficacy and appropriate application of biostimulant products. Consequently, regulatory uncertainty and ambiguity may hinder market growth by creating barriers to market entry, limiting investment, and undermining consumer confidence in biostimulant technologies.

Opportunity : Increase adoption of precision agriculture.

One opportunity in the biostimulants market is the increasing adoption of precision agriculture technologies. Precision agriculture utilizes data-driven approaches such as remote sensing, GPS guidance systems, and data analytics to optimize crop management practices and resource use efficiency. Biostimulants can complement precision agriculture techniques by providing targeted solutions to specific agronomic challenges identified through precision farming data analysis.

Challenge: Variability of product efficacy

Biostimulant effectiveness can be influenced by various factors such as product formulation, application timing, environmental conditions, and crop genetics. Due to this variability, farmers may experience inconsistent results when using biostimulant products, leading to uncertainty about their economic and agronomic benefits. Additionally, the lack of standardized testing protocols and performance metrics makes it difficult for farmers to evaluate and compare different biostimulant products accurately.

Biostimulants Market Ecosystem

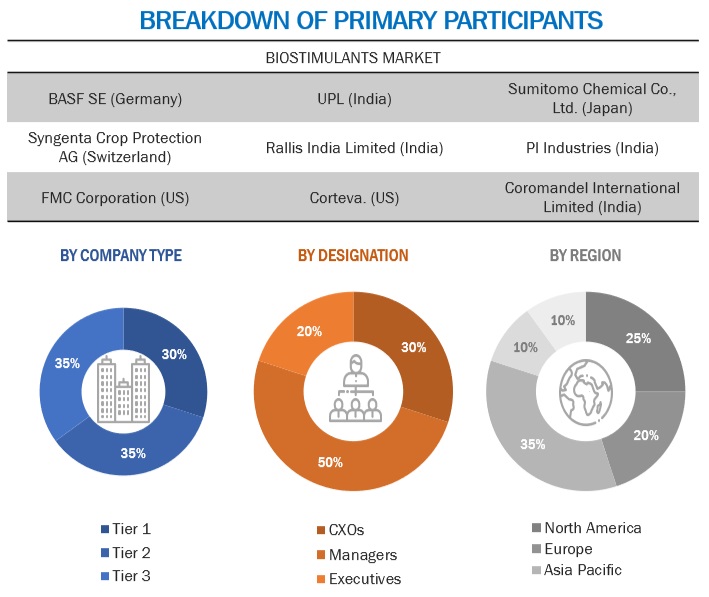

Key players within this market consist of reputable and financially robust biostimulants manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, advanced technologies, and robust global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), UPL (India), FMC Corporation (US), Rallies India Limited (India), Sumitomo Chemical Co., Ltd. (Japan), Corteva. (US), Nufarm (Australia), Syngenta Crop Protection AG (Switzerland), PI Industries (India), ILSA S.p.A. (Italy), Coromandel International Limited (India), Haifa Group (Isarel), T.Stanes and Company Limited (India), Gowan Company (US), and Koppert (The Netherlands).

In crop type segment, oilseeds & pulses to grow at consistent rate in the global biostimulants market.

The consumption of oilseeds and pulses as dietary staples is on the rise in developing nations where they are abundantly cultivated, and they are increasingly valued as cash crops for industrial use. Grains, pulses, and oilseeds are significant commodities with extensive cultivation and trade in Europe, which serves as a mature and diverse market for these products. Notably, Europe is home to three of the world's top 10 importing countries for grains (Italy, the Netherlands, and Germany), pulses (Italy, Germany, and Spain), and oilseeds (the Netherlands. While major global markets like the USA have considerable domestic production, leading to lower import volumes, Europe remains one of the largest importing regions globally. However, primary importing regions are located outside Europe, particularly in East Asia for grains and oilseeds, and Southeast Asia for pulses. According to USComtrade 2023 data, Europe accounts for approximately 22% of global grains imports, 42% of oilseeds imports, and 19% of the global pulses trade. Notably, around 70% of the oilseeds imported by Europe are locally sourced within the continent. A variety of biostimulants can be utilized in cereal and oilseed rape (OSR) crops. These biostimulants aid in the absorption of nutrients, enhance plant tolerance to and recovery from non–living environmental stress, improve plant metabolism efficiency, elevate produce quality, optimize the effectiveness of other agricultural inputs.

By mode of application, the soil treatment segment is expected to hold a significant market share in the biostimulants market.

Soil treatment with humic substances extracted from different sources has been extensively shown to enhance the iron nutrition of crop plants. The presence of humified organic matter in soil sediments further contributes to building up a reservoir of iron for plants by releasing metal ligands and forming Fe-humic substance complexes that can be readily utilized by plants for iron uptake. Enzymatic hydrolysis has emerged as a recent method to produce various biostimulants, including those derived from sewage sludge, chicken feathers, okra, and rice bran. These biostimulants are applied in soil bioremediation to address contamination by various pesticides such as chlorpyrifos, MCPA, oxyfluorfen, 2,4-D, and dicamba. Overall, soil treatment with biostimulants offers numerous benefits, including enhanced iron nutrition for crops and remediation of pesticide-contaminated soils.

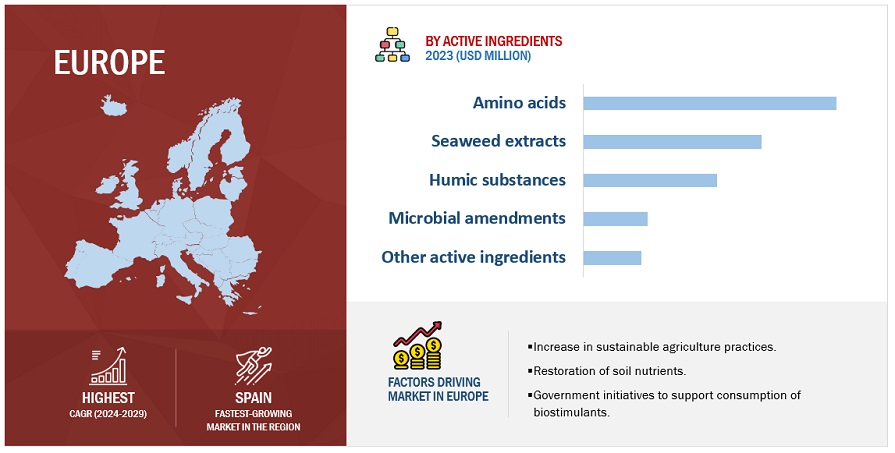

In active ingredients segment, amino acids hold the significant share in the biostimulants market.

Amino acids, vital components in plant growth and development, hold a significant share in the biostimulants market for several reasons. Their effectiveness in enhancing plant growth, yield, and stress tolerance through roles in protein synthesis and nutrient uptake make them indispensable to modern agriculture. Moreover, their compatibility with various farming practices, from foliar sprays to soil applications, offers farmers flexibility in application methods. Recognized as environmentally friendly, derived from natural sources, amino acids promote sustainable agricultural practices and reduce reliance on synthetic chemicals.

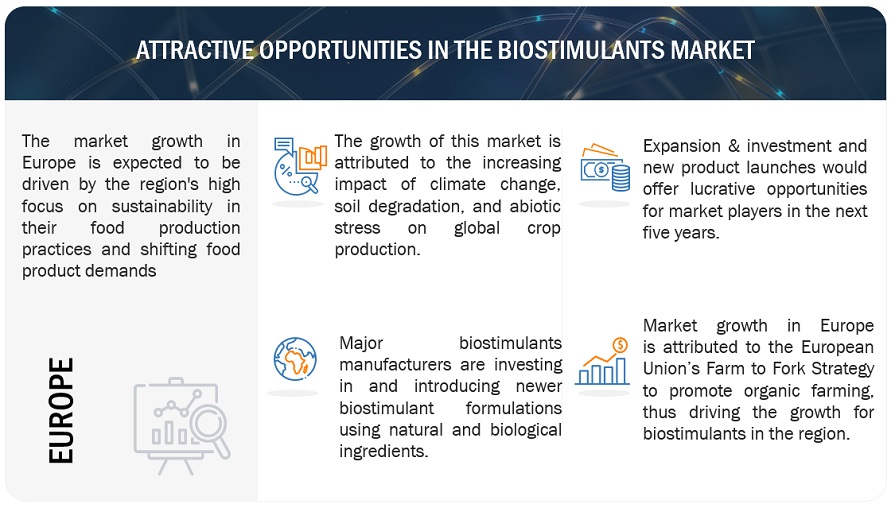

Europe to dominate the biostimumlants market during the forecast period.

European farmers and policymakers increasingly prioritize sustainable agricultural practices to address environmental concerns, reduce chemical inputs, and enhance food security. Biostimulants align well with these goals as they offer solutions to improve soil health, crop resilience, and yield sustainability. European consumers are increasingly demanding environmentally friendly and sustainably produced food products. This consumer trend translates into a growing market demand for biostimulant-treated crops, prompting farmers to integrate biostimulants into their agricultural practices.

Key Market Players

The key players in this market include BASF SE (Germany), UPL (India), FMC Corporation (US), Rallies India Limited (India), Sumitomo Chemical Co., Ltd. (Japan), Corteva. (US), Nufarm (Australia), Syngenta Crop Protection AG (Switzerland), PI Industries (India), ILSA S.p.A. (Italy), Coromandel International Limited (India), Haifa Group (Israel), T.Stanes and Company Limited (India), Gowan Company (US), and Koppert (The Netherlands). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

By Active Ingredients, Crop Type, Mode of Application, Formulation, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the biostimulants market based on active ingredients, crop type, mode of application, formulation, and region.

Target Audience

- Biostimulants traders, retailers, and distributors

- Biostimulants manufacturers & suppliers

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to biostimulants and biostimulants companies.

- Associations and industry bodies.

Biostimulants Market:

By Active Ingredients

- Humic Substances

- Seaweed Extracts

- Amino Acids

- Microbial Amendments

- Minerals & Vitamins

- Other Active Ingredients

By Crop Type

- Cerals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Other Crop Types

By Mode of Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

By Formulation

- Dry

- Liquid

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In March 2023, Sumitomo Chemical India Ltd. (India) introduced Promalin, its highly anticipated Biorational product, in Shimla, Himachal Pradesh. Developed through extensive research by Valent Biosciences, based in Illinois, USA, a subsidiary of Sumitomo Chemical Co., Ltd. (Japan). Promalin is renowned for its advanced Biorational solutions. This marks the first launch of Promalin in India by Sumitomo Chemical India Ltd. The product comprises two key ingredients: a blend of two natural gibberellins commonly found in plants, namely Gibberellins 4 and Gibberellins 7, and a naturally occurring cytokinin compound, 6-Benzyladenine.

- In August 2022, BASF Venture Capital GmbH and Aqua-Spark invested in Sead Energy Pvt. Ltd. during a Series B funding round, totaling INR 1402 million (approximately USD 18.5 million). Sead Energy specializes in producing biostimulants for agriculture using red seaweed, a sustainable raw material mainly found in tropical waters in Asia. Their integrated model includes cultivation technology suited for deep waters and adverse weather conditions, aided by satellite imagery to optimize seaweed farm locations. With operations in Bali, Indonesia, for commercial seaweed farming and processing plants in Tuticorin, India, Sead Energy leads in tropical red seaweed production and processing. BASF's investment diversifies its biostimulants portfolio and strengthens its position in the emerging market for seaweed-derived products.

- In June 2022, FMC Corporation's launch of the "Biologicals by FMC" brand underscores its commitment to the expanding field of biological crop protection, reflecting significant investment and a robust pipeline of innovative products. With over 50 biological offerings across 50 countries, including award-winning biostimulants and bionematicides, FMC aims to provide farmers with science-backed solutions for sustainable crop management. The introduction of Zironar biofungicide/bionematicide in the US and Provilar biofungicide in Brazil this year, along with plans for four global biopesticide launches in the next four years, positions FMC as a key player in the biostimulants market, reinforcing its commitment to addressing agricultural challenges with innovative biological technologies.

Frequently Asked Questions (FAQ):

Which are the major companies in the biostimulants market? What are their major strategies to strengthen their market presence?

The key players in this include BASF SE (Germany), UPL (India), FMC Corporation (US), Rallies India Limited (India), Sumitomo Chemical Co., Ltd. (Japan), Corteva. (US), Nufarm (Australia), Syngenta Crop Protection AG (Switzerland), PI Industries (India), ILSA S.p.A. (Italy), Coromandel International Limited (India), Haifa Group (Israel), T.Stanes and Company Limited (India), Gowan Company (US), and Koppert (The Netherlands). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the biostimulants market?

Ongoing advancements in biotechnology and agricultural research are expanding the understanding of plant-microbe interactions and the mechanisms of biostimulants. This knowledge is leading to the development of more effective and targeted biostimulant products, driving market growth. The integration of biostimulants with precision agriculture technologies presents a promising opportunity. By leveraging data analytics, sensors, and digital farming tools, farmers can optimize the application of biostimulants, improving their efficacy and maximizing their impact on crop productivity and sustainability.

Which region is expected to hold the highest market share?

The European region has the highest consumption of biostimulants due to several factors. Firstly, Europe boasts a well-developed agricultural sector with a significant focus on specialty crops like fruits and vegetables. These high-value crops benefit greatly from the yield improvements and stress tolerance biostimulants offer. European countries are at the forefront of biostimulant research and development. This translates to a wider variety of effective biostimulant products catering to specific needs, attracting more farmers to the market. The EU has established clear regulations for organic farming, encouraging the use of eco-friendly solutions like biostimulants. This focus on sustainability positions biostimulants favorably compared to traditional chemical fertilizers.

What are the key technology trends prevailing in the biostimulants market?

One emerging technology trend prevailing in the biostimulants market is Nanotechnology. Nanotechnology plays a pivotal role in the biostimulants industry, offering innovative approaches to enhance plant growth, improve nutrient uptake, and mitigate stressors. Nano-sized delivery systems enable targeted delivery and controlled release of biostimulant compounds, enhancing their efficacy and bioavailability. These nanoparticles can efficiently penetrate plant tissues, reaching target sites within plants to exert their effects more effectively. Moreover, nanotechnology facilitates the development of smart biostimulant formulations tailored to specific crop requirements and environmental conditions. By incorporating nanomaterials, biostimulants can be optimized for improved soil health, nutrient cycling, and stress mitigation. Thus, nanotechnology represents a promising avenue for advancing biostimulant development and application in sustainable agriculture.

What is the total CAGR expected to be recorded for the biostimulants market during 2024-2029?

The CAGR is expected to record as of 12.0% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

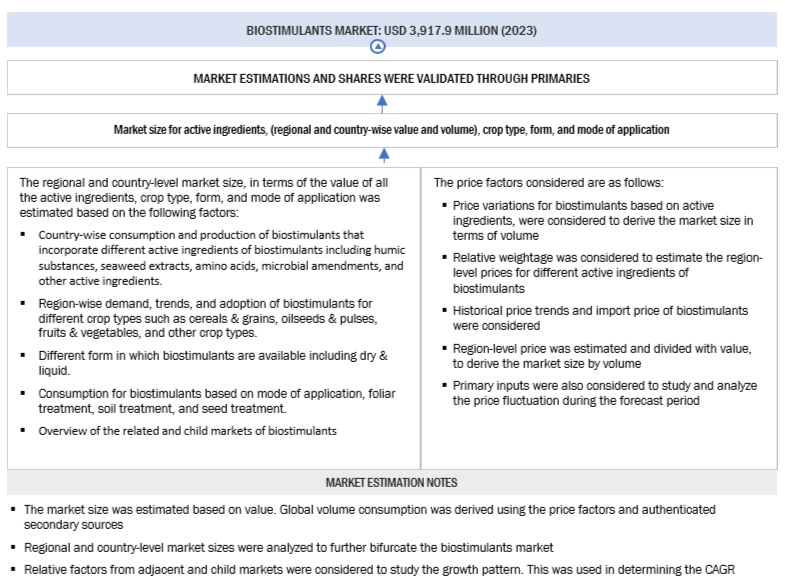

The study involved four major activities in estimating the current size of the biostimulants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biostimulants market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biostimulants market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the biostimulants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to active ingredients, crop type, mode of application, formulation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biostimulants market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the biostimulants market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Biostimulants Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biostimulants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall biostimulants market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the European Biostimulants Industry Council (EBIC), “Plant biostimulants contain substance(s) and/or microorganisms whose function, when applied to plants or the rhizosphere, is to stimulate natural processes to enhance/benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, and crop quality.”

The definition of biostimulants is largely imprecise. In many instances, an ambiguity exists between biostimulants and biofertilizers. Though organizations such as EBIC have proposed definitions, they are yet to be considered by government regulatory bodies, such as the European Union (EU) and the US Department of Agriculture (USDA).

Key Stakeholders

- Manufacturers, importers, exporters, traders, distributors, and suppliers of biostimulants

- Biostimulant laboratories and associations:

- Biostimulants Council

- The Fertilizer Institute

- Biostimulants raw material suppliers and ingredients, intermediate and end-product manufacturers, and processors

- Government, research organizations, and academic institutions

- World Health Organization (WHO)

- Codex Alimentarius Commission (CAC)

- Regulatory bodies

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Biopesticide Industry Alliance (BPIA)

- International Biocontrol Manufacturers Association (IBMA)

- Japan Biocontrol Association

- US Environmental Protection Agency (US EPA)

- Commercial Research & Development (R&D) institutions and financial institutions

- Regulatory bodies, including government agencies, NGOs, and large farms

Report Objectives

Market Intelligence

- Determining and projecting the size of the biostimulants market with respect to active ingredients, crop type, mode of application, formulation, and region.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework and market entry process related to the biostimulants market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the biostimulants market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the country

- Providing insights on key product innovations and investments in the biostimulants market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Norway, Belgium, Sweden and Denamrk.

- Further breakdown of the Rest of Asia Pacific into Philippines, Thailand, South Korea, and Vietnam.

- Further breakdown of the Rest of South America into Chile, Colombia, and Uruguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biostimulants Market