Electric 3 wheeler Market by End Use (Passenger Carriers, Load Carriers), Range (Less than 50 miles, above 50 miles), Battery Type (Lead Acid, Lithium-ion), Battery Capacity, Motor Type, Motor Power, Payload Capacity and Region – Global Forecast to 2030

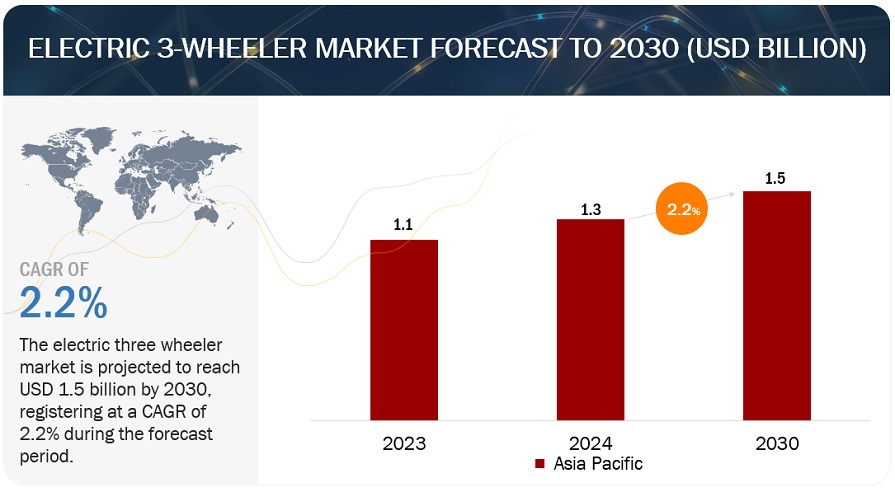

[326 Pages Report] The electric 3 wheeler market is projected to grow from USD 1.3 billion in 2024 to USD 1.5 billion by 2030, registering a CAGR of 2.2%. Increasing environmental concerns and a push for sustainability are prompting consumers and businesses to shift towards electric vehicles. Government regulations and incentives are further accelerating this transition. Additionally, the need for efficient last-mile delivery solutions in urban areas, coupled with advancements in battery technology and declining costs, is fueling demand for electric 3 wheelers. These factors combined are propelling the electric 3 wheeler market forward.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Advancements in battery technology coupled with reducing battery prices

The electric 3 wheeler market predominantly relies on lithium-ion or lead-acid batteries, with lithium batteries showing superior performance in adverse weather. The demand for lithium-ion batteries, particularly variants like Lithium Iron Phosphate (LFP) and Lithium Manganese Oxide (LMO), is projected to rise with the increasing adoption of electric 3 wheelers. Research into battery chemistry, including advanced options like intermetallic anodes and lithium metal, aims to enhance battery efficiency and overcome range limitations. Governments in countries like India, China, and Thailand are incentivizing battery production to promote electric vehicle adoption, including tax benefits and production-linked incentives. Significant price reductions in lithium-ion battery packs have been recorded, with further declines expected as manufacturers like CATL and BYD target substantial cost reductions by 2024, potentially making electric vehicles cost-competitive with internal combustion engine vehicles. Future advancements, such as solid-state batteries, hold promise for further price reductions in the coming years.

Restraint: Limited power output, range, and speed

The electric 3 wheeler market is in its early stages, with vehicles yet to match conventional standards in mileage and power. Recent launches have struggled to meet user expectations for power output, often due to limited torque and battery capacity. Top speeds are restricted, hindering industry growth. Range remains a concern, typically falling short of conventional vehicles, dissuading long-distance travelers. Manufacturers are addressing these issues with conceptual models aimed at meeting performance and design standards, signaling potential improvements in the future.

Opportunity: Partnership with delivery and logistics fleet operators

The shift to electric 3 wheelers is driven by fleet operators seeking eco-friendly solutions and cost savings. OEMs benefit from bulk sales opportunities by catering to specific fleet requirements, like payload capacities and range options. Collaborating with fleet operators fosters long-term relationships, recurring revenue, and market leadership. Partnerships also yield valuable feedback for product enhancement, ensuring electric 3 wheelers evolve with market needs. Some OEMs are already expanding through such partnerships, poised for sustained electric 3 wheeler market growth.

Challenge: High initial investments than ICE variants

Electric 3 wheelers entail lower long-term operating costs compared to their internal combustion engine (ICE) counterparts. Their initial investments exceed those required for conventional 3 wheelers. This stems from the higher costs associated with components like batteries, motors, and other electrical elements, which are pricier than traditional mechanical parts. The battery alone constitutes 40-50% of the overall production cost of electric 3 wheelers. Presently, most manufacturers provide electric 3 wheelers along with charging infrastructure, elevating the initial financial outlay for prospective buyers. The substantial expenses involved in the development of electric 3 wheelers and associated components, such as batteries and monitoring systems, pose a significant barrier to their widespread adoption. Further, electric 3 wheelers necessitate frequent and rapid charging facilitated by specialized equipment available only at EV charging stations. The cumulative costs of the battery, charger, and installation contribute to the higher price tag of electric 3 wheelers compared to conventional ICE vehicles. Additionally, the expense of electricity presents a challenge in certain jurisdictions, with costs escalating over time, potentially impeding the electric 3 wheeler market.

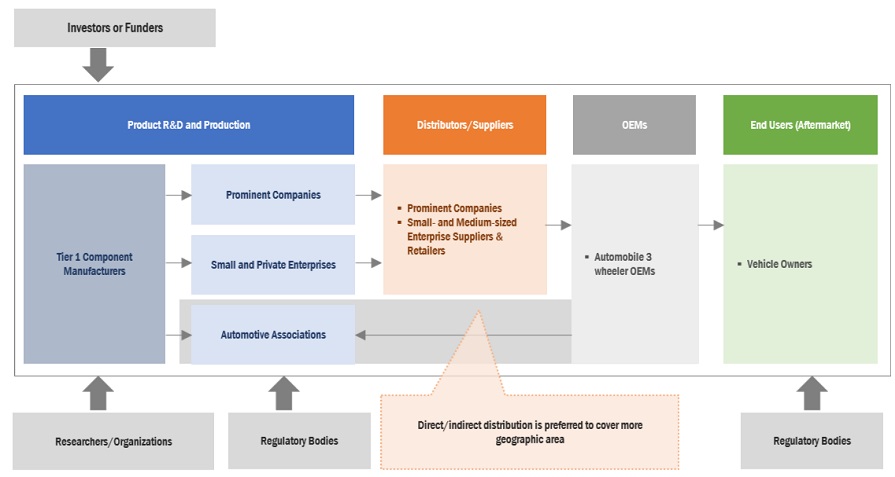

Market Ecosystem

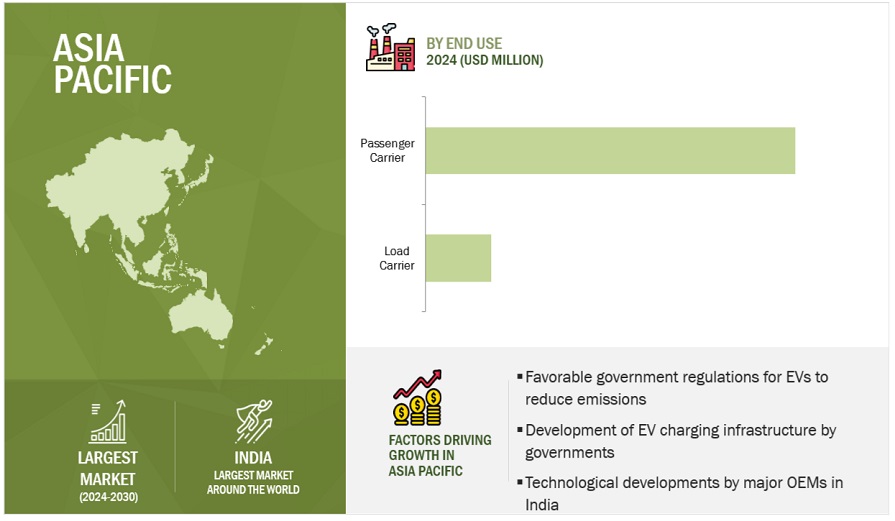

Passenger carriers to be the largest segment during the forecast period.

Passenger carriers to be the largest segment during the forecast period. Passenger carriers are electric 3 wheelers primarily designed for transporting passengers, accommodating seating capacities of up to four individuals, inclusive of the driver. Prominent models available in the market include the Mahindra Treo, Atul Elite Cargo, Comfort Plus, and Standard Deluxe. Various OEMs have engaged in the development of electric 3 wheeler passenger carriers, forging strategic partnerships to introduce advanced models to the market. In urban ares, electric 3 wheelers emerge as the optimal choice for passenger transit, offering a cost-efficient, environmentally friendly, and convenient mode of transportation. In comparison to conventional ICE counterparts, electric 3 wheelers have lower overall ownership costs, thereby saving users expenses associated with fuel and maintenance. Moreover, they are often quieter than gasoline-powered vehicles, rendering them particularly suitable for tranquil city environments. This trend is expected to propel growth within the passenger carrier segment over the forecast period.

Lithium-ion battery to be the largest segment during the forecast period.

The lithium-ion battery segment will lead the market during the forecast period. These batteries are available in diverse configurations, incorporating temperature sensors, voltage converters, and battery charge state monitors. The utilization of Li-ion batteries can enhance payload capacities and extend the range of 3 wheelers compared to lead-acid counterparts. Despite their elevated cost, Li-ion batteries offer an extended travel range per charge, making them a potentially preferable option for e-rickshaws necessitating extensive operational distances. The electric 3 wheeler industry increasingly gravitates toward Li-ion batteries owing to their notable attributes, including high energy density, rapid charging capabilities, prolonged lifespan, and diminished maintenance requirements. While initial investment concerns persist, advancements in manufacturing methodologies are expected to alleviate this challenge by driving cost reductions. Further, Government initiatives such as the FAME II Incentive and heightened import tariffs are expected to stimulate domestic manufacturing of lithium-ion batteries, consequently reducing overall electric 3 wheeler costs and solidifying their superiority over lead-acid batteries in the marketplace.

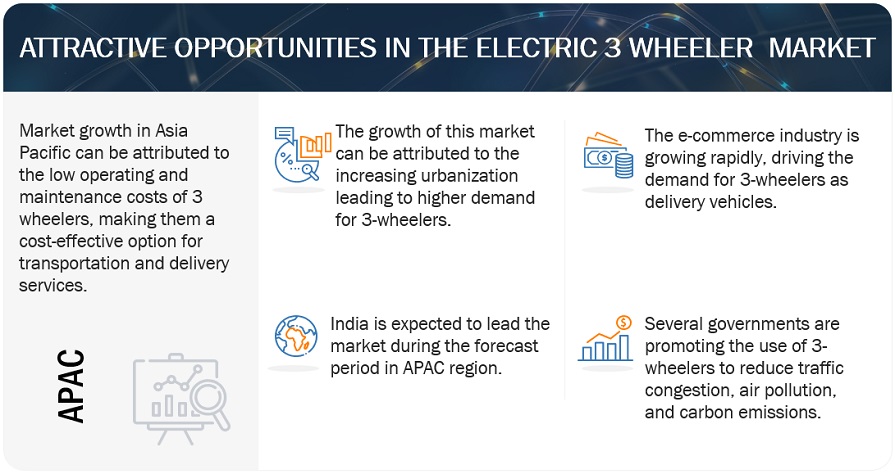

Asia Pacific is expected to lead the electric 3 wheeler during the forecast period.

In recent years, the Asia Pacific region has emerged as a pivotal center for automobile production, driven significantly by the escalating demand for EVs. This region has become a focal point for automotive manufacturing, with China and India collectively producing over 30 million vehicles annually, according to the International Organization of Motor Vehicle Manufacturers (OICA). The electric 3 wheeler market in the Asia Pacific region has experienced rapid and consistent growth year after year. This growth is attributed to the presence of some of the world's most rapidly advancing economies, including China, Japan, Thailand, and India. India particularly stands out as one of the largest markets for electric 3 wheelers. Manufacturers have acknowledged the immense growth potential of this market, spurred by the advantages associated with electrifying 3 wheelers, such as noise-free operation and reduced maintenance costs. The proliferation of electric 3 wheelers in the region caters to domestic demand and serves overseas markets. This leads to increasing emphasis on developing and producing electric 3 wheelers to meet evolving global transportation needs.

Key Market Players

The electric 3 wheeler market is dominated by Mahindra&Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Citylife Electric Vehicles (India), among others. These companies manufactures and supplies electric 3 wheeler to various countries globally. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast Units |

Value (USD Billion/Million) and Volume (Units) |

|

Segments Covered |

Motor Type, Motor Power, Battery Capacity, Range, Battery Type, Payload Capacity, End-Use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Rest of the World |

|

Companies Covered |

Mahindra&Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Citylife Electric Vehicles (India) |

This research report categorizes the electric 3 wheeler market based on Motor Type, Motor Power, Battery Capacity, Range, Battery Type, Payload Capacity, End-Use, and Region.

Based on Motor Power:

- Below 1,500 W

- 1,500–2,500 W

- Above 2,500 W

Based on Motor Type:

- Hub Motors

- Mid Motors

- Other Motors

Based on Battery Capacity:

- Below 5 kWh

- 5–8 kWh

- Above 8 kWh

Based on Range:

- Up to 50 miles

- Above 50 miles

Based on Battery Type:

- Lead-acid battery

- Lithium-ion battery

- Others

Based on Payload Capacity:

- Up to 300 kg

- 300–500 kg

- Above 500 kg

Based on End Use:

- Passenger Carriers

- Load Carriers

Based on the region:

-

Asia Pacific (APAC)

- Bangladesh

- China

- India

- Indonesia

- Japan

- Nepal

- Philipinnes

- Singapore

- Sri Lanka

- Thailand

- Vietnam

-

North America (NA)

- US

- Canada

-

Europe (EU)

- France

- Germany

- Spain

- Italy

- UK

-

Rest of the World (RoW)

- South Africa

- UAE

- Saudi Arabia

Recent Developments

- In February 2024, Car & General partnered with Piaggio Vehicles Pvt. Ltd. (PVPL), a subsidiary of Piaggio Group, to introduce electric 3 wheelers in the Kenyan market. These vehicles, known as Piaggio Ape Electrik, will be available in two variants: the Ape E-City FX Max for passenger transport and the Ape E-Xtra FX Max for cargo transportation.

- In January 2024, At the third edition of the Tamil Nadu Global Investors Meet, Terra Motors Corporation signed a memorandum of understanding with the Tamil Nadu Government. Under the MOU, the company intends to invest USD 41.66 billion in developing charging infrastructure in Tamil Nadu.

- In January 2024, Omega Seiki Mobility partnered with Kissan Mobility to deploy 500 electric 3 wheelers for last-mile delivery purposes. This partnership, valued at USD 2.40 million, encompasses various applications across sectors, including e-commerce, fast-moving consumer goods, and durables segments.

- In December 2023, Atul Auto Ltd. partnered with Perpetuity Capital to facilitate the financing of its electric 3 wheeler vehicles. This partnership entails the involvement of Oracle Marketing Private Limited, the NBFC arm of Perpetuity Capital, which will extend financing services for Atul Auto’s electric vehicles. An MOU for a Retail Finance agreement to finance a minimum of 500 vehicles in 2024 has been signed.

- In December 2023, Mahindra Last Mile Mobility Limited (MLMML), a subsidiary of Mahindra&Mahindra Ltd., collaborated with Attero to tackle environmental challenges linked to the responsible disposal of electric vehicle (EV) batteries via efficient recycling endeavors. This collaboration is intricately tailored to foster sustainability and the recycling or reuse of lithium-ion batteries.

Frequently Asked Questions (FAQ):

What is the current size of the electric 3 wheeler market by value?

The current size of the electric 3 wheeler is estimated at USD 1.3 billion in 2024.

Who are the winners in the electric 3 wheeler market?

The electric 3 wheeler market is dominated by Mahindra&Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Citylife Electric Vehicles (India), among others. These companies manufacture and supply electric 3 wheeler to various countries globally. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Which country will have the fastest-growing electric 3 wheeler market?

Sri Lanka will be the fastest-growing region in the electric 3 wheeler market due to the increasing adoption of electric 3 wheelers for short-distance travel, last-mile delivery, and the logistics industry in the country.

What are the key technologies affecting the electric 3 wheeler market?

The key technologies affecting the electric 3 wheeler market are new battery technologies, smart charging infrastructure, Iot, and connected mobility technologies.

What is the total CAGR expected to be recorded for the electric 3 wheeler market by volume during 2024-2030?

The market is expected to record a CAGR of 6.3% from 2024-2030 by volume. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the electric 3 wheeler market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, European Alternative Fuels Observatory (EAFO), European Automobile Manufacturers' Association (ACEA), China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), Electrical Vehicle Charging Association (EVCA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global Electric 3 wheeler market.

Primary Research

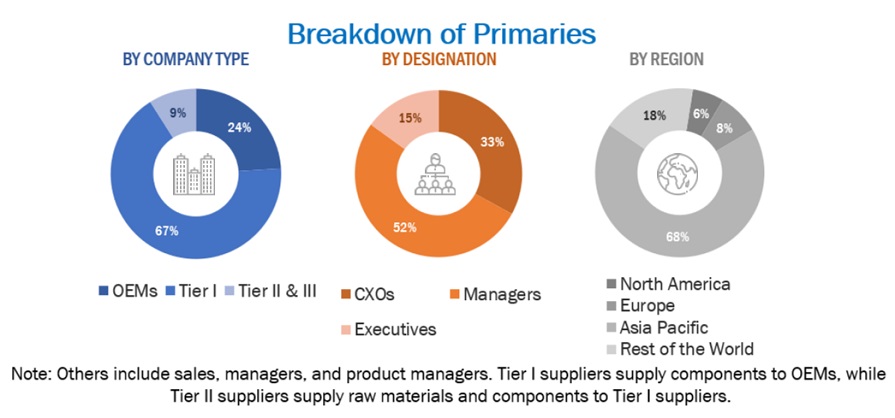

Extensive primary research was conducted after acquiring an understanding of the Electric 3 wheeler market scenario through secondary research. Several primary interviews were conducted with market experts from both the supply (automotive OEMs and E3W component providers across major regions, namely, Asia Pacific, Europe, North America, and Rest Of the World. Approximately 10% and 90% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

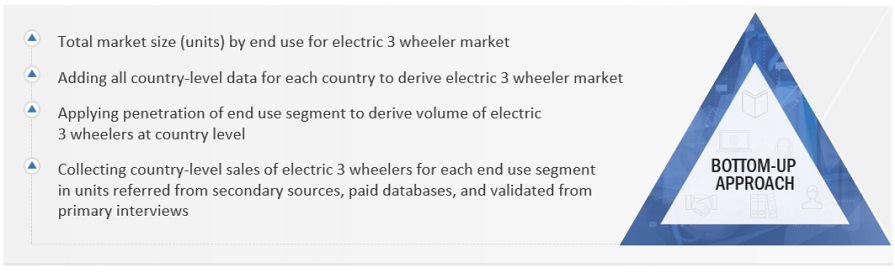

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the electric 3 wheeler market. In this approach, vehicle production statistics for each end use were considered at the country levels. The penetration of each end use at the country level was identified through model mapping to determine the electric 3 wheeler market size in terms of volume. Then, the penetration of each end use for all countries was applied to obtain the volume of the electric 3 wheeler market. The country-level volume for each end use was multiplied by the average OE price of each end use to derive the market size in terms of volume. Extensive secondary and primary research was conducted to understand the market scenario for the end use in the automotive industry. Several primary interviews were conducted with key opinion leaders related to electric vehicle developments, including OEMs, Tier-1 suppliers, and applications. Qualitative aspects such as drivers, restraints, opportunities, and challenges were considered while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

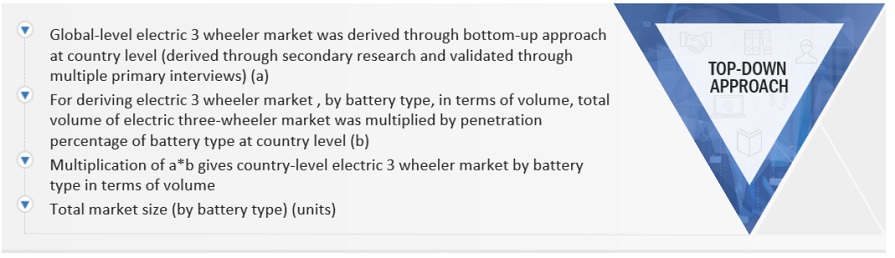

Market Size Validation

To derive the market for electric 3 wheeler market, by segment, in terms of volume, the adoption rate of all segments was identified at country level. To derive the market in terms of value, the cost breakup percentage of end use segment at the regional level was applied to the global value of the Electric 3 wheeler market. This gives the Electric 3 wheeler market for each segment in terms of volume and value. Mapping was done at the regional level to understand the contribution by type of component. The market size was derived at the regional level in terms of volume. The total volume of the electric 3-wheeler market was multiplied by the % breakdown of each component at the country level.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Electric 3-wheelers are plug-in 3-wheeled vehicles that use electric motors to achieve locomotion. The electricity is stored in a rechargeable battery that drives the electric motor. These vehicles are zero-emission electric motor-driven vehicles. The operating and top speeds of electric 3-wheelers are based on battery technology and its type.

List of Key Stakeholders

- Automotive Component Manufacturers

- Automotive OEMs

- Companies Operating in the Electric 3 Wheeler Ecosystem

- Distributors and Retailers

- Electric 3 Wheeler Component Manufacturers

- EV Battery Manufacturers

- EV Motor Manufacturers

- Fleet Operators

- Legal and Regulatory Authorities

- Manufacturers of Electric 3 Wheelers

- Raw Material Suppliers for Electric 3 Wheelers or their Components

- Technology Providers

- Electric Vehicle Association of Thailand

- Association of Indonesian Automotive Manufacturers

- Lanka Electric Vehicle Association

- Transport Authorities

Report Objectives

- To analyze the electric 3 wheeler market and forecast its size, in terms of volume (units) and value (USD million), from 2024 to 2030

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To segment the market, by end use, payload capacity, motor type, motor power, battery type, battery capacity, range, and region

-

To segment the market and forecast its size by volume (units) based on motor type

(hub motors, mid motors, and other motors) -

To segment the market and forecast its size by volume (units) based on motor power

(below 1,500 W, 1,500–2,500 W, and above 2,500 W) - To segment the market and forecast its size by volume (units) based on battery capacity (below 5 kWh, 5–8 kWh, and above 8 kWh)

- To segment the market and forecast its size by volume (units) and value (USD million) based on end use (passenger carriers and load carriers)

- To segment the market and forecast its size by volume (units) based on a range (less than 50 miles and above 50 miles)

- To segment the market and forecast its size by volume (units) based on battery type (lead acid, lithium-ion, and others)

- To segment the market and forecast its size by volume (units) based on payload capacity (up to 300 kg, 300–500 kg, and above 500 kg).

- To segment the market and forecast its size by volume (units) and value (USD million) based on region (Asia Pacific, Europe, North America, and Rest of the World)

-

To segment the market and forecast its size by volume (units) based on motor type

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Buying Criteria

- TCO Analysis

- BOM Analysis

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Electric 3-wheeler Market, by Battery Type, at the country level (For countries covered in the report)

- Electric 3-wheeler Market, by End-use, at the country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric 3 wheeler Market