Ground Support Equipment Market by Platform (Commercial, Military), Point of Sale (Equipment, Maintenance), Type (Mobile, Fixed), Autonomy (Manned, Remotely Operated, Autonomous), Power Source, Ownership and Regions - Global Forecast to 2029

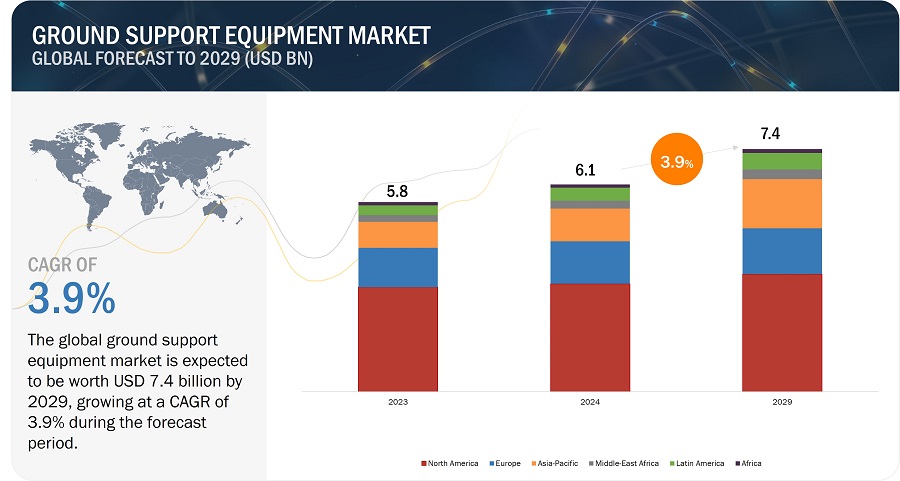

[300 Pages Report] The Ground Support Equipment market is estimated to be USD 6.1 billion in 2024 and is projected to reach USD 7.4 billion by 2029, at a CAGR of 3.9% from 2024 to 2029. Also, the ground support equipment volume is projected to grow from 38,592 units in 2024 to 44,761 units in 2029. The growth in air traffic worldwide leads to increased demand for ground support equipment to handle the loading, unloading, and servicing of aircraft efficiently. Technological advancements in GSE, such as electric and hybrid vehicles, autonomous systems, and telematics, drive market growth as airports seek more efficient, sustainable, and cost-effective solutions.

Ground Support Equipment Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Ground Support Equipment Market Dynamics

Driver: Growing air traffic and airport expansion to fuel GSE demand

The aviation industry has been experiencing remarkable growth, driven by a surge in air travel and extensive expansions of airport infrastructure globally. This has led airports to expand their operations, resulting in the addition of new terminals, gates, passenger service equipment, and other infrastructure. For instance, On March 2024, the Prime Minister of India had inaugurated 15 airport projects which includes 12 new terminals in 12 different airports which is worth USD 1.18 Million.

With increasing passenger traffic, the demand for efficient ground support equipment (GSE) is also growing. As airports strive to handle increased aircraft movements and expedite turnaround times, GSE plays a pivotal role in optimizing ground operations. From aircraft tugs to passenger boarding bridges, GSE equipment ensures seamless operations and enhances safety. Consequently, airport expansions and modernization efforts are in progress globally, particularly in emerging economies where governments are investing heavily in transportation infrastructure to support economic growth and tourism. These expansions necessitate advanced ground support equipment (GSE) to optimize efficiency and safety. Manufacturers are developing innovative GSE solutions equipped with automation, electrification, and predictive maintenance technologies. The symbiotic relationship between growing air traffic and airport expansion is fueling the market landscape for GSE manufacturers and suppliers. Thus, the exponential growth of air traffic and airport infrastructure presents abundant opportunities for innovation and growth in the ground support equipment market, making it a vital sector in the aviation industry. The below graph represents the increasing passenger traffic volume by region. Thus, the increasing passenger traffic in airports is driving the need for GSE.

Restraints: Rising damages and safety concerns by GSE

Ground Support Equipment (GSE) serves as the backbone of airport operations, facilitating the smooth movement of aircraft, baggage handling, and passenger services. However, despite their indispensable role, concerns regarding damage pose significant restraints in the ground support equipment market. One of the primary challenges GSE operators and airport authorities face is the potential for damage to aircraft during ground handling operations. Mishaps such as collisions, mishandling of baggage, or improper towing procedures can result in costly repairs, downtime, and disruptions to flight schedules. These incidents not only incur financial losses but also tarnish the reputation of airlines and airports, eroding passenger trust and loyalty.

Opportunity: Increasing adoption of greener variants in GSE

With growing concern over the aviation industry's carbon footprint, airports face pressure to minimize their environmental impact. Ground handling operations, including baggage handling and aircraft towing, often rely on polluting internal combustion-powered GSE. Embracing eGSE chargers presents a pivotal chance to combat this issue, enabling airports to slash carbon emissions, enhance air quality, and contribute positively to climate change mitigation efforts. For example, in October 2023, GSE providers Guangtai (China) and TCR (Belgium) joined forces to pioneer green innovation in airport e-buses. TCR identified key customer priorities for decarbonization, including affordable pricing, reliable technology, trusted partnerships, and prompt delivery, prompting this collaboration.

Challenges: Challenges related to GSE Fleet maintenance

Managing Ground Support Equipment (GSE) fleets presents a multifaceted challenge within the aviation industry. With diverse equipment types, varying maintenance requirements, and dynamic operational demands, effective fleet management requires meticulous planning and coordination. A significant aspect is optimizing fleet utilization while addressing maintenance needs promptly to minimize downtime and enhance operational efficiency. Strategic decision-making is crucial in fleet size determination, equipment replacement, and lifecycle management to ensure cost-effectiveness without compromising operational requirements. Maintaining compliance with regulatory standards and safety requirements adds further complexity, necessitating continuous monitoring and adherence to evolving regulations.

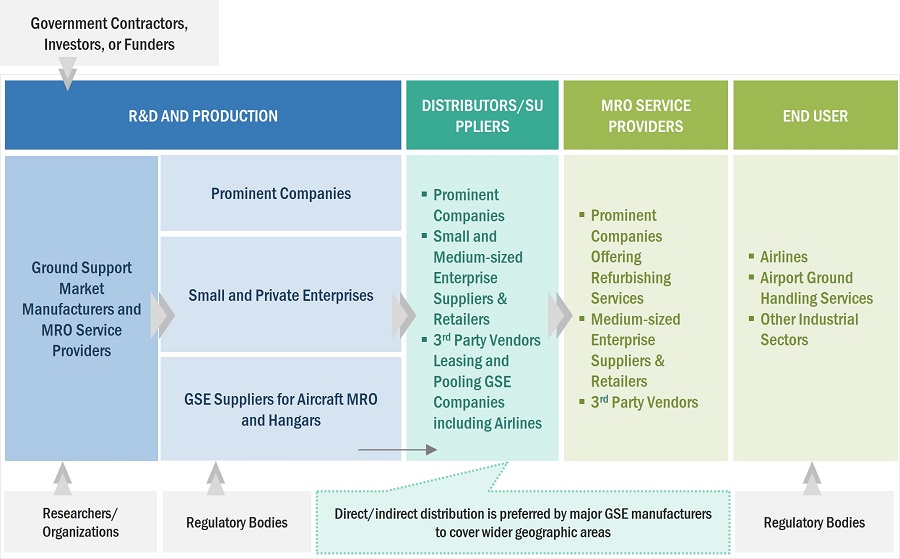

Ground Support Equipment Market Ecosystem

In the Ground Support Equipment market ecosystem, key stakeholders range from major GSE equipment providers to private enterprises, distributors, suppliers, retailers, and end customers like airlines and airport operators. Influential forces shaping the industry include investors, funders, academic researchers, distributors, service providers, and defense procurement authorities. This intricate network of participants collaboratively drives market dynamics, innovation, and strategic decisions, highlighting the complexity and vitality of the Ground Support Equipment sector.

Based on the platform, the commercial aircraft segment is estimated to have the largest Ground Support Equipment market share in 2024

Based on the platform, commercial segment has the largest market share in 2024. The GSE market for commercial airports encompasses a wide range of equipment tailored to different tasks and aircraft types. This includes aircraft tugs, baggage loaders, aircraft deicing trucks, ground power units, air conditioning units, and catering trucks. The diverse needs of commercial aviation operations contribute to the large market share of GSE in this sector.

Based on the point of sale, the maintenance segment is estimated to lead the Ground Support Equipment market in 2024

Based on the point of sale, the equipment maintenance segment is expected to grow the highest. As airports seek to maximize the lifespan and efficiency of their GSE fleets, there is a growing emphasis on comprehensive maintenance programs. Regular maintenance helps prevent breakdowns, reduces downtime, and extends the lifespan of equipment, ultimately leading to cost savings and operational efficiency gains.

Based on power source, the electric GSE segment is estimated to lead the Ground Support Equipment market in 2024

Based on power source, the electric GSE segment is estimated to lead the market. With increasing environmental concerns and stringent regulations aimed at reducing emissions and noise pollution, there is a growing demand for eco-friendly alternatives in airport operations. Electric GSE, powered by batteries or alternative energy sources such as hydrogen fuel cells, offer a cleaner and quieter solution compared to traditional diesel-powered equipment, aligning with sustainability goals.

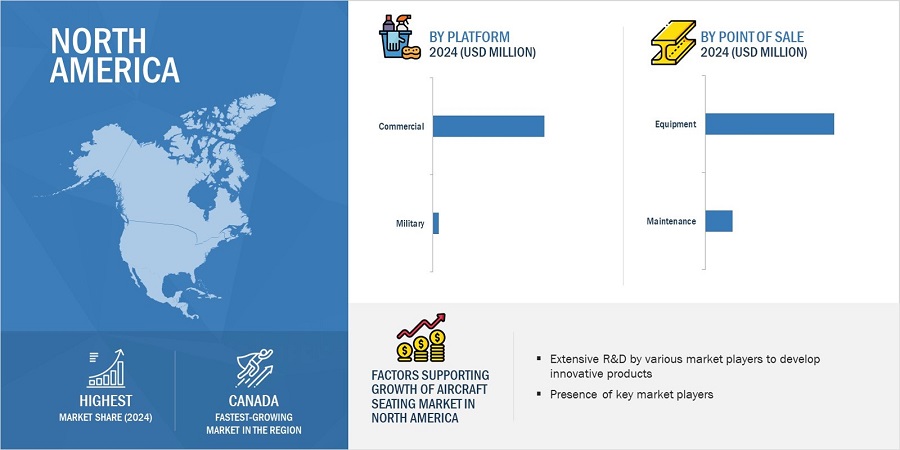

The North America market is projected to have the largest share in 2024 in the Ground Support Equipment market

Based on region, the Ground Support Equipment market has been segmented into North America, Europe, Asia Pacific the Middle East, Latin America, and Africa. North America boasts one of the largest and most mature aviation industries globally. The region is home to major airline carriers, busy airports, and extensive air transportation networks. The sheer size and scale of the aviation sector in North America drives significant demand for GSE to support ground handling operations. North America experiences high passenger and cargo traffic levels, with millions of passengers and tons of cargo transported annually. This substantial volume of air traffic necessitates robust ground support infrastructure, including a wide array of GSE to facilitate efficient aircraft turnaround times, baggage handling, and cargo operations.

Ground Support Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the Ground Support Equipment companies include Oshkosh Corporation (US) , China International Marine Containers (Group) Ltd. (China), TCR Group (Belgium), Weihai Guangtai Airport Equipment Co., Limited (China), Textron Ground Support Equipment Inc. (US) to enhance their presence in the market. The report covers various industry trends and new technological innovations in the Ground Support Equipment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By Platform, Type, Autonomy, Power Source, Point of Sale, and Ownership |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America |

|

Companies covered |

Oshkosh Corporation (US), China International Marine Containers (Group) Ltd. (China), TCR Group (Belgium), Weihai Guangtai Airport Equipment Co., Limited (China), Textron Ground Support Equipment Inc. (US) |

Ground Support Equipment Market Highlights

This research report categorizes the Ground Support Equipment markets based on Platform, Type, Autonomy, Power Source, Point of Sale, and Ownership.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Type |

|

|

By Autonomy |

|

|

By Power Source |

|

|

By Point of Sale |

|

|

By Ownership |

|

|

By Region |

|

Recent Developments

- In March 2024, Toyota Material Handling Europe is making its largest production investment OF 31 million euro (USD 33.7 Million) to increase production capacity in Mjölby, Sweden

- In February 2024, Additional to their previous partnership Mallaghan to provide Southwest Airlines their new TA8200 De-Icers to support its operations at Kansas City.

Frequently Asked Questions (FAQs):

What are your views on the growth prospect of the Ground Support Equipment market?

Response: The Ground Support Equipment market exhibits promising growth prospects driven by technological innovations, rising air travel demand, and increased focus on safety and efficiency. Technological advancements in GSE, such as electric and hybrid vehicles, autonomous systems, and telematics, drive market growth as airports seek more efficient, sustainable, and cost-effective solutions.

What key sustainability strategies are adopted by leading players operating in the Ground Support Equipment market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft seating market. Major players Oshkosh Corporation (US), China International Marine Containers (Group) Ltd. (China), TCR Group (Belgium), Weihai Guangtai Airport Equipment Co., Limited (China), Textron Ground Support Equipment Inc. (US) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft seating market?

Response: Some of the major emerging technologies are hydrogen power ground support equipment and energy harvesting for GSE.

Who are the key players and innovators in the ecosystem of the Ground Support Equipment market?

Response: Major players in the Ground Support Equipment market include Oshkosh Corporation (US), China International Marine Containers (Group) Ltd. (China), TCR Group (Belgium), Weihai Guangtai Airport Equipment Co., Limited (China), Textron Ground Support Equipment Inc. (US)

Which region is expected to hold the highest market share in the Ground Support Equipment market?

Response: Ground Support Equipment market in the North America region is estimated to account for the largest share of 53.7% of the market in 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

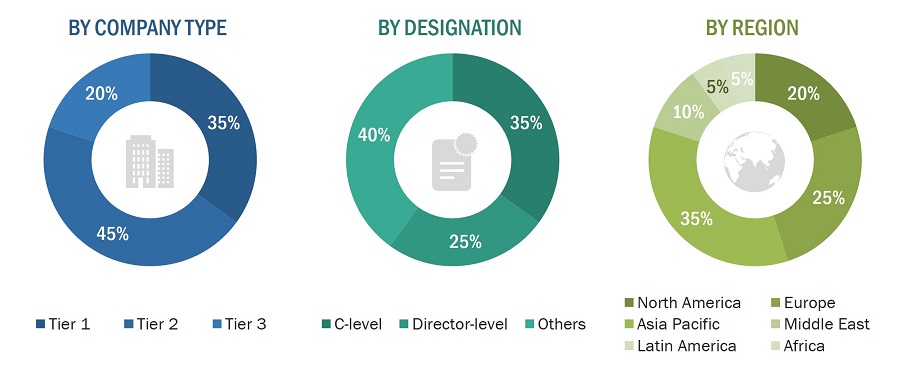

This research study on the Ground Support Equipment market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the Ground Support Equipment market and assess the market's growth prospects.

Secondary Research

The market share of companies in the Ground Handling Equipment market was determined using the secondary data acquired through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the Aircraft Ground Equipment market included government sources, such as, International Air Transport Association (IATA), Airport Council International (ACI), International Civil Aviation Organization (ICAO) and federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the Ground Support Equipment market, which primary respondents further validated.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Ground Support Equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the size of the Ground Support Equipment market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data triangulation

After arriving at the overall size of the Ground Support Equipment market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Ground Support Equipment (GSE) market encompasses all equipment, machinery, and vehicles used to support aircraft operations on the ground. This includes a wide range of specialized equipment designed to facilitate various tasks such as aircraft maintenance, loading and unloading of cargo and passengers, refueling, towing, de-icing, and general ground handling activities. GSE plays a critical role in ensuring the efficiency, safety, and smooth operation of airports and airlines worldwide. The market includes both new equipment sales as well as aftermarket services such as maintenance, repair, and spare parts.

Ground support equipment also includes various equipment used at hangars and workshops for the maintenance, repair, and overhaul (MRO) of aircraft and aero engines. The GSE in this category comprises access stands, engine stands, landing gear fixtures, and tow bars.

Stakeholders

Various stakeholders of the market are listed below:

- Manufacturers of GSE

- Original Equipment Manufacturers (OEMs) and Service Providers

- Manufacturers and Suppliers of Subcomponents

- Retailers, Wholesalers, and Distributors of GSE

- Providers of MRO Services

- Providers of Technology Support

- Logistical Partners and Transporters

- Providers of Solutions and Software

- Airport Authorities and Airlines

Report Objectives

- To define, describe, segment, and forecast the size of the ground support equipment (GSE) market based on point of sale, platform, type, power source, autonomy, ownership, and region

- To independently forecast the market size for GSE maintenance, repair, and overhaul (MRO) /hangar equipment

- To understand the structure of the GSE market by identifying its various segments and subsegments

- To forecast the size of the various segments with respect to six major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market

- To provide an overview of the tariff and regulatory landscape for the adoption of greener ground support equipment across regions

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To provide a detailed competitive landscape of the ground support equipment market, along with a ranking analysis, market share analysis, and revenue analysis of key players

- To profile key market players and comprehensively analyze their market shares and core competencies2.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

1Micromarkets are referred to as the segments and subsegments of the Aircraft Seating market considered in the scope of the report.

2Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ground Support Equipment Market

Australian MRO market overview for GSE and trends associated to the MRO (consolidation, airside premiums, etc.) for my research discussions.

We'd like to have a specific report covering conventional pushbacks, beltloaders, deicers, and baggage and cargo tractors.

As a new marketing consultant in the GSE industry, I am looking for information and forecast about the GSE market, with better accuracy on the marketing plan.

I am trying to understand if there is an opportunity to cover the market from an M&A perspective, if so, I might be interested in acquiring the report.